With gold and silver reaching record highs almost daily, leaving investment alternatives in the dust, analysts are scared about what this might mean for the wider economic ecosystem. Some believe this is not normal and might lead to a recession.

Gold’s and Silver’s Bull Rally Scare Financial Analysts 🐂🔥

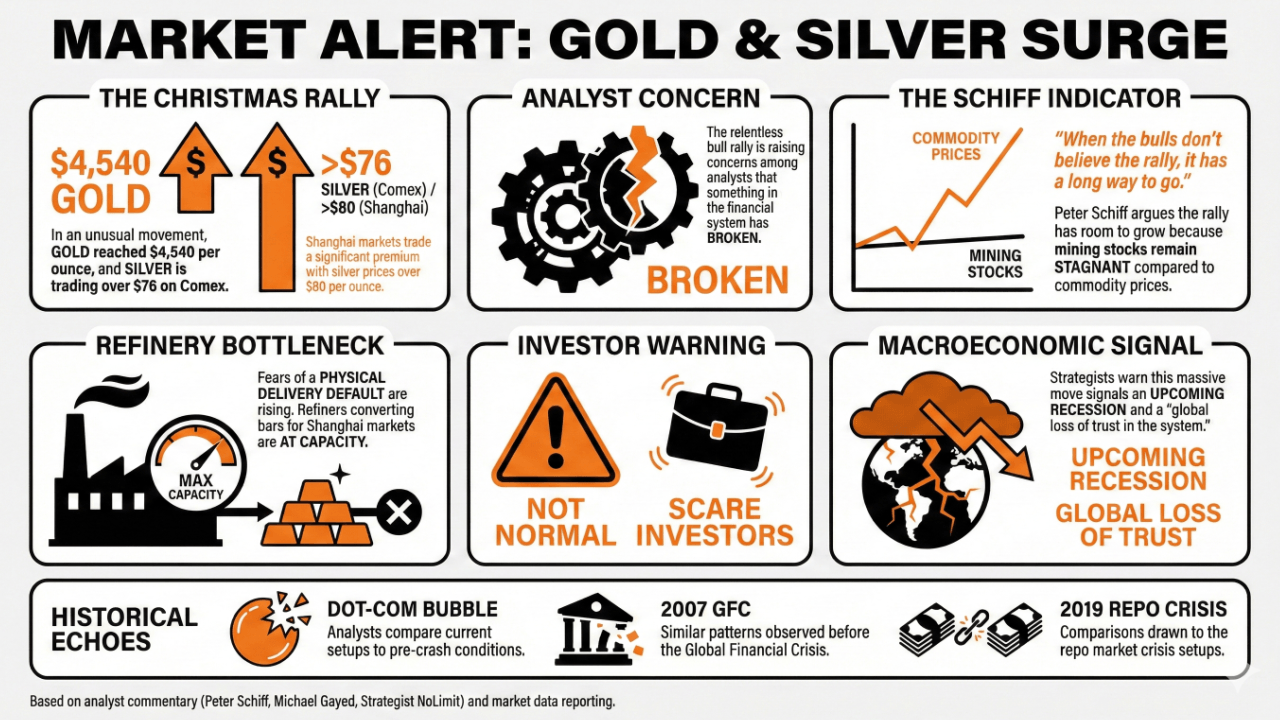

The relentless bull rally that gold and silver are experiencing is raising concerns among financial analysts, who believe that something may have broken. A recession might be just around the corner, some analysts predict. Or perhaps they’ve just discovered the concept of “normal” and are now terrified. 🤯

In a post-Christmas hike, gold reached $4,540 per ounce, and silver has now surpassed $76 on Comex, while Shanghai markets feature significant premiums with prices of over $80 per ounce. Because nothing says “economic stability” like paying $80 for a spoonful of glitter. 🪙

This metal escalade is poised to continue, as analysts note there are signs indicating there is still room for growth. Known gold bug Peter Schiff stated that one of these signs is the stagnation of mining stocks compared to the price of these metal commodities. “When the bulls don’t believe the rally, it has a long way to go,” he stressed. Or as I’d say, “When the bulls are asleep, the bears are busy counting their coins.” 💰

What’s more troubling is that there could be a physical delivery default incoming, as refiners that take 1,000-ounce bars and turn them into 1-kilogram ingots destined for Shanghai markets are at capacity. Nonetheless, Silvertrade claims that this will not stop industrial end users from taking delivery of this metal. Because nothing says “trust in the system” like a 1,000-ounce bar and a 1-kilogram ingot. 🧱

Michael Gayed, an ETF portfolio manager, stated that this situation was not normal and that it should scare investors. Or perhaps it’s just the economy’s way of saying, “You’re welcome.” 😎

Others agree, stressing that this massive move towards metals is not a good sign for the world’s economy, possibly signaling an upcoming recession. Strategist NoLimit assessed that this kind of move is part of a global loss of trust in the system, comparing it to similar setups before the dot-com bubble, the 2007 global financial crisis, and the 2019 repo market crisis. Because nothing says “confidence” like a repeat of past disasters. 🌪️

Jim Rickards recently predicted that gold might reach $10,000, with silver following along for the ride at $200 by 2026. And I’m sure the stock market is just dying to keep up. 📉

FAQ

- What recent price levels have gold and silver achieved?

Gold has surged to $4,540 per ounce, while silver has surpassed $76 on Comex, with Shanghai prices exceeding $80 per ounce. Because nothing says “economic health” like a $80 ounce of glitter. 🪙 - What indicators suggest that the current rally in metal prices might still have strength?

Analysts note the stagnation of mining stocks compared to rising metal prices, indicating the current rally is still ongoing. Or as I call it, “the market’s way of saying, ‘This is getting weird.’” 🤯 - What risks are associated with the recent surge in metal prices?

There are concerns about a potential physical delivery default due to refiners being at capacity for converting large bars into smaller ingots. Because nothing says “efficiency” like a 1,000-ounce bar and a 1-kilogram ingot. 🧱 - How do financial experts view the implications of this metal movement on the economy?

Many analysts interpret the shift toward precious metals as a warning sign for the economy, possibly indicating an impending recession and reflecting broader distrust in the financial system. Or as I’d say, “The system’s last hurrah.” 🕳️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Superman Still Lost Money Theatrically Despite ‘Strong Performance’ in WB’s Q3 Earnings

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-26 21:59