It is said that artificial intelligence thrives in data centers, those modern cathedrals of computation, brimming with chips crafted by the likes of Nvidia, Advanced Micro Devices, and Broadcom. And yet, one cannot help but marvel at the irony: machines designed to think are powered by components born of human folly. For every leap in computing power, there seems to be an equal and opposite leap in our capacity for overconfidence.

Jensen Huang, the sage of Nvidia, prophesies a $4 trillion spending spree on AI infrastructure by 2030. A bold prediction, indeed. But then again, fortune-telling is the second oldest profession, and its practitioners are no less imaginative than those of the first. If Mr. Huang’s vision comes to pass, investors may find themselves richly rewarded-or so they hope. But hope, as we all know, is the most expensive commodity on Wall Street.

Enter the iShares Semiconductor ETF (SOXX), an exchange-traded fund that offers a slice of this silicon-laden pie. With a portfolio concentrated among just 30 stocks-including AMD, Nvidia, and Broadcom-it presents itself as a gateway to the future. Or does it? After all, concentration is a double-edged sword; it sharpens returns when the winds are favorable but cuts deeply when they turn against you.

A Gallery of Silicon Aristocrats

The iShares Semiconductor ETF is not merely a collection of companies; it is a curated assembly of aspirants vying for dominance in the age of AI. Its top holdings read like a guest list for a soirée of technological ambition:

| Stock | iShares ETF Portfolio Weighting |

|---|---|

| 1. AMD | 9.77% |

| 2. Nvidia | 8.57% |

| 3. Broadcom | 8.17% |

AMD, with its MI350 series GPUs, has found favor among data center operators such as Oracle. Yet even as it prepares to unveil the MI400-a chip rumored to be tenfold more powerful-one wonders whether progress will outpace practicality. Progress, after all, is the art of running faster only to discover that the finish line keeps moving.

Nvidia, meanwhile, remains the darling of data centers, thanks to its Blackwell Ultra GPUs. These chips, fifty times mightier than their predecessors, remind us that power begets power-and hubris often follows close behind. Nvidia’s revenue dwarfs AMD’s by a factor of twelve, a testament to its market share-or perhaps to the fleeting nature of competitive advantage.

Broadcom, ever the pragmatist, designs AI accelerators tailored to the whims of hyperscale cloud providers like Alphabet‘s Google Cloud. Flexibility is its forte, though flexibility in business often resembles indecision in life. Still, its Tomahawk Ultra Ethernet switch promises low latency and high throughput-a promise that, if fulfilled, might well prove invaluable.

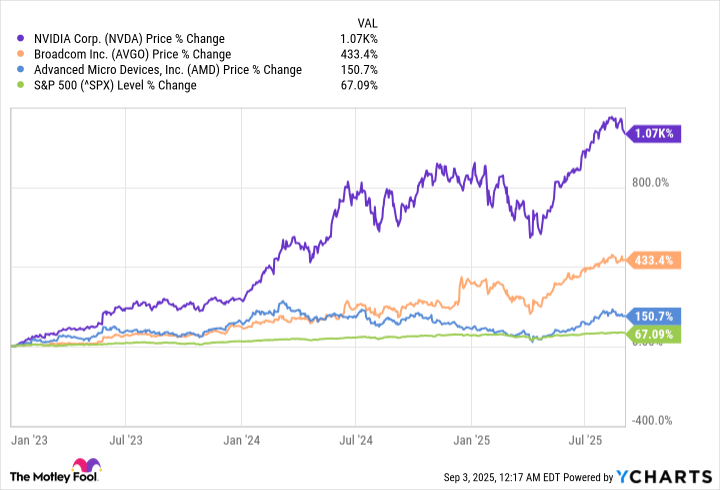

Since the dawn of the AI boom in 2023, these three titans have delivered an average return of 550%. Impressive, certainly-but let us not forget that markets, like roses, bloom most brilliantly just before they wilt.

And what of the other jewels in the iShares crown? Micron Technology, purveyor of memory chips, and Taiwan Semiconductor Manufacturing, fabricator extraordinaire, round out the roster. Together, they form a constellation of innovation-or so the narrative goes. But constellations, too, are mere illusions, their stars light-years apart.

The Alchemy of Wealth Multiplication

The iShares Semiconductor ETF boasts a compound annual return of 11.4% since its inception in 2001, surpassing the S&P 500’s modest 8.5%. Over the past decade, it has dazzled with a 24.1% annual gain. Yet history teaches us that nothing grows forever-not trees, not empires, and certainly not ETFs.

To illustrate the dream of turning $250,000 into $1 million, consider the following table:

| Initial Investment | Compound Annual Return | Time To Reach $1 Million |

|---|---|---|

| $250,000 | 11.4% | 13 Years |

| $250,000 | 17.7% | 9 Years |

| $250,000 | 24.1% | 7 Years |

A sustained annual return of 24.1% would require either divine intervention or a suspension of economic reality. Nvidia, already the world’s largest company, finds its growth decelerating-a reminder that even giants must eventually bow to gravity. Yet the semiconductor industry, buoyed by Jensen Huang’s $4 trillion prophecy, may yet surprise us. Stranger things have happened-though rarely twice.

In conclusion, the iShares Semiconductor ETF is neither savior nor swindle. It is simply another instrument in the orchestra of finance, capable of producing harmony or discord depending on the conductor. Diversification, that old refrain, remains the wisest course-for what is investing, if not the art of hedging one’s bets against the vagaries of fate? 🎭

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-09-05 11:23