February 25th arrives, not as a day of potential, but as a scheduled accounting. For Nvidia (NVDA 2.21%), it is a moment to present the tally of its dominion, the fourth-quarter report for fiscal year 2026. The expectation, naturally, is for a performance deemed “blowout.” One anticipates a surplus of numbers, a spectacle of fabricated prosperity. But let us not mistake a temporary inflation of figures for genuine, enduring strength. The market, ever eager to be deceived, will likely celebrate this transient abundance.

More telling than the past quarter’s performance, however, will be the projections offered. These “guidances,” as they are euphemistically termed, are not forecasts, but carefully constructed narratives designed to sustain the illusion. The whispers emanating from Nvidia’s largest clientele – the digital behemoths who depend upon its silicon arteries – suggest a continuation of the current flow. Should these indications prove accurate, a surge in the share price is inevitable. But let us not be naive. This is not a reward for innovation; it is a consequence of controlled dependency.

One is tempted to acquire shares at this juncture, before the inevitable, manufactured ascent. The potential for a dramatic increase is present, but it is a consequence of orchestrated expectation, not intrinsic value. There are, of course, several factors contributing to this impending… adjustment. One must document them, not as reasons for optimism, but as symptoms of a larger, more troubling pattern.

1. The Reopening of the China Gate

The temporary cessation of chip exports to China, imposed by the previous administration, created a localized deprivation within Nvidia’s supply chain. This was presented as a geopolitical hardship, a lamentable disruption. Now, with the barriers seemingly lowered, the flow of silicon resumes, and Nvidia, predictably, anticipates a restoration of revenue. It is a reinstatement of privilege, not a triumph of ingenuity.

The preliminary guidance offered by AMD, Nvidia’s competitor, regarding its own Chinese sales, serves as a premonitory signal. One anticipates a similar declaration from Nvidia, a confirmation of the restored flow. The expectation of $8 billion in revenue from China for the second quarter of fiscal year 2026, should it materialize, will be presented as a vindication. But it is merely a return to the accustomed order, a reestablishment of dependency.

Even if the volume of sales to China fails to reach these projected levels, the domestic demand remains substantial. This, however, is not a sign of a healthy economy; it is a consequence of the relentless digitization of life, a dependence on technology that is both pervasive and precarious.

2. The Hyperscalers’ Insatiable Appetite

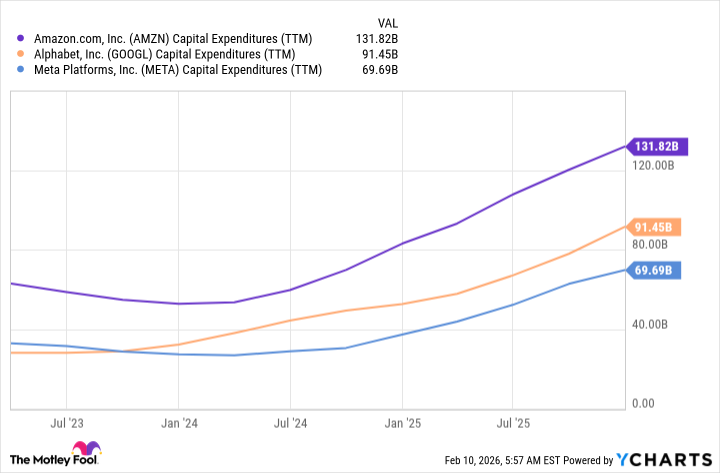

The capital expenditure plans of the so-called “AI hyperscalers” – Alphabet, Amazon, Meta – are, as always, astronomical. Billions upon billions of dollars are allocated to the expansion of their digital empires. These figures, dutifully reported by the financial press, are presented as evidence of innovation and growth. But they are, in reality, a testament to the relentless pursuit of market dominance, a consolidation of power in the hands of a few.

The anticipated spending of $175-185 billion by Alphabet, $200 billion by Amazon, and $115-135 billion by Meta is, of course, staggering. It represents a massive influx of capital into the digital realm, a reinforcement of the existing power structures. Nvidia, as a primary provider of the silicon that fuels these empires, is well positioned to benefit. But this is not a virtuous cycle; it is a self-perpetuating system of accumulation.

3. The Rubin Architecture: A Modest Efficiency

The launch of the new Rubin chip architecture is presented as a breakthrough, a significant improvement over the previous Blackwell generation. The claim that it requires one Rubin GPU for every four Blackwell chips to achieve similar performance is, undoubtedly, impressive. But let us not mistake incremental efficiency for transformative innovation. This is merely a refinement of existing technology, a squeezing of more performance from the same basic principles.

The potential for companies to upgrade their GPUs due to the cost-effectiveness of Rubin is, of course, a factor. But this is not a sign of progress; it is a consequence of planned obsolescence, a deliberate cycle of consumption and replacement.

4. The Illusion of Affordability

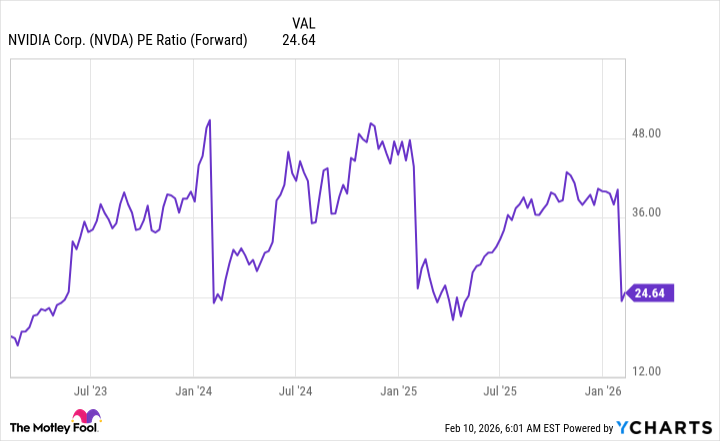

The argument that Nvidia’s stock is “cheap” is, predictably, disingenuous. While trailing earnings metrics may suggest a high valuation, the use of forward earnings measures is presented as a more “appropriate” assessment. This is a convenient manipulation of data, a selective presentation of information designed to justify a higher price.

At less than 25 times forward earnings, Nvidia’s stock is, indeed, near its lowest price in three years. But this is not a sign of undervaluation; it is a temporary aberration, a fleeting moment of equilibrium before the inevitable ascent. The comparison to the S&P 500, trading at 21.8 times forward earnings, is a transparent attempt to normalize the valuation.

The prediction of a 20% pop in the stock price is, of course, a self-fulfilling prophecy. It is a calculated attempt to generate momentum, to entice investors into a rising market. Those who wait until after February 25th to buy will, undoubtedly, pay a higher price. But they will not be acquiring a bargain; they will be participating in a carefully orchestrated illusion.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Gold Rate Forecast

- Brent Oil Forecast

2026-02-15 14:03