Right. So, the market. It’s…a lot. Everyone’s terribly excited about Artificial Intelligence, which is good, I suppose. Though I do worry about the robots taking over. And the sheer amount of electricity they’ll need. It’s enough to give anyone a headache. Anyway, I’ve been looking at stocks, trying to be sensible, and I’ve landed on Vertiv. VRT. It sounds…solid. Like a good pair of shoes. Which, frankly, is reassuring.

The problem is, everything feels a bit frothy, doesn’t it? Everyone’s throwing money at AI, and I’m starting to suspect a lot of it is just…hope. But Vertiv, they actually do something. They provide the infrastructure. The power, the cooling, the racks…all the boring but essential stuff that keeps the AI humming. Which, again, is good. Less chance of it suddenly deciding it doesn’t like us.

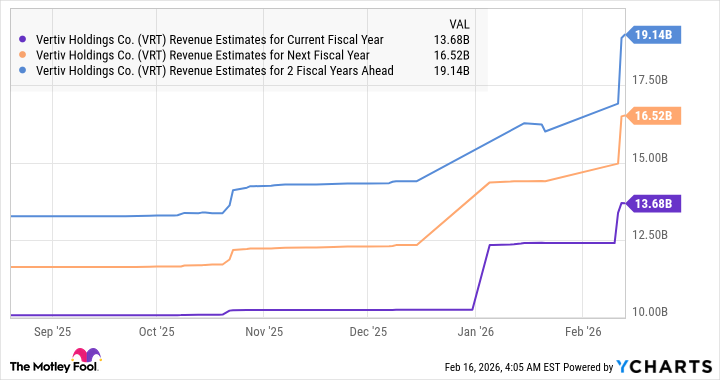

I’ve been tracking their numbers, and they’re…promising. Revenue up 27.5% to $10.2 billion. Adjusted earnings up 47% to $4.20 a share. It’s all very…upward. They’re projecting another good year in 2026, with revenue growth of 32%, potentially hitting $13.5 billion. Though, honestly, projections are always a bit…optimistic, aren’t they? Like promising yourself you’ll start a diet on Monday.

Units of Cryptocurrency Lost: 0 (so far). Hours Spent Staring at Financial Reports: 17. Number of Times I’ve Considered Just Buying a Farm: 4.

The really interesting bit is their order backlog. It’s huge. Up 81% year-on-year, at $15 billion. Apparently, they’re receiving more orders than they can actually fulfill. Which, in theory, is a good thing. It means demand is high. But it also means they need to…you know…actually deliver on those orders. Which is always the tricky part.

Apparently, the big hyperscalers – the ones building all these massive data centers – are planning to spend around $700 billion this year. That’s a 78% increase. And then there are companies like OpenAI and Anthropic, and these new “neocloud” providers like CoreWeave and Nebius Group, all building out their infrastructure. It’s a bit of a frenzy, really. And Vertiv is, essentially, selling them the building blocks.

Is it a Buy? (The Eternal Question)

Vertiv’s stock has already shot up – over 117% in the past year. Which is…encouraging. It’s currently trading at 9 times sales, which, compared to the rest of the tech sector, isn’t terribly expensive. Though, of course, “not terribly expensive” doesn’t necessarily mean “cheap.” It just means it’s not quite as ridiculously overpriced as some other things.

Analysts are expecting continued growth in 2026 and beyond. Which is nice to hear. Though, I always take analyst predictions with a grain of salt. They’re usually wrong. Or at least, they’re usually overly optimistic.

So, is it a buy? Honestly, I’m not entirely sure. It feels…sensible. Which, in this market, is almost suspicious. But the numbers are good, the backlog is huge, and they’re selling something real. Which, let’s face it, is more than can be said for a lot of other investments. I’m tentatively adding it to my portfolio. Though I’ll probably spend the next week worrying about it.

Number of Times I’ve Checked My Portfolio Today: 18. Number of Grey Hairs Gained: Approximately 7. Level of Overall Anxiety: Elevated.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Brent Oil Forecast

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Michael Burry’s Market Caution and the Perils of Passive Investing

2026-02-18 23:23