The matter of Robin Hood Markets (HOOD +6.82%) presents itself not as a simple chronicle of financial performance, but as a curious echo within the labyrinth of speculative instruments. I have, in past examinations – records now seemingly lost to the infinite archives of digital forecasting – posited a decline of at least fifty percent in its valuation. The recent descent, a fall of fifty-three percent and accelerating, confirms, if not a predictive gift, then a certain resonance with the stock’s inherent instability. It is as though the market, a vast and indifferent library, occasionally reveals a pre-written page.

The surge in 2025, much like the ephemeral blooms of certain desert flowers, was fueled by unsustainable currents. These currents, reminiscent of the 2021 rally, arose from the fervor of retail investors – a population prone to both ecstatic speculation and sudden retreat. Their predilection for cryptocurrencies, those digital phantoms, proved a particularly volatile foundation. One suspects a deeper pattern: a cyclical attraction to novelty, followed by a predictable disillusionment.

Robin Hood’s platform, a gateway for the uninitiated, attracts a clientele drawn to immediacy. They are, for the most part, newcomers to the game, their actions governed by impulse rather than calculation. When the prevailing winds shift, as they inevitably do, this cohort tends to vanish, leaving behind a residue of unrealized gains and a diminished market presence.

The Diminishing Returns of the Cipher

The company’s foray into prediction markets, a partnership with Kalshi, offered a fleeting distraction. While generating some initial interest, it accounted for less than ten percent of total revenue in 2025 – a negligible sum in the grand accounting. The true locus of concern, as always, lies within the realm of cryptocurrency. It is here, in the volatile exchange of digital tokens, that the stock’s fate is most intimately entwined.

One recalls the events of 2021, when Robin Hood’s crypto transaction revenue experienced a vertiginous ascent – a 4,560% increase. Tokens like Dogecoin and Shiba Inu, those emblems of speculative excess, drove this surge. But, as is the nature of such things, the bloom faded. By 2022, crypto revenue had plummeted by seventy-five percent, dragging the stock with it in a similar decline. The pattern, it seems, is not merely repetition, but a kind of geometric progression.

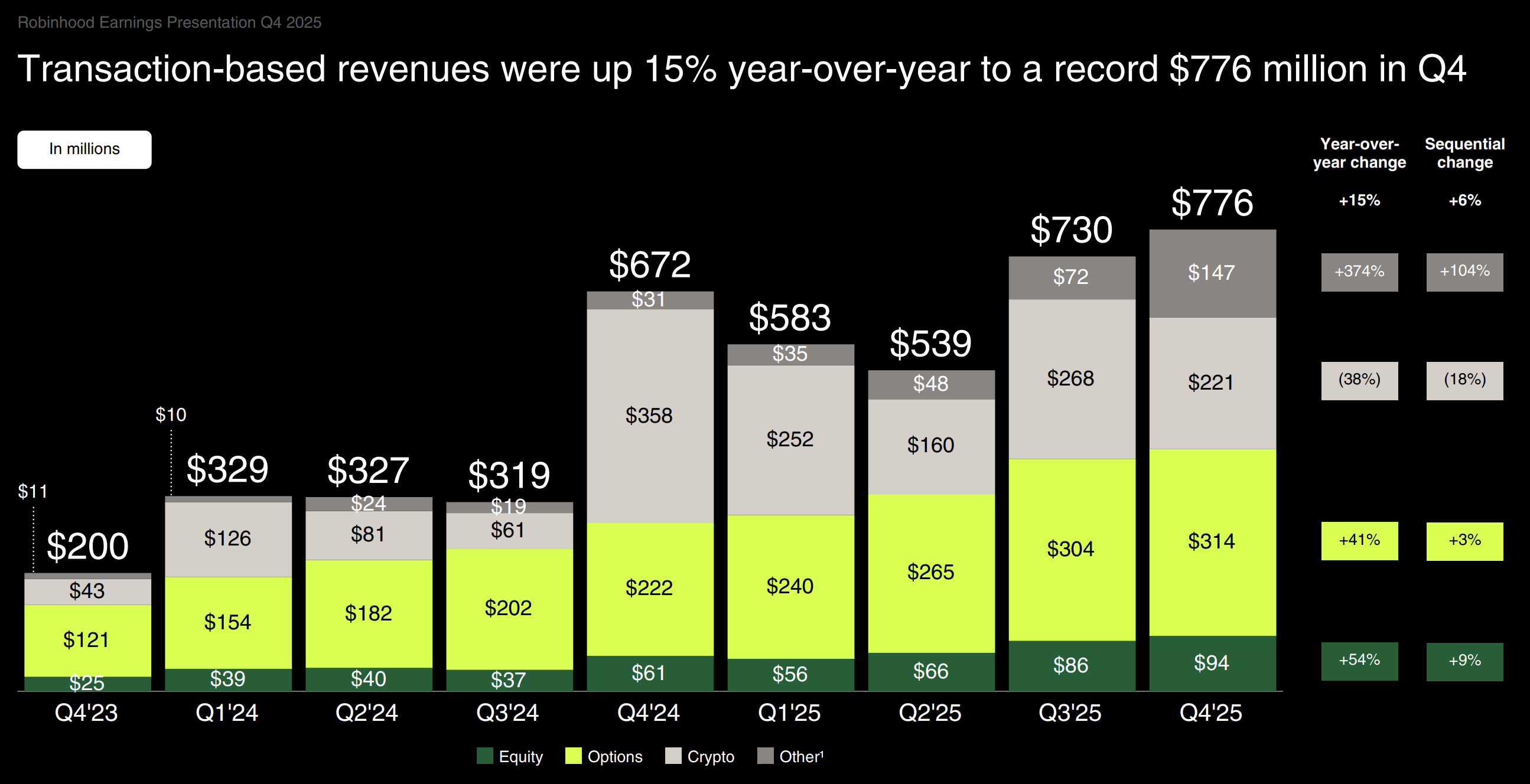

The present moment mirrors this past. A surge in the fourth quarter of 2024, fueled by the speculative fervor surrounding a change in political winds, once again saw crypto transaction revenue exceeding fifty percent of total revenue. However, the subsequent quarter of 2025 witnessed a decline of thirty-eight percent. Even the supposedly immutable Bitcoin and Ethereum have lost significant value. The echoes of 2022 are growing louder, suggesting a similar trajectory. The market, it seems, delights in the symmetry of its own failures.

The Illusion of Value

Despite the waning fortunes of its crypto business, Robin Hood’s transaction revenue continues to climb, driven by activity in the stock and options markets. Options trading, now the company’s largest source of revenue, is, however, a precarious foundation. Retail investors, prone to panic during market downturns, tend to abandon these risky derivatives, exacerbating the decline. The Library of Babel, one might say, contains an infinite number of flawed strategies.

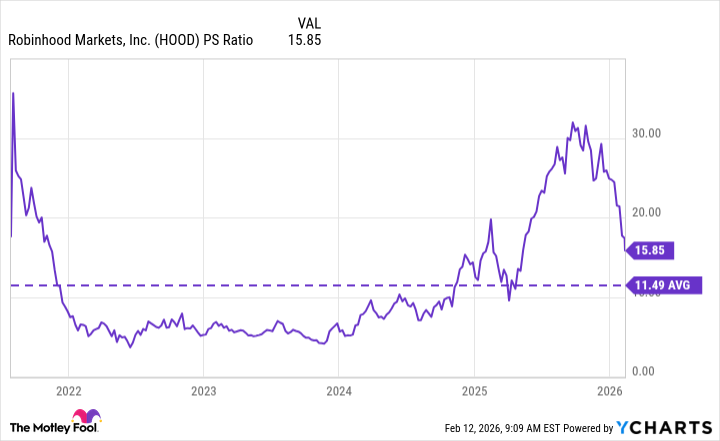

The stock’s current price-to-sales ratio of 15.9, significantly higher than its average since its public offering, is a source of concern. This inflated valuation, juxtaposed with the collapsing crypto revenue and the inherent risks of options trading, suggests a fundamental disconnect from reality. The market, it seems, is prone to constructing elaborate illusions.

The decline in monthly active users – a thirteen percent drop year-over-year – further reinforces this assessment. A shrinking user base will inevitably lead to a decline in transaction revenue. The stock, therefore, appears poised for further decline. A fall of twenty-seven percent, bringing it in line with its long-term average P/S ratio, seems a realistic, if not optimistic, target. The labyrinth, after all, rarely offers easy exits.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Gold Rate Forecast

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

2026-02-15 13:33