In film and TV, it’s common for established actors and recognizable faces to be cast, even if they don’t perfectly match the age a role calls for. This often means adult actors are playing teenagers or young adults, especially in high school or coming-of-age stories. While things like makeup and costumes can help, viewers often notice when an actor is much older than the character they’re portraying. The following examples highlight cases where Black male actors were cast in roles where they were noticeably older than the characters they played.

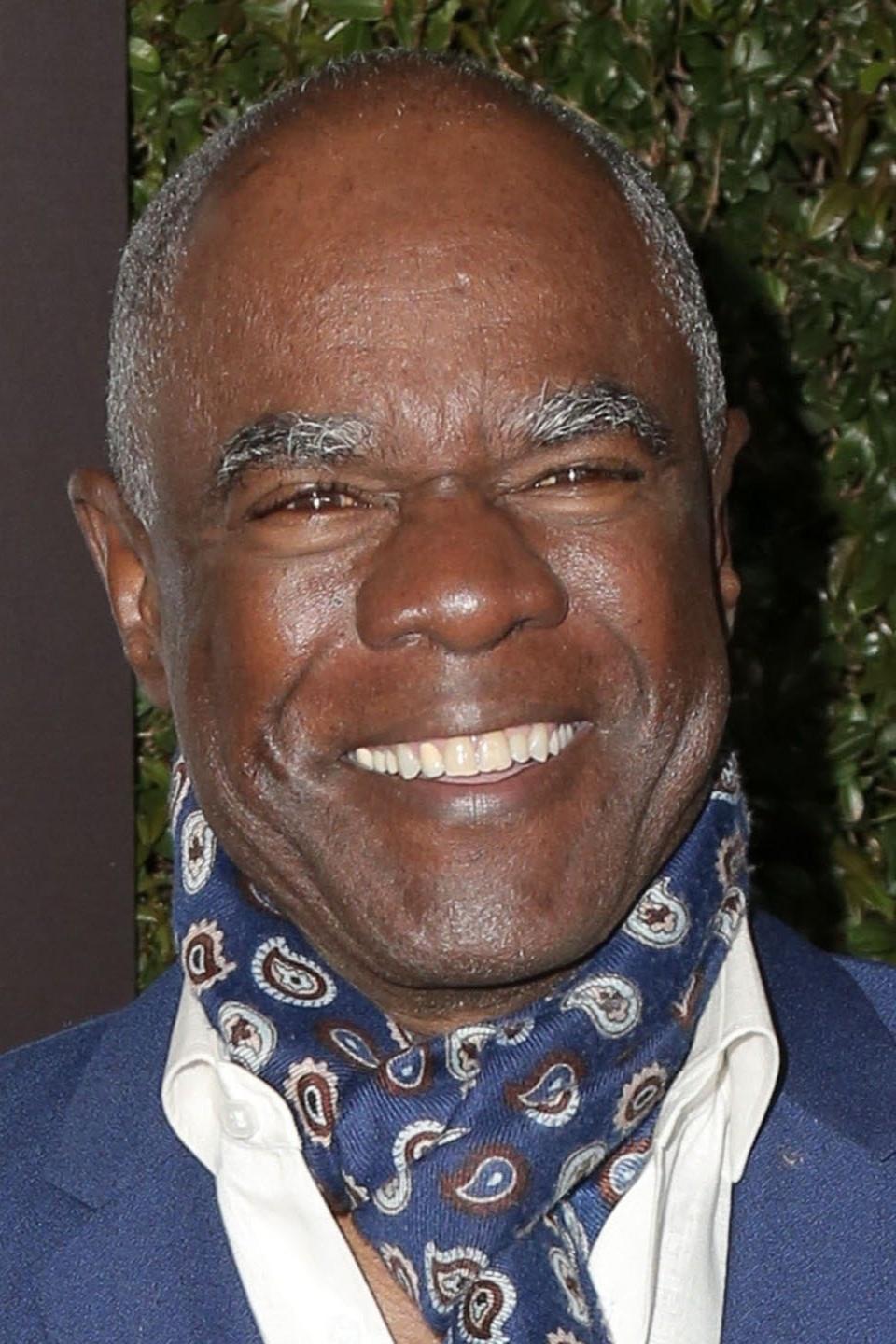

Laurence Fishburne

The actor played Furious Styles in the 1991 film ‘Boyz n the Hood’. Remarkably, he was only 29 years old when he took on the role of the protagonist’s father, making him just seven years older than the actor who played his son. Despite this small age difference, his performance was praised for its depth and maturity, and the casting choice is still talked about by fans today.

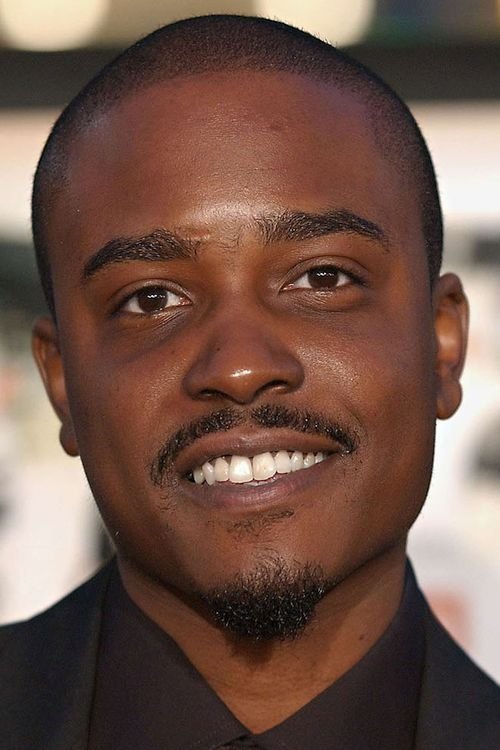

Cuba Gooding Jr.

The actor played Tre Styles in the movie ‘Boyz n the Hood’ when he was 23 years old. His character was a high school student, around 17 or 18 years old. The actors often looked older than the teenage characters they were portraying, creating a noticeable contrast. Later in his career, he won an Academy Award for a different performance.

Morris Chestnut

Morris Chestnut played the character Ricky Baker in ‘Boyz n the Hood.’ While filming, he was 22 years old but portrayed a high school student striving for a college athletic scholarship. The role called for him to play a focused senior with big plans for his athletic future. Because he looked older than some of the other young actors, it was noticeable. This film was a significant turning point and helped launch his successful Hollywood career.

Ice Cube

The rapper and actor became known for his role as Doughboy in the 1991 film ‘Boyz n the Hood’. He was 22 when he played the troubled teen from South Central Los Angeles, a character who was supposed to be about the same age as the other high school students in the movie. This performance was key in starting his acting career, and he convincingly portrayed the role’s emotional depth even though he had already been out of high school for a few years.

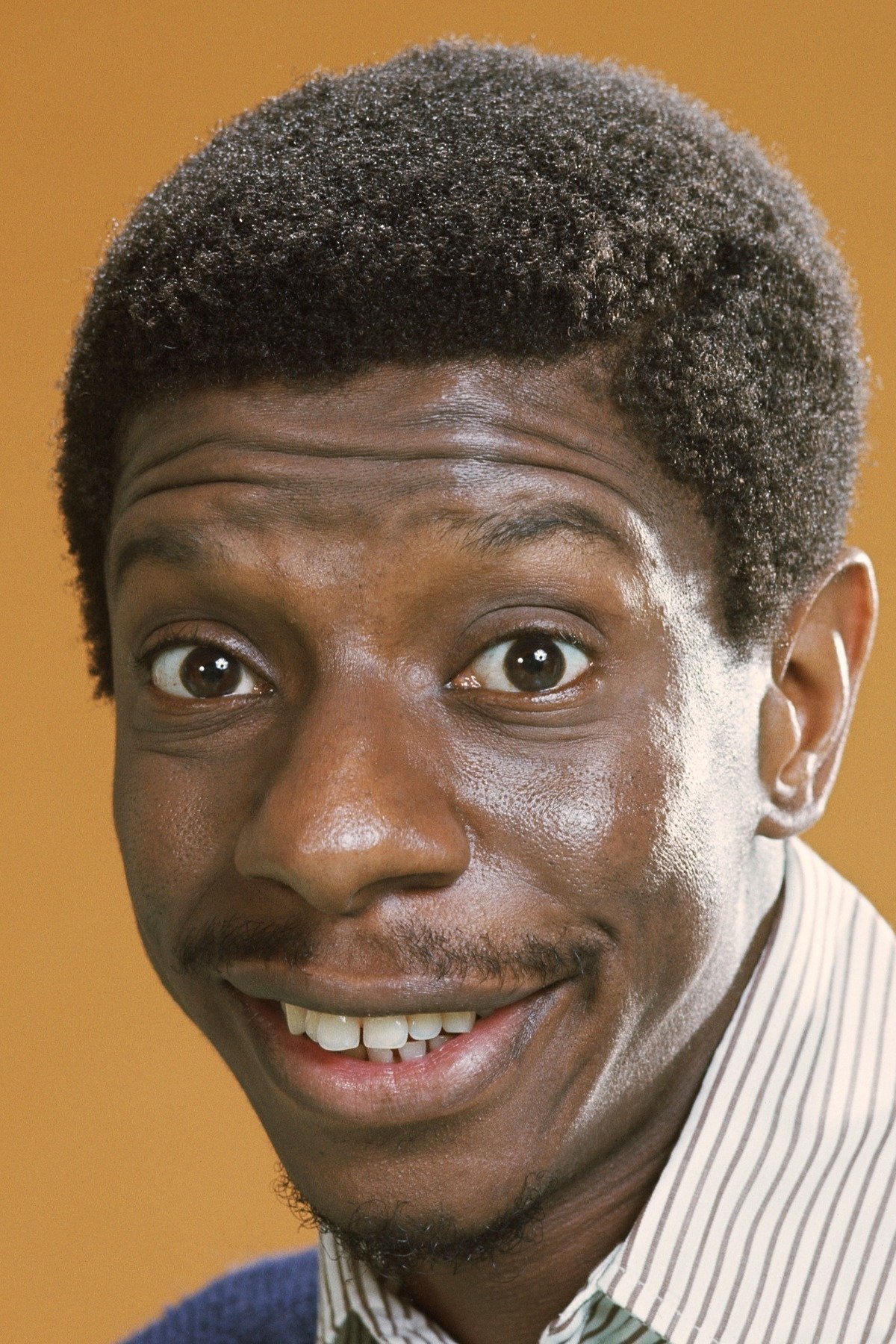

Jimmie Walker

This comedian became famous for his role as J.J. Evans on the show ‘Good Times’. He played the teenage character from age 26 to 32. The series followed a family living in Chicago public housing in the 1970s. Throughout most of the show, his character was portrayed as still relying on his parents. Despite the age difference between the actor and the role, viewers loved his lively and funny performance.

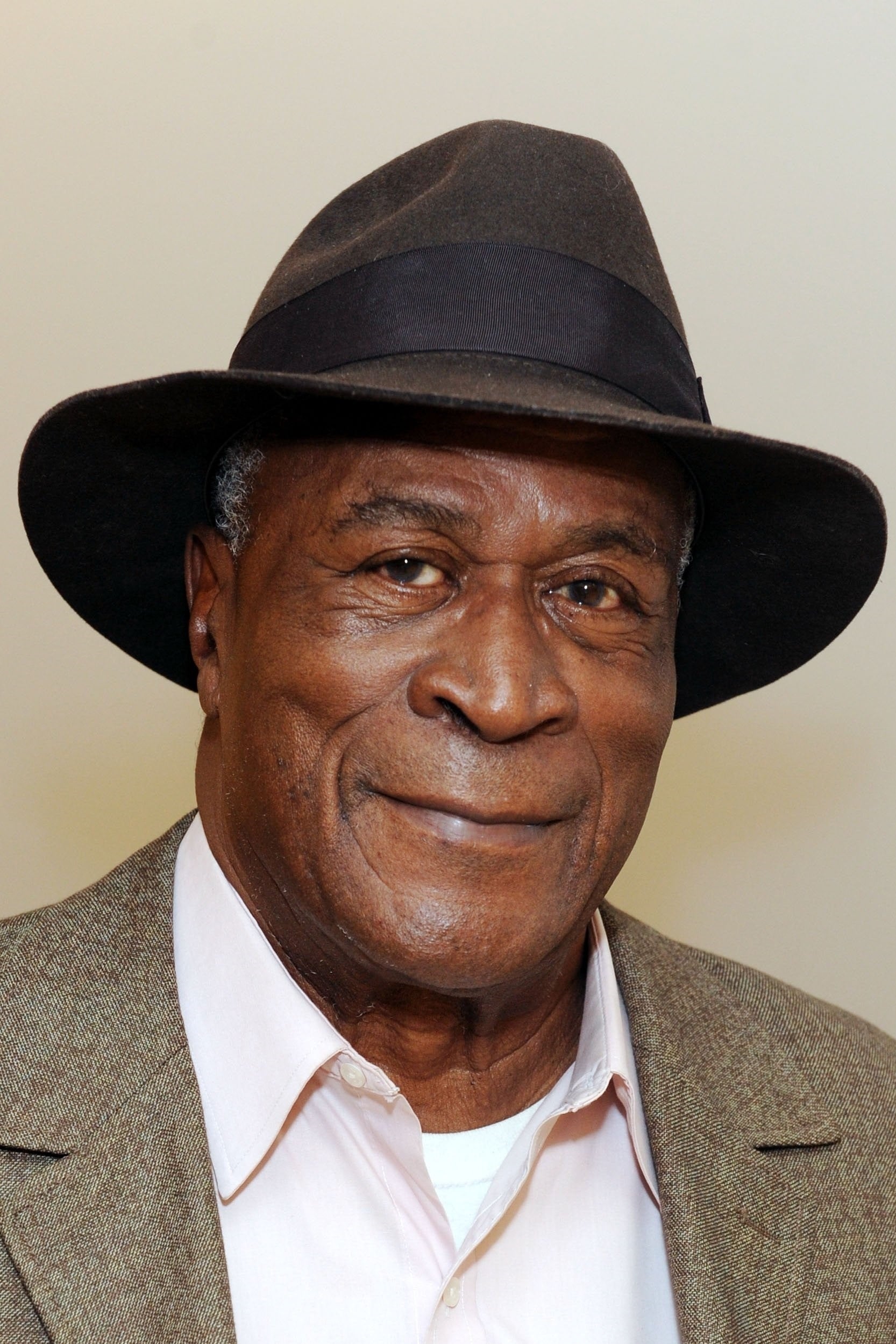

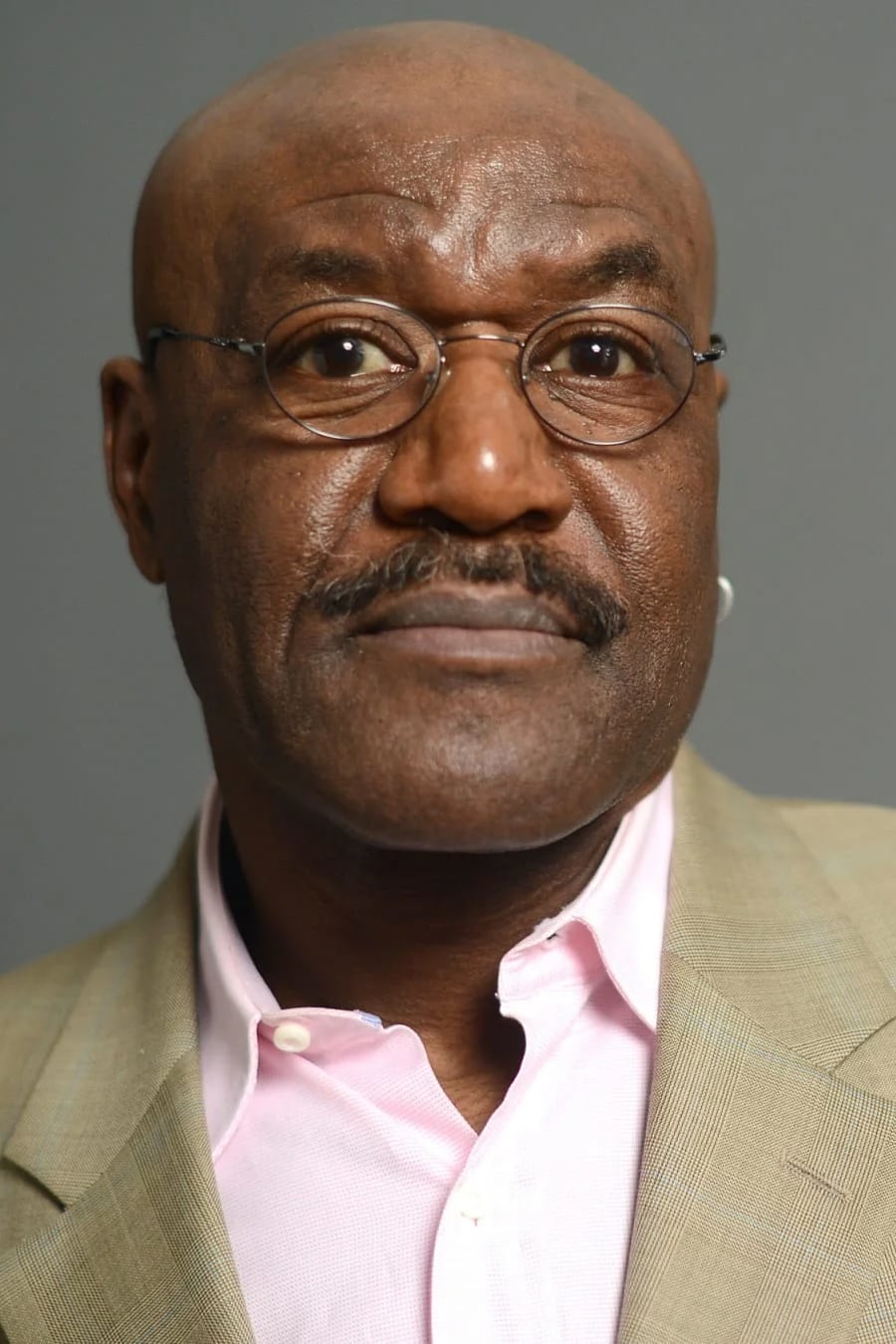

John Amos

John Amos was best known for his role as James Evans, the father on the TV show ‘Good Times’. When the series began in 1974, he was just 34 years old – surprisingly young, considering he played the father of an actor who was 26! He portrayed a reliable and supportive father figure. After three seasons, he decided to leave the show because he disagreed with the creative choices being made about its future.

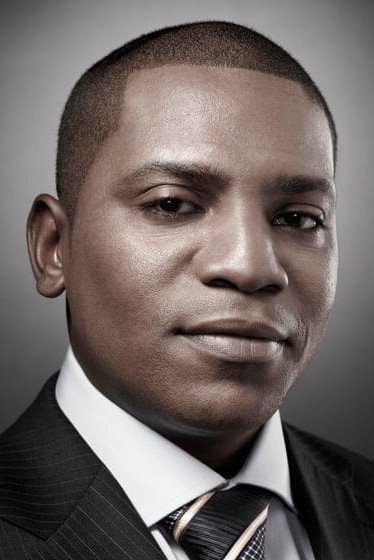

Wood Harris

I always thought Wood Harris was fantastic as Julius Campbell in ‘Remember the Titans.’ It’s kind of wild knowing he was thirty years old playing a high school student! The real Julius was only a teenager when all that happened, but Harris definitely looked the part of a powerful football player. It’s a classic example of Hollywood casting someone older to play a younger role, and honestly, it totally worked in this case.

Mekhi Phifer

The actor starred as Odin James in the 2001 film ‘O’, a modern adaptation of a Shakespearean play. At 26, he played a high school basketball star in a story centered around the competitive and often fraught relationships within a school. His character was a teenager dealing with the complexities of high school social life, and the actor gave a powerful performance that highlighted the movie’s tragic elements.

Derek Luke

The actor began his film career in 2002, starring as the main character in the biographical drama ‘Antwone Fisher’. He was 28 during filming, but played a young sailor who was only 18 years old. The film was based on the true story of a Navy serviceman, and the actor’s young appearance made it believable. This role won him awards and helped start his successful acting career.

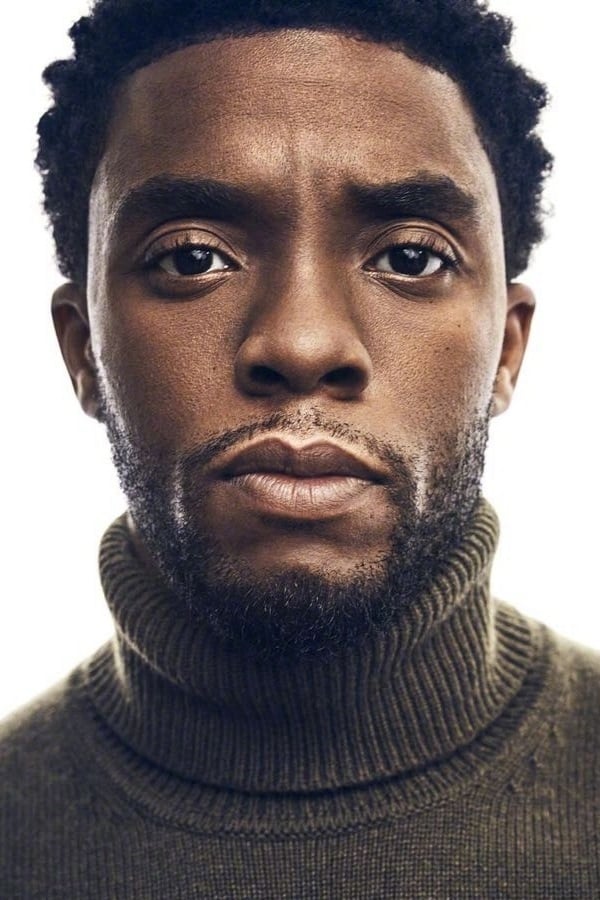

Chadwick Boseman

The actor, who recently passed away, famously played James Brown in the 2014 film ‘Get On Up’. He was 36 years old while convincingly portraying Brown as a teenager, a feat he achieved through dedicated physical performance and dance. The movie spanned Brown’s entire life, from his youth to his later years, and despite the age gap, the actor received widespread praise for his commitment to the role.

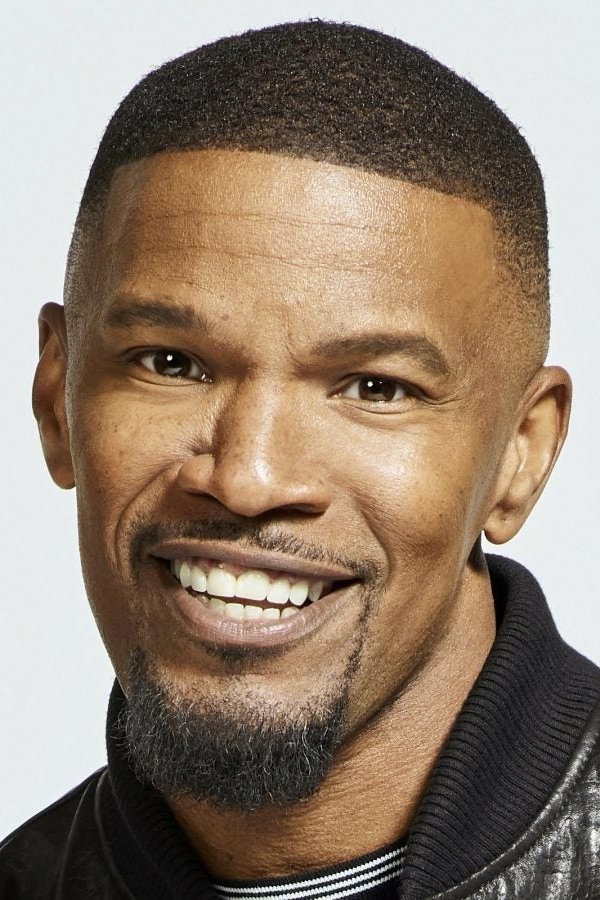

Jamie Foxx

Jamie Foxx gave an incredible performance as Ray Charles in the 2004 movie ‘Ray’. He was 36 years old when he played Charles as a young man, and the role required him to portray the musician at various points in his life and career. He won an Academy Award for his stunning portrayal of the music icon. His skillful imitation of Charles’s mannerisms and voice made any differences in their ages seem unimportant.

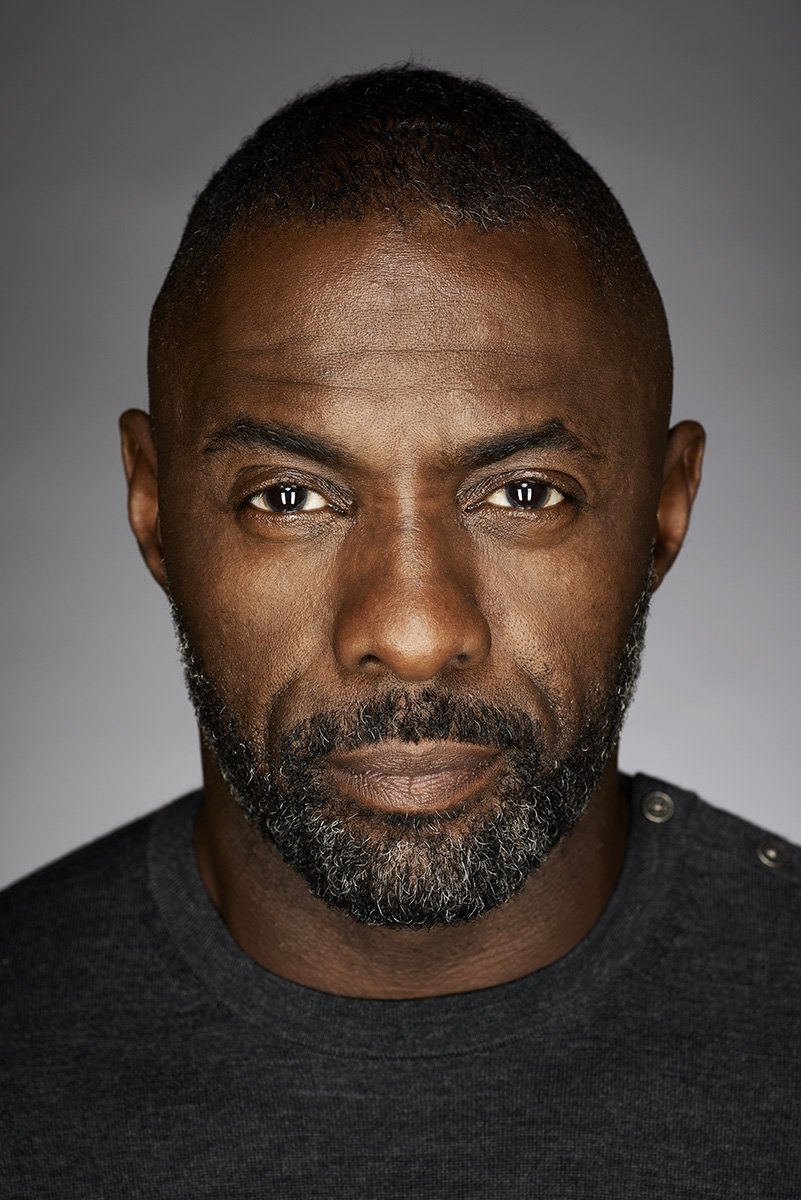

Idris Elba

In the 2021 western film ‘The Harder They Fall,’ this actor portrayed the outlaw Rufus Buck. Interestingly, the real Rufus Buck was just 18 years old when he was executed for his crimes. The actor, who was 49 at the time of the film’s release, was considerably older than the historical figure. The movie generally took many creative freedoms when depicting the lives of famous people from the Old West. The actor’s strong performance and presence made the villain particularly intimidating.

Jonathan Majors

In the western film ‘The Harder They Fall’, the actor portrayed the famous cowboy Nat Love. The movie focuses on a younger, more rebellious version of the historical figure, depicting him at the height of his outlaw days. Though the actor was 32, the real Nat Love would likely have been much younger during the events shown in the film, which prioritized a dramatic revenge story over strict historical accuracy. The actor’s performance was key to the film’s unique and modern style.

Will Smith

In the movie ‘Gemini Man,’ Will Smith played both a veteran operative and a younger version of himself, thanks to groundbreaking digital technology. At 51, Smith convincingly portrayed a character who appeared to be 23 years old. Filmmakers used sophisticated motion capture to digitally de-age him, allowing him to perform stunts and deliver lines as if he were a man in his early twenties. The film used this innovative visual effect to delve into ideas about identity and cloning.

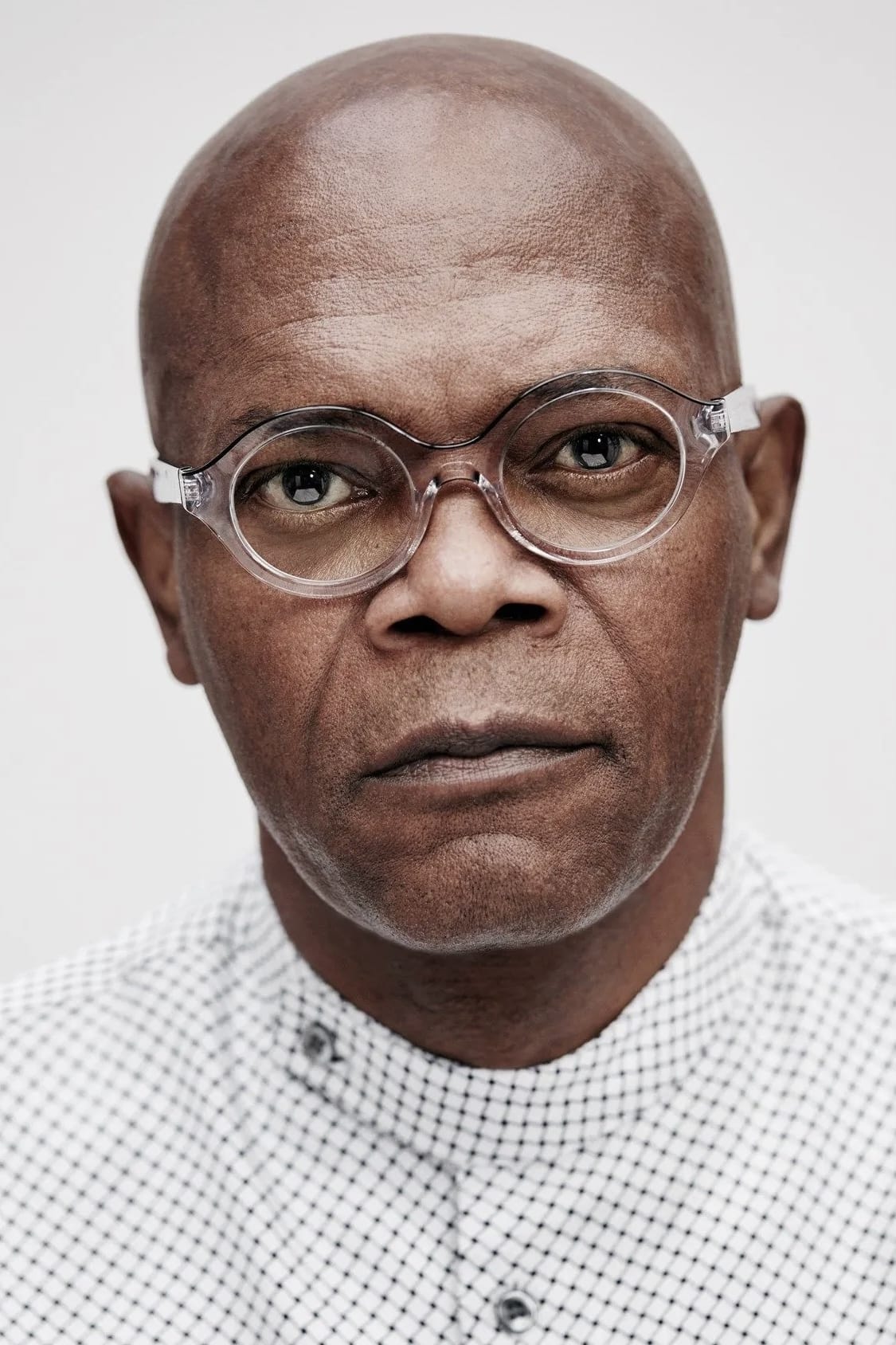

Samuel L. Jackson

This experienced actor played a younger Nick Fury in the 2019 movie ‘Captain Marvel’. Though he was 70 years old during filming, his character was supposed to be in his 40s, set in the 1990s. To make him look younger, filmmakers used digital technology to alter every single frame of his performance. This was one of the most significant applications of this technology for a key supporting role. Despite the de-aging effects, he delivered the same energetic performance audiences expect from his decades-long career.

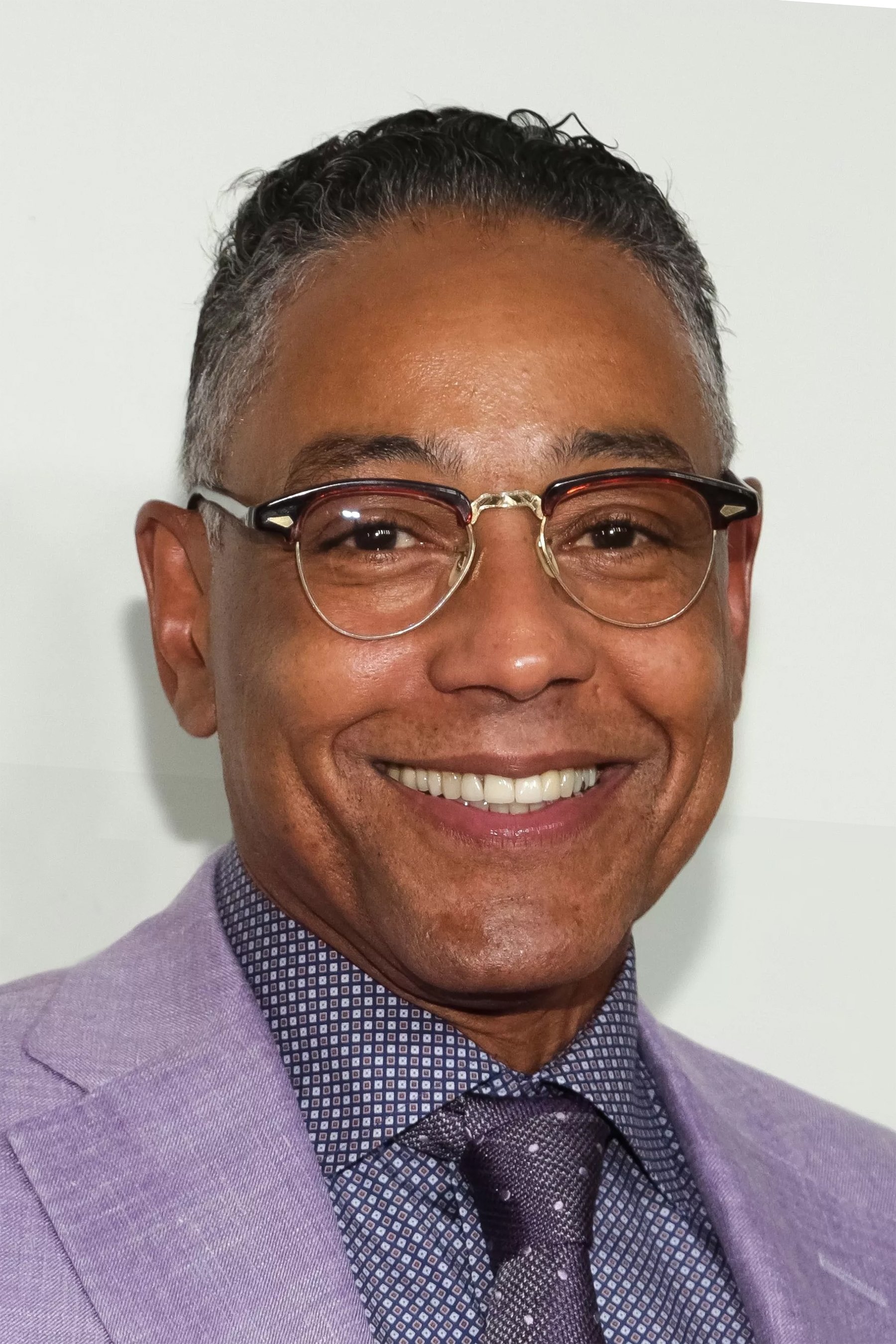

Giancarlo Esposito

The actor returned as Gustavo Fring in the series ‘Better Call Saul’. While filming, he was in his early 60s, but his character was meant to appear much younger – around the age he was when first introduced in ‘Breaking Bad’. The show’s storyline demanded he convincingly portray a man in his 40s or 50s. Even with the years passing, he perfectly captured the character’s calm and controlled personality, and fans loved seeing him reprise the role, acknowledging the natural changes in his appearance.

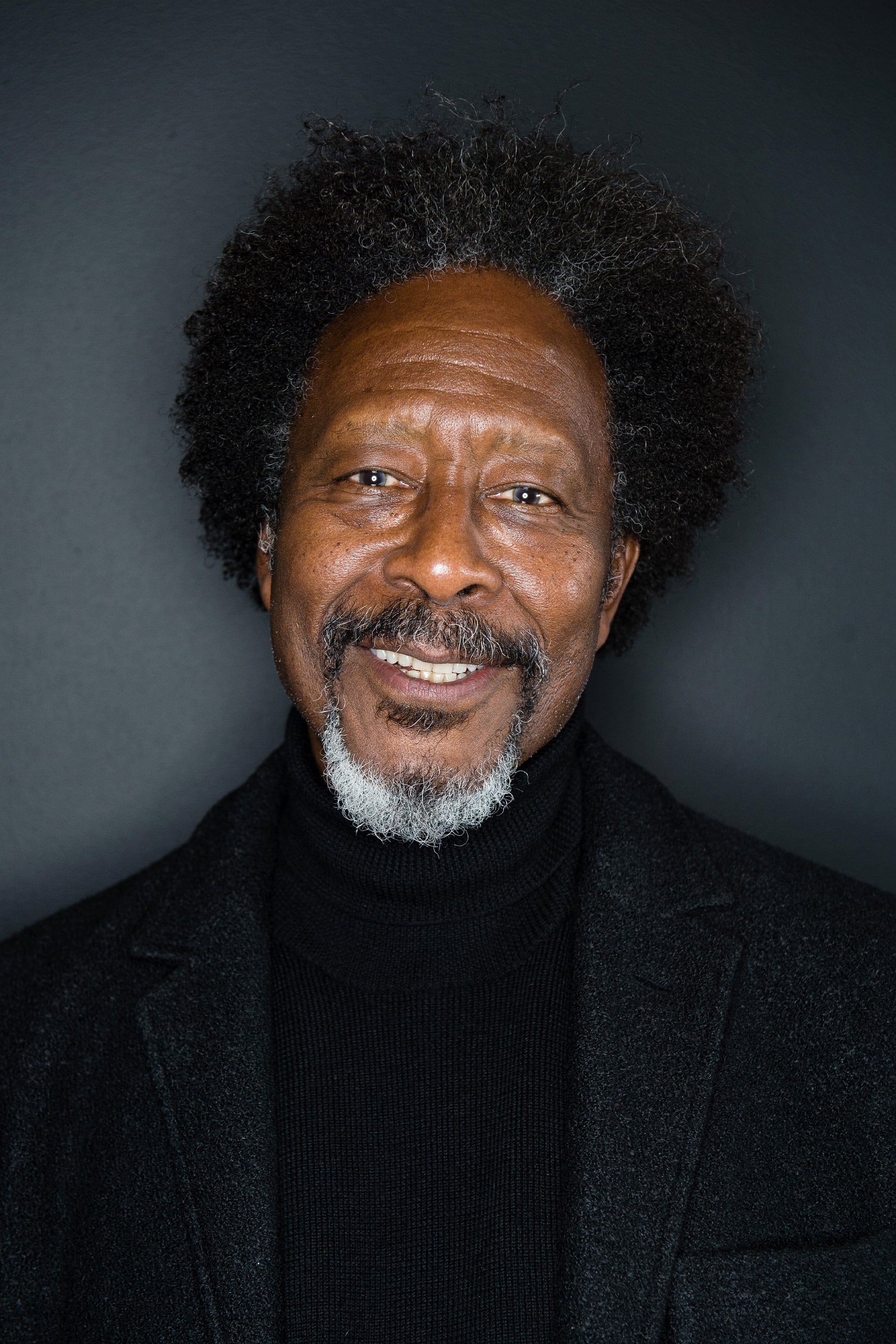

Glynn Turman

Glynn Turman starred as the high school student Preach in the 1975 film ‘Cooley High,’ despite being 28 years old at the time – much older than the teenage character he played. The movie tells the story of a group of friends growing up and finding love in 1960s Chicago. His performance is now considered a classic and helped shape many later films set in urban environments. Despite the age difference between the actor and his role, ‘Cooley High’ became a culturally significant film.

Donald Faison

The actor is known for playing Murray Duvall in the 1995 movie ‘Clueless’. At 21, he convincingly portrayed a high school student and Dionne’s boyfriend, a character who was supposed to be around 16 or 17 years old. He later returned to the role in a television series based on the movie, appearing in multiple seasons. His naturally young look enabled him to play teenage characters for a long time in his career.

Robert Ri’chard

I first really noticed this actor when he landed the role of Arnaz Ballard on ‘One on One’ back in 2001. He was so young then, only 23, and he basically grew up with the character over the years, playing him through his twenties. It was fun watching Arnaz evolve from a high schooler into a college student and then navigate adult life on the show. Honestly, he just had this naturally youthful look and wasn’t very tall, which made him totally believable as a teen, and he really became a familiar face in all those teen shows that were popular in the early 2000s.

Columbus Short

The actor starred as DJ Williams in the 2007 dance movie ‘Stomp the Yard’. He played a college freshman and was 24 years old at the time. The film focused on the intense world of fraternity stepping competitions. His character was navigating the grief of losing his brother while also adjusting to college life. Despite not having danced recently, he demonstrated impressive athleticism and dance skills in the role.

Ne-Yo

I remember seeing Columbus Short as Rich Brown in ‘Stomp the Yard’ back in 2007. He was playing a college student, but honestly, at 27, he seemed a little older than the typical undergrad! It was cool to see him tackle some really intricate dance routines with a bunch of younger dancers. That movie was one of the first times I really noticed him as an actor, and it definitely showcased his talent.

Jesse Williams

The actor started on ‘Grey’s Anatomy’ as Dr. Jackson Avery in season six. At 28, he played a surgical resident – a role usually filled by someone in their mid-20s. He played the character for more than ten years, growing with the role into his late 30s. Because the show didn’t always follow real-time, his character’s age sometimes didn’t quite match. He quickly became a popular character and a key part of the show’s long run.

T.I.

The artist starred as Rashad in the 2006 movie ‘ATL’, playing a high school senior despite being 25 years old at the time. The film centers on a group of friends spending their last summer together at a skating rink before starting their adult lives. Critics especially liked his realistic and genuine portrayal of a teenager worried about what comes after graduation.

Kel Mitchell

Beginning in 2015, the actor appeared in the Nickelodeon series ‘Game Shakers,’ playing Double G – a wealthy and successful hip hop artist and father. The role marked a return to the network where he first gained fame as a teenager. He brought the same energetic, physical comedy style to ‘Game Shakers’ as he did on ‘All That,’ portraying a larger-than-life character who interacted with a group of young, entrepreneurial kids. He was in his late 30s during the show’s run.

Nick Cannon

The actor starred as Devon Miles in the 2002 movie ‘Drumline’. He was 21 years old when he played a first-year college student at a made-up university in Atlanta. His character was a naturally gifted, but somewhat boastful, drummer from New York City. He spent several weeks practicing to convincingly portray a professional percussionist in the film’s musical scenes. His performance was key to the film’s popularity, making it both a box office hit and a beloved classic.

Jason Weaver

He became well-known for playing a young Michael Jackson in the 1992 TV miniseries ‘The Jacksons: An American Dream’. At just 13 years old, he portrayed the pop star during his early years with the Jackson 5, starting when Michael was nine. He even sang all of the character’s songs, and his voice closely matched the original recordings. This performance is still considered a highlight of his work as a child actor.

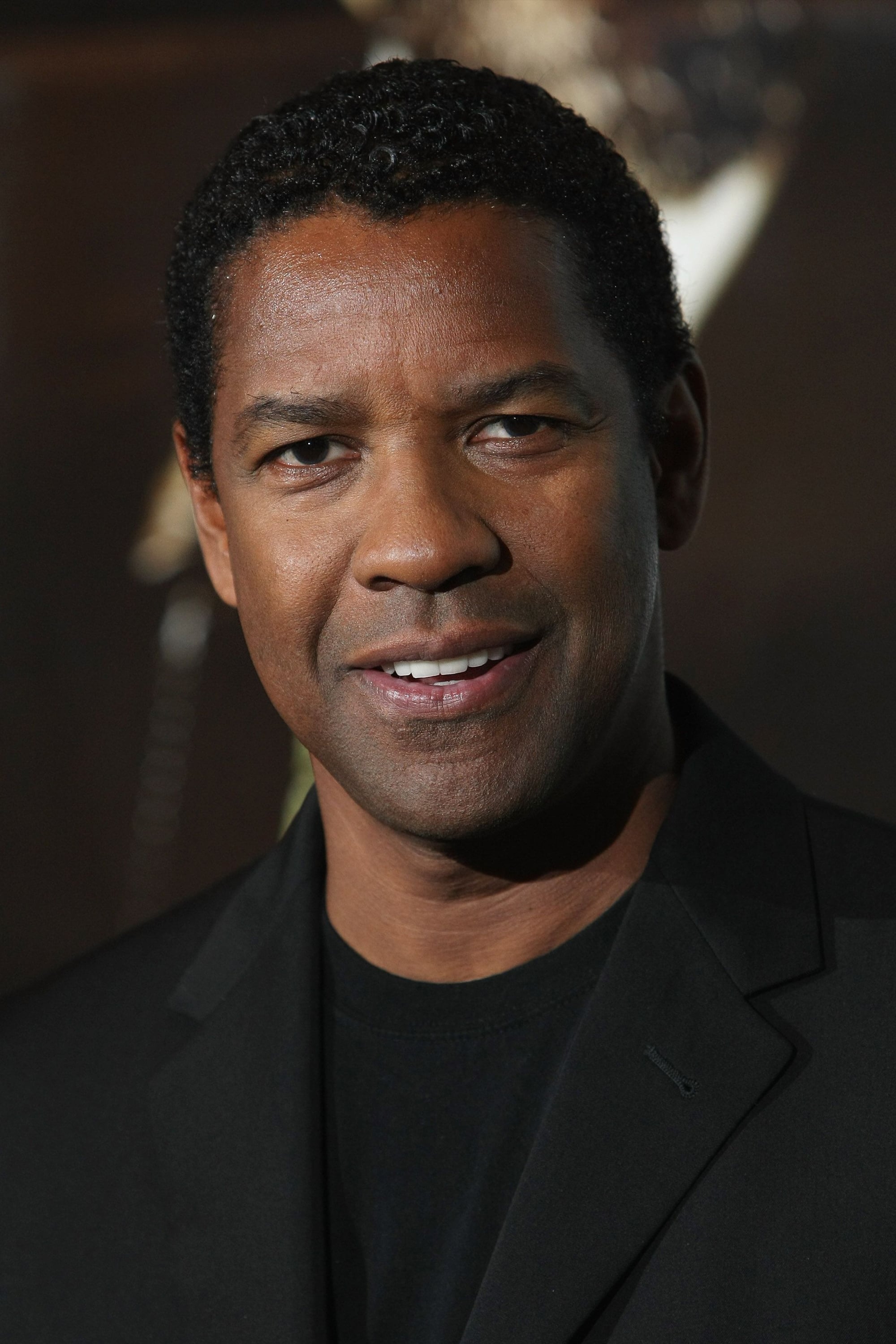

Denzel Washington

The celebrated actor took on the role of Troy Maxson in the 2016 movie ‘Fences’. Though he was 61 at the time, the character was written as 53 years old – a former baseball player dealing with difficulties from his past and within his family during the 1950s. He had previously earned widespread praise for playing the same role on Broadway. His strong performance was so compelling that the slight age difference wasn’t noticed by most viewers.

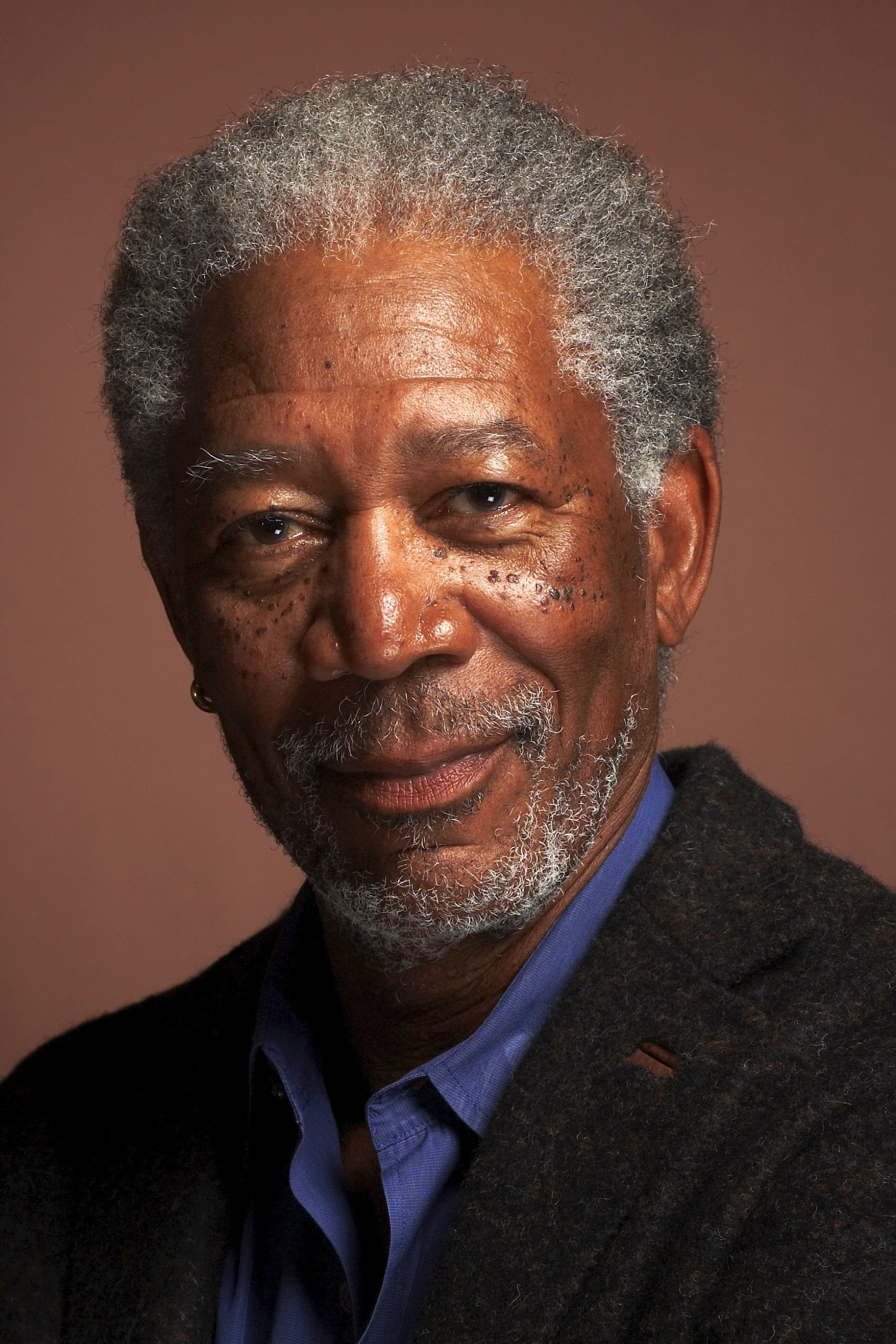

Morgan Freeman

Morgan Freeman famously played the character of Red in the 1994 film ‘The Shawshank Redemption’. He was 57 years old during filming. Interestingly, the Red from the original Stephen King story was a younger, white man with Irish roots. The filmmakers changed the character specifically to suit Freeman and his captivating presence. His narration and performance in the film are now considered legendary.

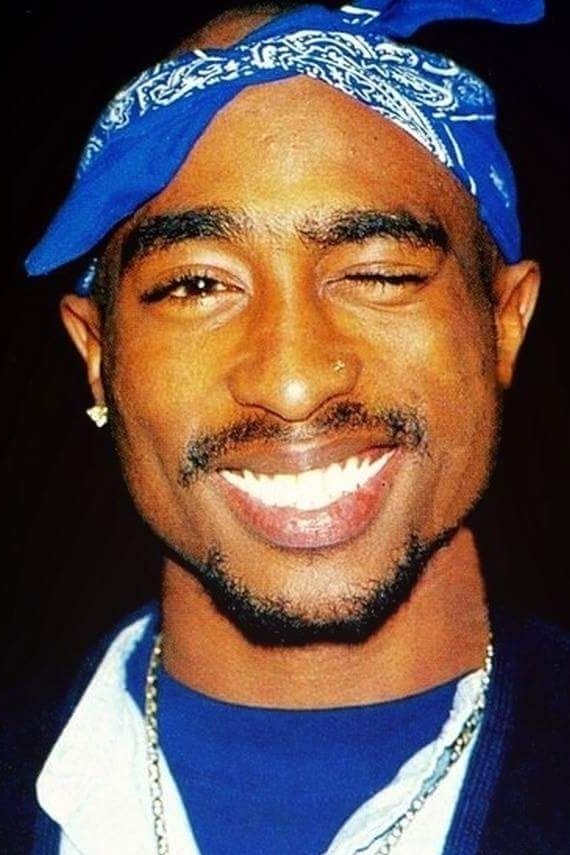

Tupac Shakur

The late rapper and actor famously played Bishop in the 1992 film ‘Juice’. While filming, he was 20 years old but convincingly portrayed a high school student in Harlem. The movie centers on four friends trying to gain power and respect in their community. His powerful performance stood out and hinted at his talent for serious acting. Although a little older than most high school students, he perfectly captured the film’s tough and realistic feel.

Omar Epps

The actor starred as Quincy Hall in the 1992 movie ‘Juice’. Though he was 18 during filming – around the age of a high school student – he portrayed a younger character. The film depicted the challenges faced by teenagers navigating street violence and interactions with the police. This was his breakout role, launching his career and marking him as an up-and-coming talent. For several years after ‘Juice’, he continued to take on roles as young people.

Delroy Lindo

The actor starred in Spike Lee’s 2020 film, ‘Da 5 Bloods,’ portraying a Vietnam War veteran revisiting the country at age 67. Interestingly, because of the war’s timeline, his character was roughly the same age as the actor himself – likely in his late 60s or early 70s. The filmmakers cleverly avoided using technology to make the actors appear younger in flashback scenes, instead relying on the audience to envision them as their younger selves.

Clarke Peters

The actor portrayed Otis in the 2020 drama ‘Da 5 Bloods’ and was 68 years old during filming. Similar to the other actors, he played his character at two different times: in the present and during scenes set during the Vietnam War. The filmmakers intentionally avoided using digital effects to emphasize how time had affected the characters. His performance was praised for being both powerfully understated and emotionally resonant.

Isiah Whitlock Jr.

The actor portrayed Melvin in Spike Lee’s ‘Da 5 Bloods’, playing a veteran soldier at age 65. He appeared in flashbacks with other senior cast members, depicting their characters as younger men during the 1960s. This technique highlighted the long-term psychological effects of war. Before the film’s tone became more serious, he brought a lot of humor and levity to the story.

Norm Lewis

The experienced Broadway actor played Eddie in the movie ‘Da 5 Bloods’. At 57, he portrayed a former soldier who was the youngest of the four main veterans. Even so, he was much older than he would have been during his time as a soldier. The film centers on the strong connection between the men as they hunt for hidden gold, and his character helps the others remember their shared history.

Anthony Mackie

In the 2002 movie ‘8 Mile’, the actor portrayed Papa Doc, a local rapper and gang leader. At 24 years old, he played a rival to Eminem’s character in a story set within Detroit’s hip hop world, focusing on young artists striving for success. His character was depicted as more mature and experienced than the other up-and-coming rappers in the film.

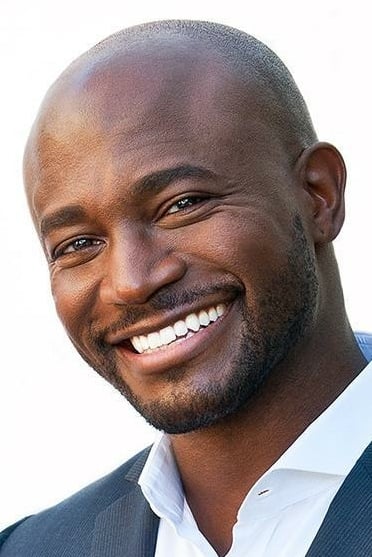

Taye Diggs

Okay, so I was really excited when Taye Diggs came back as Harper Stewart in ‘The Best Man Holiday’ back in 2013. He was 42, but the story jumped forward from the first movie – which came out 14 years earlier – and everyone was supposed to be a bit younger. He honestly didn’t look a day over 30, which was great because it made the time jump feel seamless. The movie did really well in theaters, and it even led to a spin-off series, which is always cool to see!

Morris Chestnut

The actor portrayed Lance Sullivan, a professional football player, in ‘The Best Man Holiday’. At 44 years old, he played a character still actively playing in the NFL, which is unusual since most athletes retire much earlier, especially from physically demanding positions. He was in excellent shape, which allowed him to realistically portray an athlete at the height of their career. He later played the same role in another television show.

Terrence Howard

The actor gained recognition for his role as Djay in the 2005 film ‘Hustle & Flow’. At 36, he powerfully portrayed a Memphis man trying to make it as a rapper, while also working as a pimp. The character was intended to be in his late 20s or early 30s, striving for a better life. His performance was critically acclaimed and earned him an Oscar nomination for Best Actor, highlighting both his dramatic range and musical ability.

Share your thoughts on these casting choices in the comments.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

- Top 20 Educational Video Games

2026-03-08 17:19