The relentless march of computation, a fever dream of ever-increasing capacity, has brought us to a curious precipice. Classical systems, for all their triumphs, are bound by the iron laws of physics, a finite realm of possibility. Thus, the whispers of quantum mechanics, of superposition and entanglement, have stirred a desperate hope—a belief that we might circumvent these limitations, unlock a new order of processing power. But hope, as any seasoned observer of the markets knows, is a treacherous commodity, easily inflated, easily dashed.

Rigetti Computing, a name now echoing through the halls of speculative finance, embodies this precarious hope. They fashion themselves as pioneers in this nascent field, building not merely machines, but a potential future. They possess a fabrication facility, a testament to ambition, and a programming language, Quil, born of necessity. They even offer access to their quantum capacity, a cloud-borne offering to those willing to gamble on the unrealized. It is a complete, self-contained ecosystem…a fragile one, perhaps, but complete nonetheless.

Ark Investment Management, guided by the hand of Cathie Wood, issues pronouncements on the future, “Big Ideas” reports that chart the course of technological progress. Their latest missive, a sober assessment of the quantum landscape, casts a long shadow over the enthusiasm that has gripped the market. It suggests a chilling truth: the promised revolution may be further distant than we dare admit, a mirage shimmering on the horizon of decades.

An Early Leader, Burdened by Prophecy

Rigetti, in its singular focus, has achieved a degree of technical proficiency. Their Cepheus-1-36Q, a multichip quantum computer, boasts a fidelity of 99.5%. A respectable number, to be sure, but a fidelity, in this context, is merely a measure of imperfection. It speaks to the errors inherent in the system, the constant struggle against the chaos of quantum states. Each operation, each calculation, carries with it the specter of inaccuracy. A 99.5% fidelity means an error roughly once every twenty operations. A small number, perhaps, but multiplied across millions of calculations, it becomes a chasm of uncertainty.

The language of computation has shifted. Bits, the simple binary units of classical computing, have yielded to qubits, entities capable of existing in multiple states simultaneously. This superposition, this inherent ambiguity, is the source of quantum power, but also the source of its instability. It is a delicate dance between possibility and certainty, a constant negotiation with the laws of probability.

Yet, despite these advancements, Rigetti’s revenues remain… modest. A mere $5.2 million in the first three quarters of the year. For a company valued at $5 billion, this is not progress, but a haunting discrepancy. A gilded cage built on air. The market has imbued them with a worth that their current performance simply cannot justify. It is a dangerous delusion, a collective act of faith divorced from reality.

They speak of future systems: a 150-qubit computer by 2026, a 1,000-qubit behemoth by 2027. Promises, promises. Each iteration promises greater fidelity, greater power. But scaling these systems is not a linear progression. It is an exponential climb, a relentless battle against the forces of entropy. To assume that past performance guarantees future results is not merely naive, but a fundamental misunderstanding of the underlying physics.

The Shadow of Alphabet, and the Weight of Years

Alphabet, the colossal entity that houses Google, is also pursuing the quantum dream. They possess resources that dwarf Rigetti’s, a vast infrastructure and a team of brilliant minds. Their approach is methodical, deliberate, a slow but steady march towards a distant goal. They are not driven by the need to impress the market, but by a genuine desire to understand the fundamental laws of the universe.

Ark’s research suggests that even Alphabet, with all its power, will not be able to crack the RSA-2048 encryption algorithm – the bedrock of internet security – until the year 2063. A chilling prospect, to be sure. But it also underscores the immense difficulty of the task. Breaking this encryption would be akin to dismantling the foundations of the digital world. It is a challenge that will require decades of relentless innovation.

RSA, a deceptively simple algorithm, relies on the difficulty of factoring large numbers. A quantum computer with 20 million qubits could theoretically solve this problem in a matter of hours. But the reality is far more complex. Today’s quantum computers can barely maintain coherence for milliseconds. They are fragile, temperamental machines, prone to errors and disruptions. The gap between theory and practice is vast, a chasm of technical challenges.

Ark posits that, with accelerated progress, cryptographic decryption could be within reach by 2044. But this requires a doubling of qubits and a 40% reduction in error rates every two years. Rigetti, in its ambition, claims to be on track to achieve similar gains. But such rapid progress is unsustainable. The laws of physics are not easily bent to the will of the market.

The Spectre of Valuation, and the Inevitable Reckoning

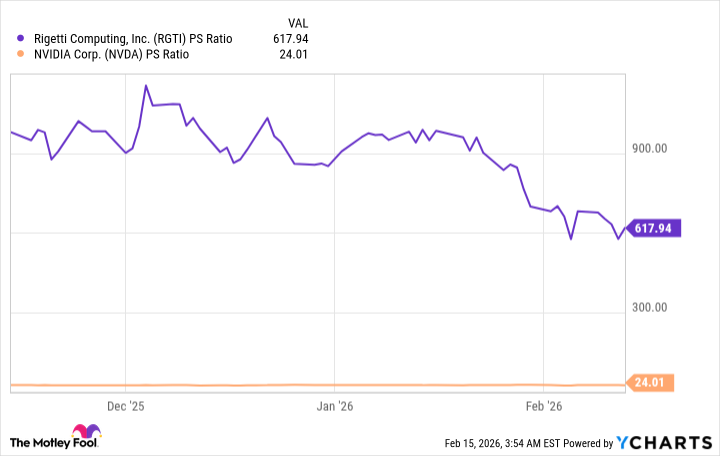

Rigetti’s stock, despite a recent decline, remains ludicrously overvalued. A three-year return of 1,550% has created a bubble of speculative fervor. But a $5 billion valuation for a company with minuscule revenue is not rational, it is madness. A price-to-sales ratio of 617 is an obscenity, a testament to the irrational exuberance of the market.

Nvidia, a true powerhouse in the world of artificial intelligence, boasts a P/S ratio of just 24. The discrepancy is staggering. It speaks to a fundamental disconnect between perception and reality. The market has fallen in love with a dream, ignoring the harsh realities of the underlying business.

Decades may pass before quantum computers achieve the error rates necessary for widespread commercial adoption. Rigetti will need to generate substantial revenue to justify its current valuation. The likelihood of such a scenario is remote. A significant correction in the stock price is not merely probable, it is inevitable. The market, in its capricious nature, will eventually demand a reckoning. And when that day arrives, the dreamers will be left with nothing but the weight of their illusions.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-02-18 05:12