Everyone keeps asking me about the market. As if I, a man who once spent three hours trying to program the coffee maker, am qualified to predict anything beyond the next burnt batch. Still, here we are. The Dow, the S&P 500, the Nasdaq – they’ve all been doing this little dance under President Trump, a sort of exuberant jig that reminds me uncomfortably of my Aunt Mildred at a wedding. She always went a bit too far, a little too enthusiastic, and you just knew it wasn’t going to end well. And, frankly, the numbers are starting to feel the same.

Since January 2025, it’s been a rally, a proper bull market. Fifteen percent here, sixteen percent there, eighteen for the Nasdaq. It’s enough to make a sensible person consider investing in something…anything. Except, of course, sensible people probably already have. I tried to explain it to my neighbor, Mr. Henderson, a retired taxidermist. He mostly wanted to know if there were any good stocks in the stuffed animal industry. I just nodded and backed away slowly.

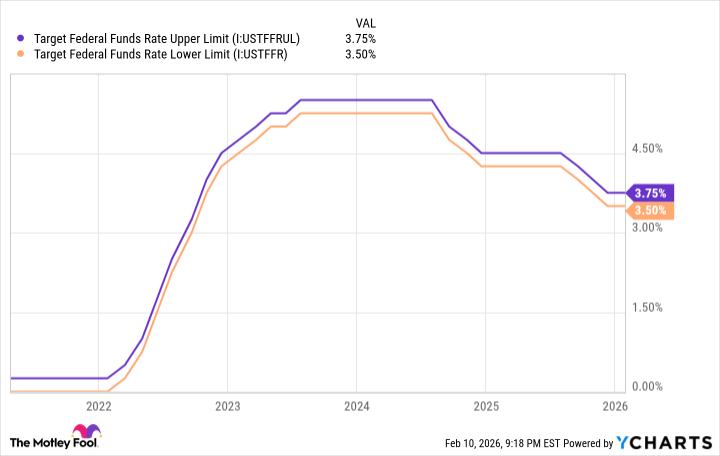

There’s AI, of course, and quantum computing, which sounds like something out of a particularly bleak science fiction novel. Analysts at PwC claim AI will add trillions to the global economy. Trillions. That’s a lot of robots. And the Fed lowering interest rates? Well, that’s just free money, isn’t it? Like finding a twenty in an old coat pocket. Tempting, but you always wonder where it came from.

The tax cuts haven’t hurt, either. Companies are buying back shares, which sounds suspiciously like rearranging the deck chairs on the Titanic. But hey, at least it looks good on paper. And speaking of paper, there’s this thing called the Shiller P/E Ratio. It’s a bit like trying to decipher ancient hieroglyphs, but apparently, it’s a good indicator of whether we’re heading for a crash. Which, if you ask me, is always a possibility. I once saw a squirrel take down an entire bird feeder. Anything can happen.

This ratio, this CAPE Ratio, has been around since 1871. It averages earnings over ten years, which seems sensible enough. And right now? It’s high. Really high. Second-highest in history, trailing only the dot-com bubble. Which, if you remember, ended rather spectacularly. My cousin Barry lost his entire retirement fund investing in pet rocks. Actual pet rocks. He still talks about them, convinced they’ll make a comeback.

Historically, when the Shiller P/E gets this inflated, things tend to…correct. The Dow, the S&P 500, they all take a tumble. Sometimes a small one, sometimes a rather dramatic one. The average decline? Somewhere between 20% and 89%. Eighty-nine percent! That’s the kind of number that keeps me up at night. Although, to be fair, I’m usually up at night worrying about whether I left the iron on.

So, is the Trump bull market unstoppable? Probably not. Is a correction coming? Almost certainly. And will I be prepared? Absolutely not. I’m far too busy trying to figure out how to program the coffee maker. And, honestly, that feels like a much more pressing concern.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Best Video Games Based On Tabletop Games

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Gold Rate Forecast

- Brent Oil Forecast

2026-02-15 12:12