Oh, what a curious conundrum! Here sits a whopping $5.7 billion market cap, glowing proudly like a giant goose that lays no golden eggs. You see, none of that shiny revenue trickles down to the poor little token holders, who are left clutching their tokens like children hoping for candy-but alas, only governance votes and snickers in return. 🍬🚫

Price Stuck in a Muddy Puddle While Protocol Makes a Splash

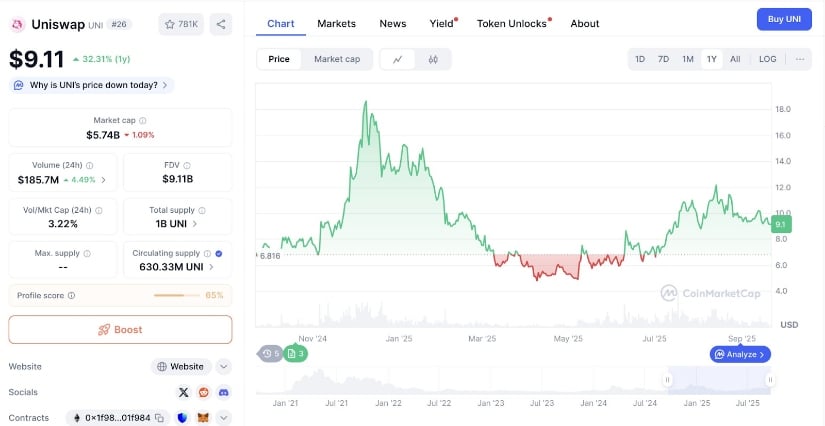

In the far-off land of Twitter (or “X,” as the young folks insist), the wise sage Clemente squawked about this baffling “disconnect.” Imagine this: Uniswap rakes in an eye-popping $1.65 billion in fees every year, which is enough to buy a small island or at least a mountain of chocolate bars. Meanwhile, Asset Labs sips a modest $50 million annual tea. Sounds like a jolly good show, right? Yet, the token’s price remains mired at a measly $9.11, holding firm to a $5.7 billion market cap with all the excitement of a snail on vacation.

Here lies the rub: this token isn’t a treasure chest-it’s a voting card. Yes, holders get to twiddle their thumbs and vote on proposals like judges in a peculiar talent show, but no dollars are handed out. No buybacks, no burning fires of financial delight, no dividends dancing like fairies. How very disappointing! Some jokers say, “Is governance worth billions?” The answer? Well, it’s as if you paid for a feast but only got to watch the chefs cook. 🍲👀

Prices Shimmy Down Despite the Protocol’s Huge Fees

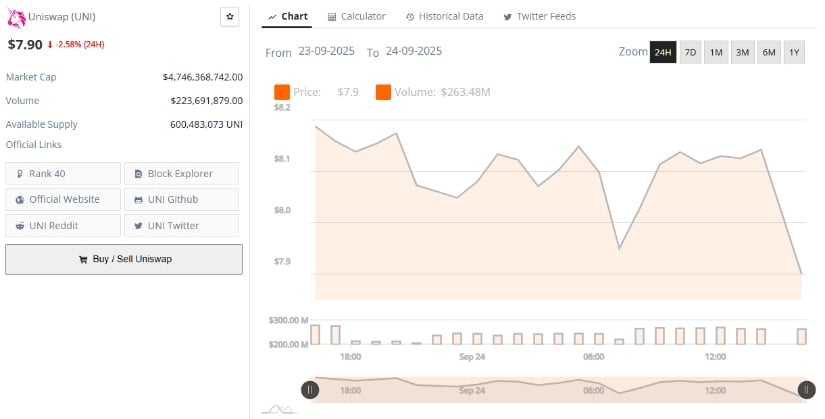

Our trusty allies at BraveNewCoin report UNI slipping to $7.90, shedding a sad 2.58% in the last 24 hours with a market cap now closer to $4.74 billion. It’s like watching a grand party lose guests one by one, while the music keeps thumping loudly in the background. Daily volume gallops at $223.6 million, and there are about 600 million tokens circulating, like a swarm of bees buzzing, but not making much honey for the holders.

Despite the protocol’s mountains of fees, the market’s mood is as jittery as a cat on a hot tin roof. Investors squint, wondering if this token is all puff and no stuff, looking rather sheepish compared to its money-making platform. The eternal debate rumbles on: Is this token a golden goose, or just a regular old chicken wearing a fancy hat?

Bearish Clouds Loom, But There’s a Flicker of Hope

At the moment, UNI inches upward to $8.12-a tiny 0.72% rise, like a shy mouse peeking out after weeks of jerky, rollercoaster-like swings from highs of $12.29 to lows of $4.55. Sellers still seem to rule the roost, though maybe just maybe the market is trying to settle down and have a nice cup of tea.

The mystical momentum indicators whisper sadly: the MACD is sulking below zero, the signal line trailing like a disappointed friend, and the histogram hints that perhaps the selling frenzy is losing its steam. Meanwhile, the RVI sits at a cautious 46.42, staring down from just below its moving average of 49.77. The mood is bearish, but not the “hide-under-the-bed” kind-more like the “put-on-a-jacket” kind.

So the question remains, dear reader: will the token continue to snooze while the protocol fireworks blaze? Or will hopeful buyers step in to give this peculiar governance token a proper party? Stay tuned, grab some popcorn 🍿, and keep your wits about you!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-24 23:31