It’s a curious affliction, this tendency of investors to build portfolios resembling leaning towers. Even the esteemed Mr. Buffett, a gentleman not entirely unfamiliar with accumulating capital, once allowed a single company – a fruit-themed one, no less – to dominate his holdings. A charming imbalance, perhaps, but hardly a testament to strategic foresight. One might compare it to a collector of postage stamps discovering he owns only pictures of pigeons.

Diversification, you see, is not merely a word whispered by brokers; it’s a shield against the inevitable vagaries of fortune. Yet, in this American landscape, we are often tempted to overindulge in domestic equities, as if the prosperity of our neighbors guarantees our own. Especially now, when the so-called S&P 500 appears less an index of broad economic health and more a popularity contest among a handful of tech behemoths – Nvidia, Microsoft, and, naturally, the aforementioned fruit company. A precarious position, wouldn’t you agree? Like placing all your eggs in a basket woven from silicon and shareholder enthusiasm.

But fear not, for there exists a remedy. A subtle maneuver, a calculated risk, if you will. And it manifests in a fund that offers exposure to the often-overlooked realm of small-cap stocks, with a distinctly international flavor. A counterbalance to the “Magnificent Seven,” as they are so dramatically called. And, as a delightful bonus, this fund has recently demonstrated a performance that leaves the S&P 500 looking rather… pedestrian.

Introducing the DLS ETF

Allow me to present the WisdomTree International SmallCap Dividend Fund (DLS 0.07%). A rather lengthy name, admittedly, but one that accurately describes its purpose. This ETF tracks companies paying dividends, specifically small-cap stocks in developed markets outside the United States and Canada. A clever strategy, wouldn’t you say? To seek opportunity where others are not looking. It’s akin to a detective searching for clues in the dustbins of the financial world.

Currently, the fund holds over a thousand stocks, none of which commands a disproportionate share of the portfolio – less than 0.65% for any single holding. A commendable restraint, wouldn’t you say? The top ten account for a mere 5% of the total weighting. No looming Apple-shaped shadows here. And, given the S&P 500’s obsession with technology, the DLS ETF offers a welcome exposure to sectors that are often overlooked – industries where fortunes are built not on algorithms, but on actual, tangible goods.

| Sector | Percentage of Investment |

|---|---|

| Industrials | 27.5% |

| Consumer Cyclical | 13.6% |

| Financial Services | 13.2% |

| Basic Materials | 9.3% |

| Real Estate | 8.1% |

| Consumer Defensive | 7.8% |

| Technology | 7.7% |

| Others | 20.8% |

How Does the DLS ETF Perform?

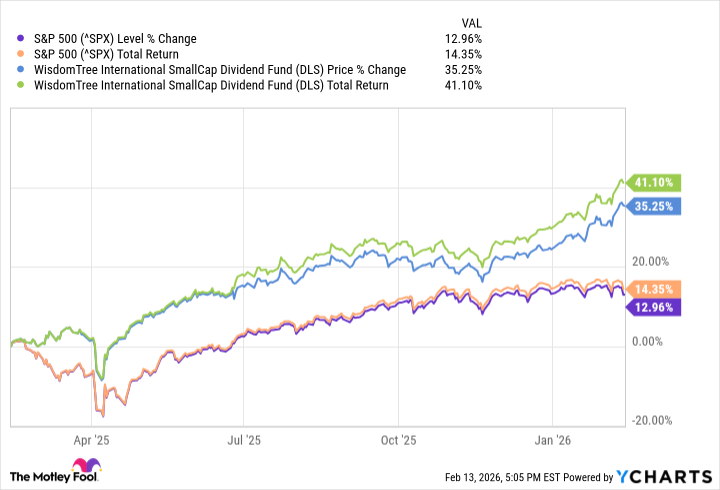

Over the past year, the WisdomTree International SmallCap Dividend Fund has been a rather generous benefactor to its investors. A gain of 35% in twelve months, eclipsing the S&P 500’s modest 13%. A respectable performance, wouldn’t you agree? Though, one must always remember that past performance is no guarantee of future riches. Still, it’s a comforting sign, like discovering a hidden stash of banknotes in an old overcoat.

And let’s not forget the dividend. A yield of 3.7% provides an additional stream of income, a pleasant trickle of capital flowing into your coffers. Including dividends, the total return over the past year reaches a remarkable 41%, leaving the S&P 500 trailing far behind at 14.3%. A clear demonstration that sometimes, the smaller fish yield the greater rewards.

Why the DLS ETF Works

Even when diligently investing in a broad index fund like the S&P 500, one can find oneself with gaps in their portfolio. It focuses on large companies, is heavily weighted toward the United States, and, as we’ve established, is rather fond of technology stocks. A rather predictable bias, wouldn’t you say?

The WisdomTree International SmallCap Dividend Fund ETF artfully fills those gaps with small-cap stocks outside of North America, avoiding the pitfalls of overreliance on a single sector. And, to sweeten the deal, it pays a handsome dividend. With its international flair and exposure to the often-underappreciated world of small-cap stocks, the DLS ETF can be a valuable addition to a long-term investment strategy. A subtle maneuver, a calculated risk, and perhaps, a pathway to a more diversified and prosperous future.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-02-17 23:32