In a world where cryptocurrencies dance like disheveled marionettes, Ethereum is valiantly attempting to claw its way back above the illustrious $2,000 mark. Ah, but what a time it is! The broader crypto market resembles a tightrope walker with vertigo-navigating the treacherous landscape of uncertainty and relentless selling pressure. Yes, dear reader, recent price movements suggest a fragile recovery effort, akin to a cat trying to swim, rather than a bold trend reversal. With volatility strutting its stuff, traders are as cautious as a cat in a room full of rocking chairs.

Enter the oracle known as CryptoQuant, offering us a glimpse into the cryptic world of Ethereum’s derivatives. We learn that the Estimated Leverage Ratio on Binance has taken a nosedive to a mere 0.557-its lowest since last December. This decline follows a raucous period of leverage that peaked at a rambunctious 0.675, evoking images of traders tossing caution to the wind like confetti at a wedding.

What does this all mean? A simple deduction: traders are retreating from their high-risk escapades, perhaps reflecting upon their choices over a cup of weak tea. They are scaling back, closing those wild leveraged positions, or moving towards strategies more conservative than a librarian with a fine for overdue books. Such changes often occur during consolidation phases, when markets attempt to stabilize after a bout of volatility that could make even the bravest souls quake.

Declining Leverage Points To Potential Market Stabilization

The analyst, our modern-day Cassandras, posits that this decline in Ethereum’s leverage ratio mirrors a grander reduction in speculative risk across the derivatives market. Lower leverage suggests that traders are trimming their extravagant positions or perhaps closing them entirely, seeking safety like a squirrel hoarding acorns before winter’s chill. Historically, such deleveraging phases have heralded the formation of new price bases, as market participants prioritize capital preservation over fleeting speculative joys.

The descent from 0.675 to 0.557 is no minor hiccup; it’s a clarion call, a signal of meaningful change in market sentiment. Elevated leverage tends to enhance volatility, creating conditions ripe for abrupt liquidations, while declining leverage ushers in a calm sea, where price movements are less like a wild stallion and more like a gentle breeze.

From a medium-term perspective, this transition may indeed be constructive, akin to a phoenix rising from the ashes. Reduced leverage fosters a healthier foundation for price discovery, especially if supported by a strengthening demand that doesn’t resemble a mirage in the desert. Thus, the combination of lower leverage and stable price action suggests the market might be consolidating, preparing for more decisive moves once liquidity and sentiment align like stars in a cosmic ballet.

Ethereum Price Remains Under Pressure Below Key Averages

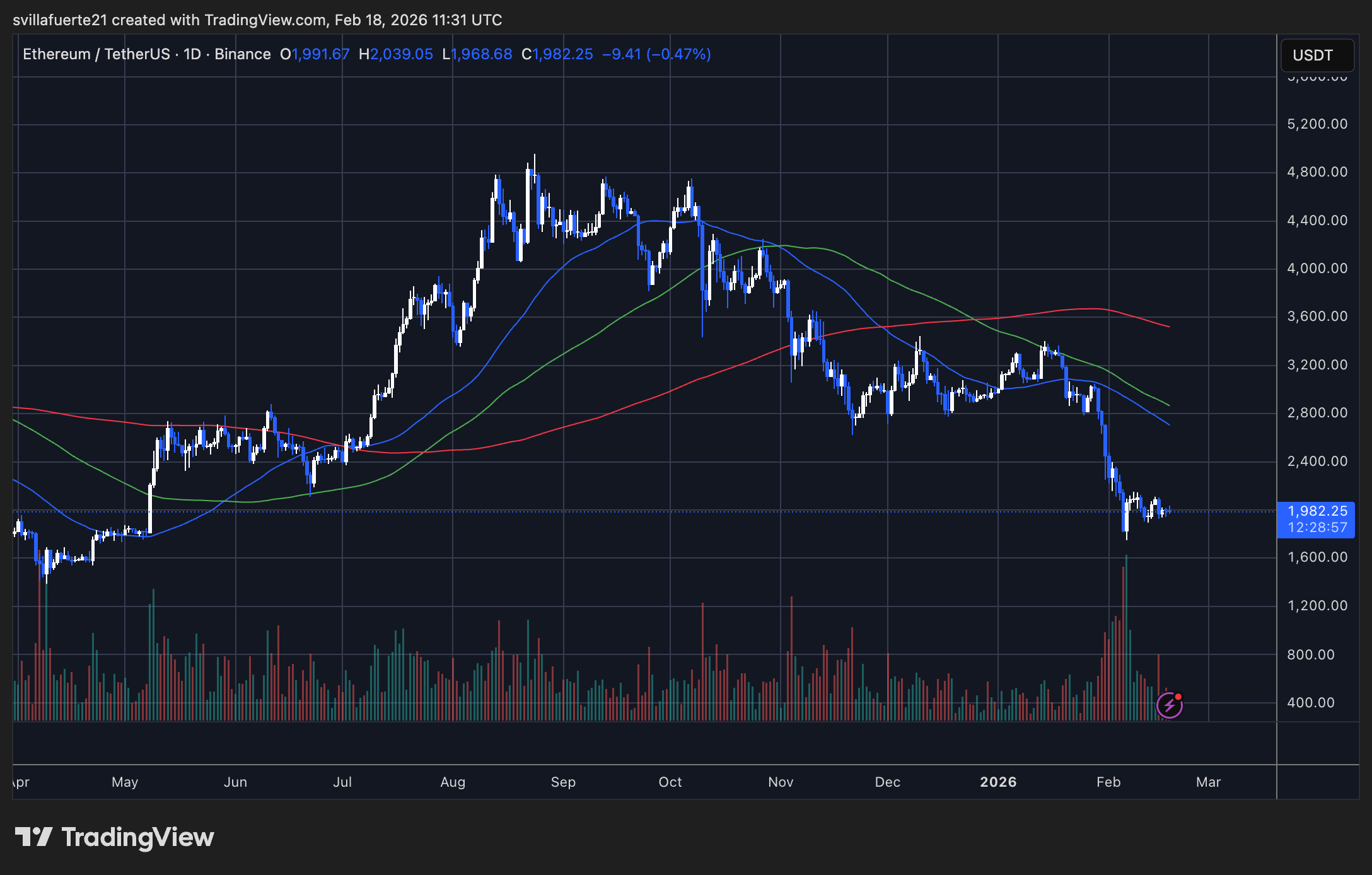

Here we find Ethereal Ethereum still loitering around the $2,000 mark, following a sharp corrective move reminiscent of a catapulting cannonball after its late-2025 highs. The chart reveals a bearish structure, with prices consistently recording lower highs since the October peak-like an underdog story gone awry, failing to sustain its heroic recoveries above key moving averages. Attempts at stabilization yield nothing but shallow rebounds, indicating persistent selling pressure and a market positioning itself cautiously, like a poker player eyeing their opponents.

Remarkably, ETH remains beneath its short-, medium-, and long-term moving averages, which are all trending downwards-a sure sign of sustained bearish momentum. This alignment suggests that any rallies shall face resistance unless the price can reclaim its former glory decisively. The elusive 200-day moving average now stands tall, a major structural resistance zone, watching like a stern teacher with a ruler.

Volume data adds context to this saga. The latest sell-off was accompanied by a noticeable spike in trading activity, reminiscent of a chaotic market day where emotions run high. Since then, volume has moderated, consistent with a consolidation phase rather than an immediate reversal, leaving us all wondering if the sun will shine again or if we’re headed for another gloomy day.

From a technical standpoint, the $1,900-$2,000 range now acts as a short-term stabilization zone, like a safe harbor amid turbulent seas. However, failure to hold this area could expose lower support levels, while a sustained break above nearby resistance would be needed to signal improving momentum. And so, the saga continues…

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

- Michael Burry’s Market Caution and the Perils of Passive Investing

2026-02-19 07:36