The current enthusiasm for Artificial Intelligence stocks is, shall we say, experiencing a period of… adjustment. A polite way of saying that people are starting to wonder if they’ve accidentally wandered into a particularly elaborate bubble, one constructed entirely of algorithms and venture capital. (It’s surprisingly fragile, really. One badly-written line of code and the whole thing could deflate like a punctured existential balloon.) Concerns about escalating capital expenditures amongst the tech giants are, naturally, being blamed. This is standard procedure; somebody always gets the blame when reality intrudes upon optimistic projections.

However, before we all rush to sell everything and invest in something reliably boring – say, artisanal cheese futures – it’s worth remembering that these companies are, in theory, spending all this money to automate things. To make processes less… process-y. The idea is that AI will contribute to the global economy in ways that are, if not entirely predictable, at least statistically probable. (Though, of course, statistics are just a polite way of saying “educated guesses”.)

Market research firm IDC, which presumably has access to slightly more data than the rest of us, suggests that every dollar spent on AI services might generate $4.90 in value. This is either remarkably efficient or a testament to the power of creative accounting. (It’s probably both.) Regardless, it does make one wonder if we shouldn’t at least glance in the direction of Nebius Group (NBIS +4.33%) and Twilio (TWLO +1.96%). Two companies that, if nothing else, are attempting to profit from the general AI-shaped kerfuffle.

Nebius Group: Renting Out the Thinking Machines

Nebius, it turns out, is in the business of providing “neocloud infrastructure.” Which, as far as we can tell, means they rent out computers that are particularly good at thinking. Or, more accurately, at performing complex calculations that simulate thinking. (The distinction is crucial, though most AI would probably disagree.) They offer both the hardware – powerful graphics processing units, or GPUs – and the software to manage it all. The full-stack approach, they claim, is a competitive advantage. (It’s certainly more comprehensive than just offering half a stack.)

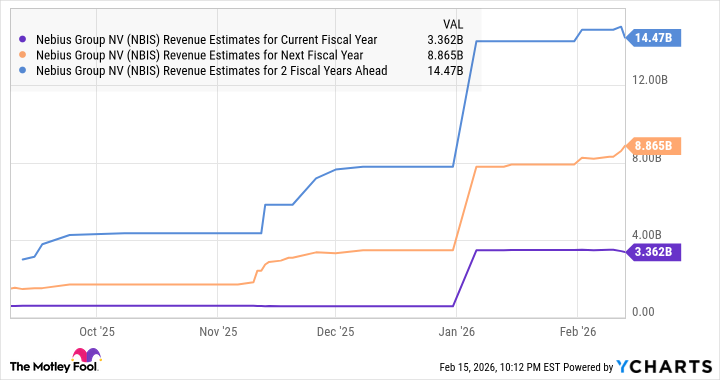

Nebius boasts a clientele that includes such luminaries as Meta Platforms and Microsoft. (One can only imagine the inter-company memos.) Their recent quarterly results showed a revenue jump of approximately sixfold, reaching $530 million. (A substantial increase, though still dwarfed by the sheer volume of cat videos uploaded to the internet every minute.) They anticipate an annualized run rate revenue (ARR) between $7 billion and $9 billion by the end of 2026. (A sevenfold increase. At this rate, they’ll be able to afford a really nice stapler.)

This growth is fueled by a massive expansion of their data center capacity. They’re planning to increase their number of data center sites from seven to sixteen in 2026. (More servers. More blinking lights. The modern equivalent of a really big library.) They’ve already surpassed their target of 100 megawatts (MW) of active data center power capacity, currently operating at 170 MW, and aim for 800 MW to 1 gigawatt (GW) by the end of 2026. (Enough power to illuminate a small country, or run a very large number of AI simulations.)

Analysts are predictably optimistic, forecasting a significant jump in revenue in 2026. (Analysts are always optimistic. It’s part of their job description.) The stock is currently trading at 59 times sales, which is, admittedly, rather expensive. (But then again, so is everything these days.) However, the exponential growth and substantial backlog might justify the price. (Or it might not. The market is a fickle beast.)

Twilio: Making Phones Smarter (Or at Least More Annoying)

Twilio isn’t exactly a household name in the AI software market. (Most households are more familiar with the concept of a comfortable sofa.) However, their growth trajectory is improving, thanks to the aforementioned AI kerfuffle. They’re a cloud communications company that helps businesses connect with their customers across various channels – text, chat, voice, and video. (Essentially, they’re in the business of facilitating more interactions. Whether those interactions are welcome is another matter.)

Twilio helps clients boost sales by enhancing customer engagement through personalized recommendations. (The goal, of course, is to convince customers to buy things they didn’t know they needed.) They’re using AI tools to deliver better insights about customers, and this strategy appears to be paying off. (Though it’s difficult to say whether the customers are actually benefiting.)

Their Voice AI solution saw a 60% year-over-year revenue increase in the fourth quarter of 2025. (A substantial increase, though one must wonder what percentage of that increase is attributable to automated telemarketers.) This solution automates customer support, provides real-time suggestions to agents, and offers personalized recommendations. (The ultimate goal: to replace human interaction with algorithmically-generated pleasantries.)

Twilio’s active customer base increased by 24% year-over-year in Q4 2025, reaching 402,000. (More customers. More data. The cycle continues.) Their dollar-based net retention rate is 109%, up from 106% the previous year. (Existing customers are spending more money. A sign of success, or a symptom of Stockholm Syndrome?) This metric suggests that AI tools are helping Twilio win a bigger share of their customers’ wallets. (Or at least, convincing them to open them.)

Twilio’s 2025 revenue increased by 14% to just over $5 billion, while adjusted earnings per share jumped by 33% to $4.89. (Positive numbers. Good for shareholders. Less good for the concept of a balanced work-life.) They’re forecasting a 15% revenue increase in the current quarter. (If they achieve this, they might be able to afford a slightly nicer stapler.)

The stock is currently trading at 3.6 times sales and 20 times forward earnings, a discount to the Nasdaq Composite’s multiples. (A potential bargain, if you believe in the power of algorithms.) Analysts have a median price target of $147, suggesting potential gains of 28%. (A plausible scenario, assuming the AI bubble doesn’t burst.)

Given its solid growth potential, Twilio might be worth a look. (Or it might not. Investing in the stock market is always a gamble. A beautifully complex, statistically improbable gamble.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Brent Oil Forecast

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

2026-02-19 04:02