Many years later, as the accountants tallied the final figures, old Manrique remembered the scent of jasmine clinging to the humid air the day Netflix first flickered to life, a promise of stories delivered through the ether. He hadn’t known then, of course, that this small miracle would one day require a sum equivalent to the annual rainfall of the Amazon, all to absorb the fading echoes of a rival’s ambition. The numbers, they always told a story, but rarely the whole one.

Netflix, that restless wanderer of the digital plains, has known both the feverish heat of success and the creeping chill of uncertainty. It rose, a phoenix from the ashes of Blockbuster, offering a refuge from the predictable narratives of broadcast television. For a time, it seemed invincible, a kingdom built on algorithms and the insatiable appetite for stories. But even kingdoms, as the ancient maps remind us, are susceptible to erosion. Now, the stock, once a beacon for investors, drifts nearly forty percent below its zenith, prompting whispers of a bargain, a chance to gather the fallen fruit before the frost arrives.

The Weight of Ghosts

The current disquiet stems from a transaction of staggering proportions – eighty-two and a half billion dollars, a sum that could resurrect forgotten cities. Netflix intends to acquire certain media assets from Warner Bros. Discovery, a company that, in a strange twist of fate, decided these pieces of its empire were better off adrift. It’s as if Warner Bros. Discovery, sensing a coming storm, cast these assets out to sea, hoping someone else would bear the weight of their upkeep. Netflix, ever the collector of lost things, extended a hand.

The problem, of course, is the financing. Netflix holds a mere nine billion in readily available funds. The remaining seventy-plus billion will be conjured through debt, a spectral burden that hangs over the company like a persistent fog. Investors, naturally, are concerned. They remember the stories of companies swallowed by their own ambition, of empires built on borrowed time. The question isn’t simply whether Netflix can afford the acquisition, but whether it can absorb the weight of these ghostly assets without sinking beneath the surface.

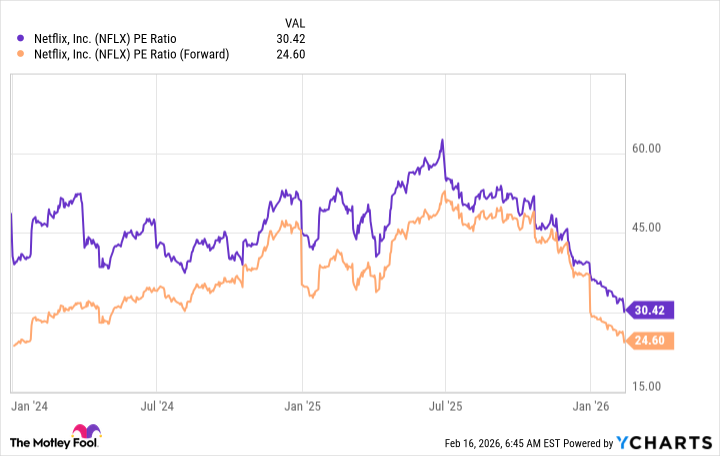

The past few years have seen valuations stretched to the breaking point, a fever dream of exponential growth. Netflix, at its peak, traded at multiples that demanded the impossible, a perpetual motion machine of revenue. Sixty times earnings, nearly fifty times forward projections – a price tag reserved for miracles. The current dip, therefore, is not necessarily a sign of weakness, but a return to something resembling reality. There are whispers of companies pursuing artificial intelligence, growing at rates that defy gravity, yet trading at more reasonable valuations. It’s a reminder that even in the digital age, the laws of physics still apply.

Today, Netflix trades at a valuation more akin to its peers, a quiet acknowledgment that it is, after all, just a company. The acquisition, then, becomes a test. Can Netflix weave these new assets into its tapestry, creating something stronger and more vibrant? Or will they remain fragmented, a constant drain on resources? If it succeeds, this dip could prove to be a rare opportunity, a chance to acquire a valuable asset at a reasonable price. But if it fails, Netflix risks being dragged down into the depths, another casualty of the streaming wars. The numbers, as always, will tell the tale, though the full story will only be revealed many years later, when the accountants finally tally the final figures, and old Manrique remembers the scent of jasmine in the humid air.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Brent Oil Forecast

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Michael Burry’s Market Caution and the Perils of Passive Investing

2026-02-19 02:42