Nike, that paragon of athletic apparel, has long reigned supreme, but the Swoosh has had a few hiccups of late. One might liken its recent trajectory to a gentleman attempting to waltz while wearing a pair of ill-fitting boots-stiff, ungraceful, and prone to missteps.

The former CEO, Mr. Donahoe, attempted a pivot to a more tech-centric model, which, much to the dismay of the shareholders, did not quite pan out. Nike overinvested in performance marketing, a move akin to a man attempting to woo a lady with a dictionary instead of a bouquet of flowers. Meanwhile, its wholesale business languished, leaving the door ajar for rivals like Hoka and On, who seized the opportunity with the enthusiasm of a terrier at a biscuit sale.

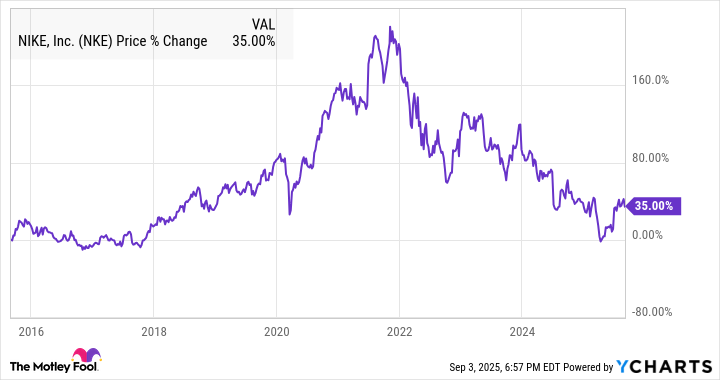

This state of affairs led to Mr. Donahoe’s departure, a decision as inevitable as the setting of the sun. Enter Mr. Elliott Hill, a veteran executive with the poise of a seasoned cricket player, who has since set about mending fences and rekindling the flame of innovation. Yet, the stock remains a long way from its former peak, a situation best described as “in the soup,” to borrow a phrase from the more colorful parlance of the stock market.

Though the stock rebounded after a June earnings report, the numbers remain less than stellar. Revenue for the full year dipped to $46.3 billion, a 10% decline, and net income plummeted by 44% to $3.2 billion. One might say the figures were as unimpressive as a poorly executed cricket match, yet investors, ever the optimists, chose to look beyond the numbers.

While current purchasers may have missed the recent rally, the question remains: is it too late to join the fray? Let us consider the case for a cautious “perhaps.”

The Numbers Are Still Ugly

Nike is but a fledgling in its recovery, and the path ahead is fraught with uncertainty. Even as the stock surged post-earnings, the results were as unimpressive as a secondhand umbrella in a storm. Revenue for the full year fell to $46.3 billion, and net income slumped to $3.2 billion-a dashing performance, if one were to judge by the standards of a poorly attended tea party.

Yet, management, ever the silver-tongued orator, assured shareholders that better days lie ahead. For the first quarter, revenue is expected to decline mid-single digits, though costs from tariffs may add a hefty $1 billion to the ledger. One might say the outlook is as cheery as a rainy Tuesday.

Nike’s Core Advantages Remain

Though Nike has stumbled, its core assets remain as robust as a well-stocked larder. The brand’s sponsorship roster is as illustrious as a royal gala, featuring the likes of Michael Jordan and LeBron James. Its sneakers, from the Air Force 1 to the Air Jordan, are as timeless as a well-told joke.

Management, ever the Jeeves-like figure, understands the need to rekindle its reputation for innovation. While upstarts like Hoka and On may pose a challenge, Nike’s global goodwill is as enduring as a well-worn pair of shoes. The task of revival, though daunting, is not impossible-provided one avoids the pitfalls of a certain former CEO’s misguided strategies.

There’s Plenty of Upside Potential

While a return to former glory is no certainty, the footwear and apparel market has grown since 2021, offering a glimmer of hope. Nike’s net income peaked at $6 billion in fiscal 2022, a figure that now seems as distant as a memory of childhood summers. Yet, if the brand can recapture its former vibrancy, a return to such heights is not beyond the realm of possibility.

In short, while the road ahead is fraught with peril, the potential for a triumphant return remains. One might say it is as likely as a man winning a race against a tortoise-unlikely, but not entirely impossible. 🏀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

- Gold Rate Forecast

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-05 11:17