Okay, let’s talk NuScale Power. They’re trying to reinvent nuclear, which, let’s be honest, is a little like trying to reboot Morbius – ambitious, possibly doomed, and definitely requiring a lot of explaining. The idea is small, factory-built nuclear reactors. Think LEGOs, but instead of a pirate ship, you get…well, a power plant. Several of these little guys can team up to generate actual, usable electricity. Right now, everyone’s buzzing about data centers. Apparently, keeping the internet running requires a lot of juice, and these reactors promise 24/7 power. It’s like having a really reliable, slightly terrifying nightlight for the cloud.

Now, there’s a whole startup scrum trying to power the AI revolution. Oklo and Nano Nuclear Energy are in the mix, but NuScale is currently the only U.S. company with an NRC-approved design. Which is…something. It’s like being the first person to bring a spork to a buffet – innovative, but you’re still using a spork. The problem? They haven’t actually built one yet. They’re currently operating on the business model of “future revenue” which, as anyone who’s ever freelanced knows, is a risky proposition.

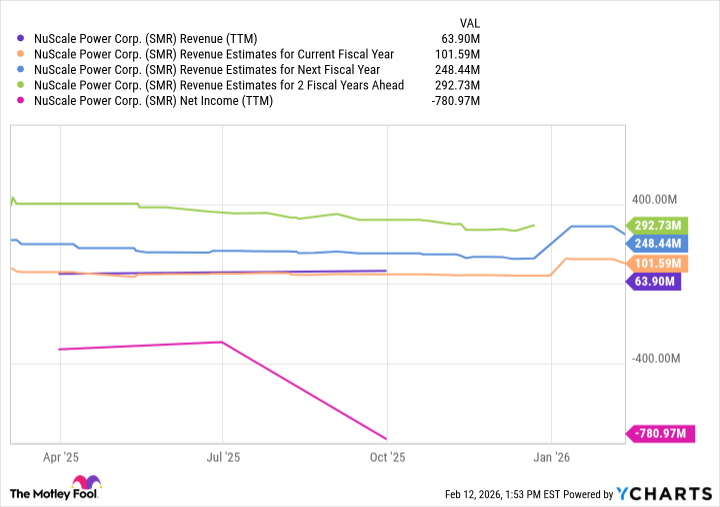

Let’s talk numbers. NuScale has a $4.5 billion market cap, but revenue of around $64 million. That’s a price-to-sales ratio that would make even Elon Musk blush. It’s like paying $70 for a hot dog, and hoping it comes with a self-driving car. From a macro perspective, this is the kind of exuberance that tends to precede a correction. We’re seeing a lot of investment in future energy solutions, and that’s good. But future revenue doesn’t pay the electric bill today.

So, should you drop $500 on NuScale? Look, if you’re the type of investor who enjoys a good adrenaline rush and doesn’t mind the possibility of losing your shirt, go for it. This company has long-term potential, if they can actually turn their designs into functional power plants. It’s a high-risk, high-reward play. A bit like ordering the fish on the airplane. But if you’re looking for a more diversified approach to nuclear energy, consider an ETF. It’s the investment equivalent of bringing a friend to a potentially awkward party. You’ve got backup.

Ultimately, NuScale is a bet on the future. And the future, as anyone who’s watched a single sci-fi movie knows, is rarely what we expect. It’s probably going to involve robots, a shortage of avocados, and a surprisingly complicated parking situation.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Gold Rate Forecast

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

2026-02-15 15:22