The market, for a stretch now, has been a generous field. The S&P 500, a measure of many hopes, has climbed for seasons, six of the last seven bringing a good yield. The Dow, old as a weathered fence post, has breached fifty thousand, a number that feels less like a reckoning and more like a dare. And the Nasdaq, ever eager, continues to spin returns like a restless top.

These gains weren’t blown in by chance, mind you. They’ve been fed by a confluence of things—the shimmering promise of new technologies, the surprising strength in company earnings, and a steady stream of money flowing from corporations back into their own hands. But beneath it all, the quiet hand of the Federal Reserve has been easing the flow of credit, lubricating the gears of the economy. Lower rates are a balm, a way to encourage borrowing, building, and the hopeful expansion of enterprise.

The former President, a man accustomed to having his way, has spoken plainly about his desire for continued easing. Wall Street, naturally, has echoed the sentiment. But the man now nominated to guide the Fed, Kevin Warsh, seems to be looking at a different horizon. It’s a shift in the wind, a change in the currents, and those who stand to lose the most are beginning to feel a prickle of unease.

A Different Kind of Shepherd

The Federal Open Market Committee, a gathering of twelve souls responsible for the nation’s monetary policy, operates like a careful shepherd, guiding the flock of the economy. They adjust the cost of borrowing, buying and selling bonds, attempting to strike a balance between growth and stability. Jerome Powell, the current shepherd, is nearing the end of his term, and the question now is not just who will take the reins, but in what direction will they lead.

The former President, never one for subtlety, has chosen Mr. Warsh as his nominee. A man who served on the Board of Governors through a difficult time, a period of storms and uncertainty. There’s a history there, a record of choices made when the ground was shifting beneath our feet. And that record suggests a different philosophy, a different set of priorities.

Mr. Warsh, unlike some, appears less concerned with the immediate swell of the market and more focused on the long, slow burn of inflation. While others were tending to the immediate needs of a struggling workforce, he was watching the price of bread, the cost of a roof over one’s head. A prudent concern, perhaps, but one that could dampen the spirits of those hoping for a quick return.

The Weight of the Balance Sheet

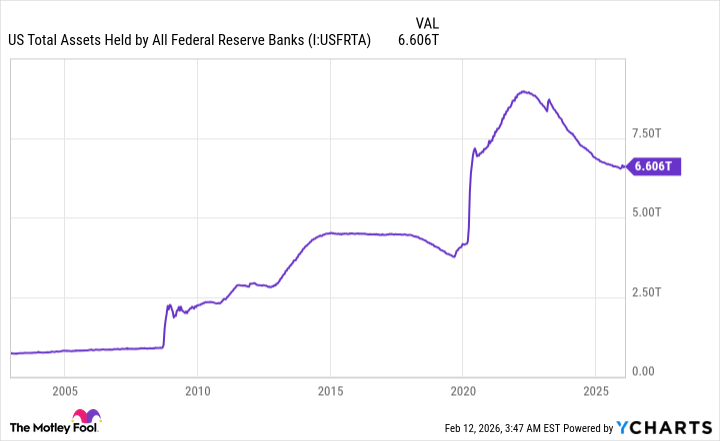

But the question of rates is only part of the story. The Fed also holds a vast balance sheet, a mountain of bonds and securities. For years, they’ve been buying these assets, injecting money into the economy, propping up prices. Mr. Warsh, however, seems to believe that this intervention has gone too far. He envisions a leaner, more passive Fed, one that allows the market to find its own level.

It’s a tempting idea, in theory. A return to first principles. But in practice, it could mean a tightening of credit, a rise in interest rates, and a cooling of the economy. The effect would be felt most keenly by those who can least afford it—the small business owner struggling to make payroll, the young family hoping to buy a home. The same people who benefited from the recent growth might find themselves left out in the cold.

There are hurdles, of course. Mr. Warsh must first be confirmed by the Senate, and even if he is, he will be just one voice among twelve on the FOMC. But the direction of the wind is changing, and those who navigate these waters must pay heed. The market, like a restless sea, is always searching for a new equilibrium. And sometimes, the most generous fields give way to barren ground.

It’s a time for careful observation, for a reckoning with the realities of debt and growth. The turning of the wheel is never a gentle process. It’s a reminder that prosperity is not a given, but a fragile thing, easily lost. And those who forget that lesson do so at their peril.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Gold Rate Forecast

- Brent Oil Forecast

2026-02-15 14:42