Now, I reckon there’s a good many folks out there lookin’ to make a dollar, and not a few who’ve cast their eye toward these Real Estate Investment Trusts – REITs, they call ’em. The State Street SPDR Dow Jones REIT ETF (RWR 1.43%), it’s a basket o’ a hundred such concerns, a right sizable collection if you ask me. It’s a way, see, to dip your toes in the whole pond of brick and mortar, without havin’ to actually own a brick, or worry about leaky roofs. A clever arrangement, though I suspect some fella in a waistcoat is gettin’ a cut.

I’ve been watchin’ this ETF, RWR, like a hawk watches a hen house, and I’ve noticed a thing or two. Seems there’s two currents that could send this little vessel soarin’, or sinkin’ it faster than a lead weight. It’s a simple story, really, if you can wade through the financial jargon.

The Long and Short of Interest

These REITs, they’re sensitive creatures, beholden to the whims of interest rates. When rates climb, it costs ’em more to borrow money, like askin’ a man to pay extra for the air he breathes. They can’t build new properties, can’t expand, and folks start lookin’ elsewhere for a safe place to park their money. It’s a right pickle, I tell ya.

But when those rates fall? Why, that’s a different kettle o’ fish altogether. Borrowin’ gets cheaper, buildin’ booms, and folks start seein’ real estate as a good bet again. It’s a simple principle, really – money likes a smooth path, and lower rates are just that. So, if those rates decide to take a tumble, this RWR ETF could very well take flight.

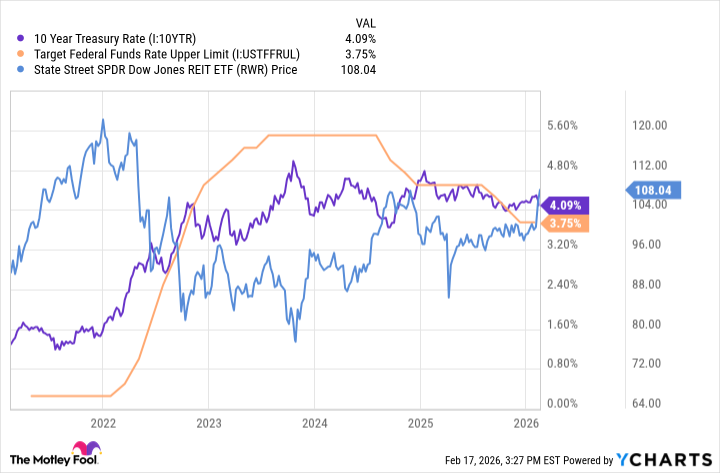

Now, the Federal Reserve has been fiddlin’ with rates for a spell, but the long-term ones – the 10-year Treasury, that’s the one to watch – haven’t been movin’ much. It’s like tryin’ to steer a steamboat with a feather. That 10-year, it’s the real governor on this whole operation.

As you can see in that chart, RWR and that 10-year Treasury, they tend to dance a jig in opposite directions. If that 10-year dips below 4%, well, I reckon RWR could have a right good time of it.

What Makes the 10-Year Tick?

Now, a heap o’ things can influence that 10-year rate – the Fed, wars and rumors o’ wars, the state o’ the economy, and that slippery critter, inflation. But I’ve got my eye on inflation the closest. It’s the Fed’s compass, and usually the biggest driver o’ those long-term rates.

Just recently, the annual inflation rate rose a mere 2.4% over the last twelve months – less than some folks were expectin’. It’s comin’ down from the high water mark o’ 7% we saw after the pandemic, and gettin’ closer to the Fed’s target o’ 2%. A good sign, if you ask me, though I’ve seen promises broken before.

If inflation keeps fallin’, and the Fed lets those rates ease up a bit, well, that could be just the wind in the sails o’ these REITs. The tariffs are startin’ to fade, oil prices are droppin’ (which means cheaper gas, thank goodness), and we didn’t have a major disaster last year to send insurance rates sky high. It’s a confluence o’ events, and I reckon it’s worth keepin’ an eye on.

A Word to the Wise

This State Street SPDR Dow Jones REIT ETF, it offers a way to spread your bets across the whole real estate sector. If that 10-year Treasury rate does indeed fall, and inflation stays tamed, well, this ETF could very well soar. But remember, friend, there are no guarantees in this world, and a fool and his money are soon parted. Just do your homework, and don’t bet the farm on any one thing.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

2026-02-19 14:12