In the tumultuous realm of digital gold, where man’s greed and despair entwine like serpents, one analyst whispers of salvation amid the chaos, even as Bitcoin plummets to the abyss of $89,000. 🤡

Lo, Standard Chartered’s Geoffrey Kendrick, that most patient of sages, beholds the carnage of Tuesday’s midnight plunge and chuckles, as if witnessing the third act of a divine comedy. “Behold!” he proclaims to his clients, “this sell-off is but a familiar specter, a ghost from the past two years, haunting us with its predictable wails!”

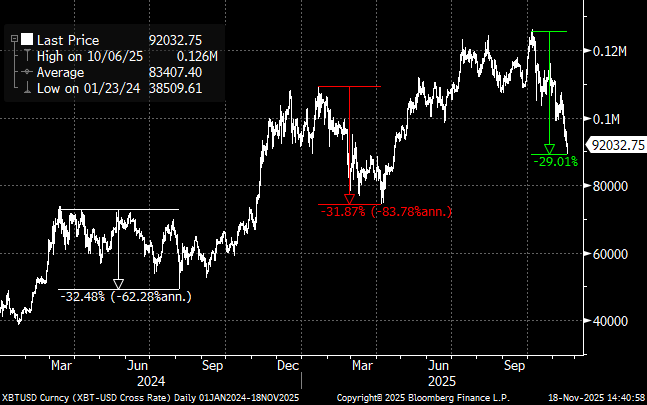

With the solemnity of a monk deciphering scripture, Kendrick unveils a chart, its curves and valleys a testament to history’s cyclical embrace. Three times hath BTC danced with volatility, each time bottoming out before ascending to glory. “The pattern is clear,” he intones, “as clear as the nose on a fool’s face.”

Yet Kendrick’s gaze turns to Strategy (MSTR), that once-proud titan of treasuries, now humbled by the tides of fate. Its mNAV, once a crown of golden premiums, now lies bare at 1.0. “The metrics have collapsed,” he sighs, “like a house of cards in a hurricane.”

And so, with the wisdom of a man who has spent decades wrestling foreign exchange markets, Kendrick declares: “The sell-off is over! The halving cycle? A relic of a bygone age! Rally to the year’s end-it is my base case!” 🎉

Market Metrics: A Tragicomic Tale

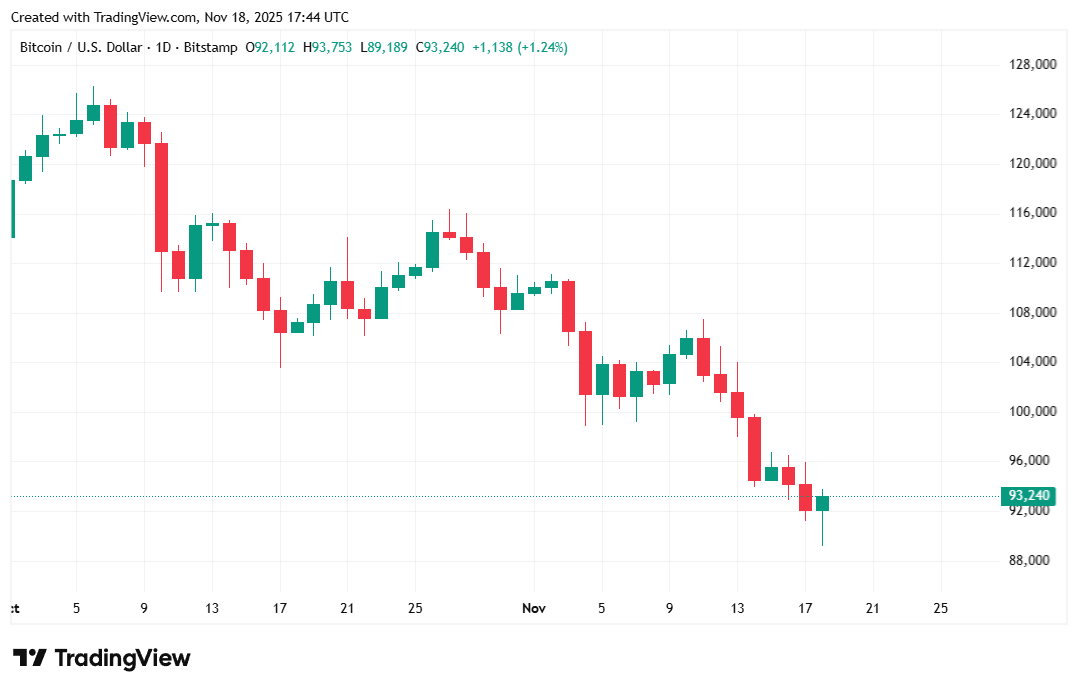

Bitcoin, that fickle lover, trades at $93,251.65-a paltry 0.22% rise in 24 hours, yet a 9.42% fall in seven. Coinmarketcap’s data reveals a dance between $89,300.46 and $93,745.08, as if the market itself were a soul trapped in purgatory.

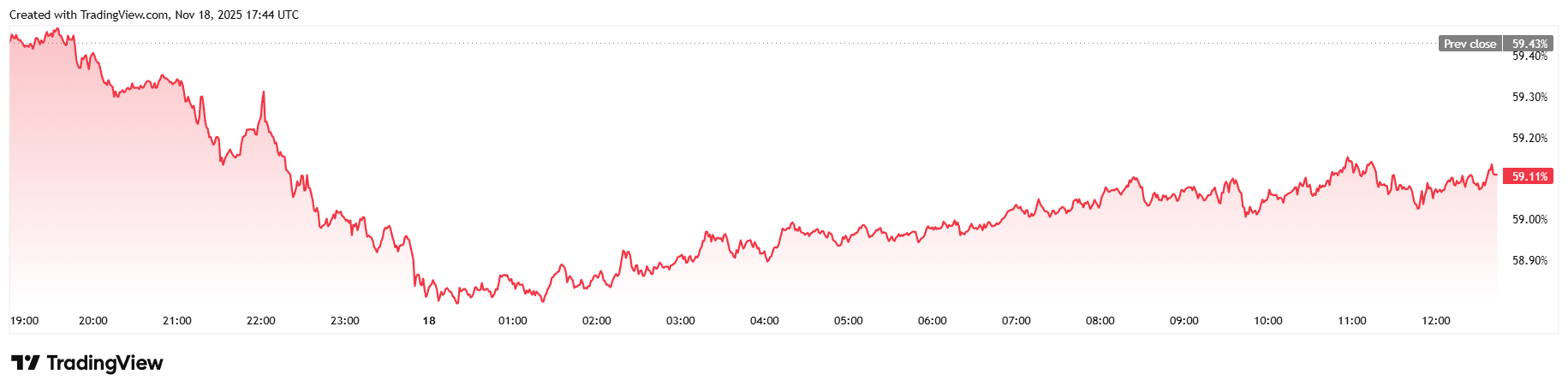

Daily trading volume soars to $120.05 billion-a 40.42% leap-while market cap inches toward $1.95 trillion. Yet BTC’s dominance wanes, slipping to 59.11%, as altcoins like Solana and Ether smirk in triumph. 😏

Open futures contracts hover at $66.44 billion, while liquidations devour $409.80 million-longs weep $359.12 million, shorts a mere $50.68 million. A tale of woe, indeed.

FAQ ⚡

- Why does Standard Chartered think the sell-off is over?

Kendrick claims Bitcoin’s plunge mirrors past corrections, followed by “rallies so glorious, they’d make a saint weep.” - What key metric is Kendrick watching?

He fixates on Strategy’s mNAV hitting 1.0, a “death knell for premiums” and a “symphony of despair.” - When does the bank expect Bitcoin to rebound?

“By year’s end, or I’ll eat my hat-and probably my socks too.” - How is Bitcoin trading now?

BTC flutters near $93K after a “midnight massacre” to $89K, with liquidations “howling like wolves at the moon.” 🐺

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-11-18 22:08