Action movies usually depend on skilled professionals to handle risky stunts. But some actors prefer to do their own stunts to make their performances feel more real. These actors train for months in things like martial arts and driving. Doing their own stunts lets directors film the action up close, without needing to use lots of cuts or hide the actor’s face. This dedication to physical performance has become a signature part of their work and something fans really appreciate.

Tom Cruise

Tom Cruise is well-known for doing his own stunts in the ‘Mission Impossible’ movies. He’s famously scaled the Burj Khalifa and even hung off a plane while it was taking off. To stay in shape for these demanding scenes, he follows a strict training routine. He’s so committed to doing things for real that he often gets special certifications, like pilot’s licenses or skydiving qualifications. This dedication helps create the incredibly realistic action sequences his films are known for.

Jackie Chan

Jackie Chan is a world-famous martial artist celebrated for his incredible and self-choreographed fight scenes. Throughout his career, he’s suffered many injuries, including broken bones and head injuries – particularly while filming ‘Armour of God’. His unique fighting style combines impressive acrobatics, comedic moments, and clever use of whatever is around him. Chan even created his own stunt team to guarantee everyone working with him maintains his high standards of physical performance, making him a beloved icon in action movies worldwide.

Keanu Reeves

Keanu Reeves is known for doing most of his own stunts in the ‘John Wick’ movies. He trained hard in judo and Brazilian jiu jitsu to learn the fast-paced fighting style the role demanded, and practiced extensively with firearms to look skilled and realistic on screen. Even while recovering from neck surgery during ‘The Matrix,’ he insisted on performing his own fight choreography. This dedication has earned him a great deal of admiration from stunt professionals around the world.

Jason Statham

Jason Statham’s background as a professional diver gave him a natural talent for the physical demands of acting. He’s known for doing his own stunts and driving in movies like ‘The Transporter’, and he’s a strong supporter of recognizing stunt performers with awards. Statham feels performing his own stunts helps him stay immersed in his roles, especially during action scenes. Because he’s so athletic, he can handle challenging physical feats that most actors would need a stunt double for.

Daniel Craig

Daniel Craig redefined James Bond with his realistic and athletic portrayal, beginning with ‘Casino Royale’. He insisted on doing most of his own stunts – like the exciting parkour chase in his debut film – even though it led to injuries such as a lost tooth and a cut finger. Craig believed performing his own stunts was crucial to making the character feel authentic. His Bond films are known for prioritizing practical effects and action sequences over relying heavily on digital effects.

Harrison Ford

Harrison Ford is well-known for doing his own stunts throughout his career, starting with his roles in ‘Indiana Jones’ and ‘Star Wars’. He famously ran ahead of a genuine rolling boulder during the filming of ‘Raiders of the Lost Ark’ to make the scene look realistic. Even later in his career, he continued to perform many of the physical scenes in movies like ‘Indiana Jones and the Dial of Destiny’. This commitment to doing his own stunts often resulted in minor injuries, but it also helped establish him as a legendary action hero.

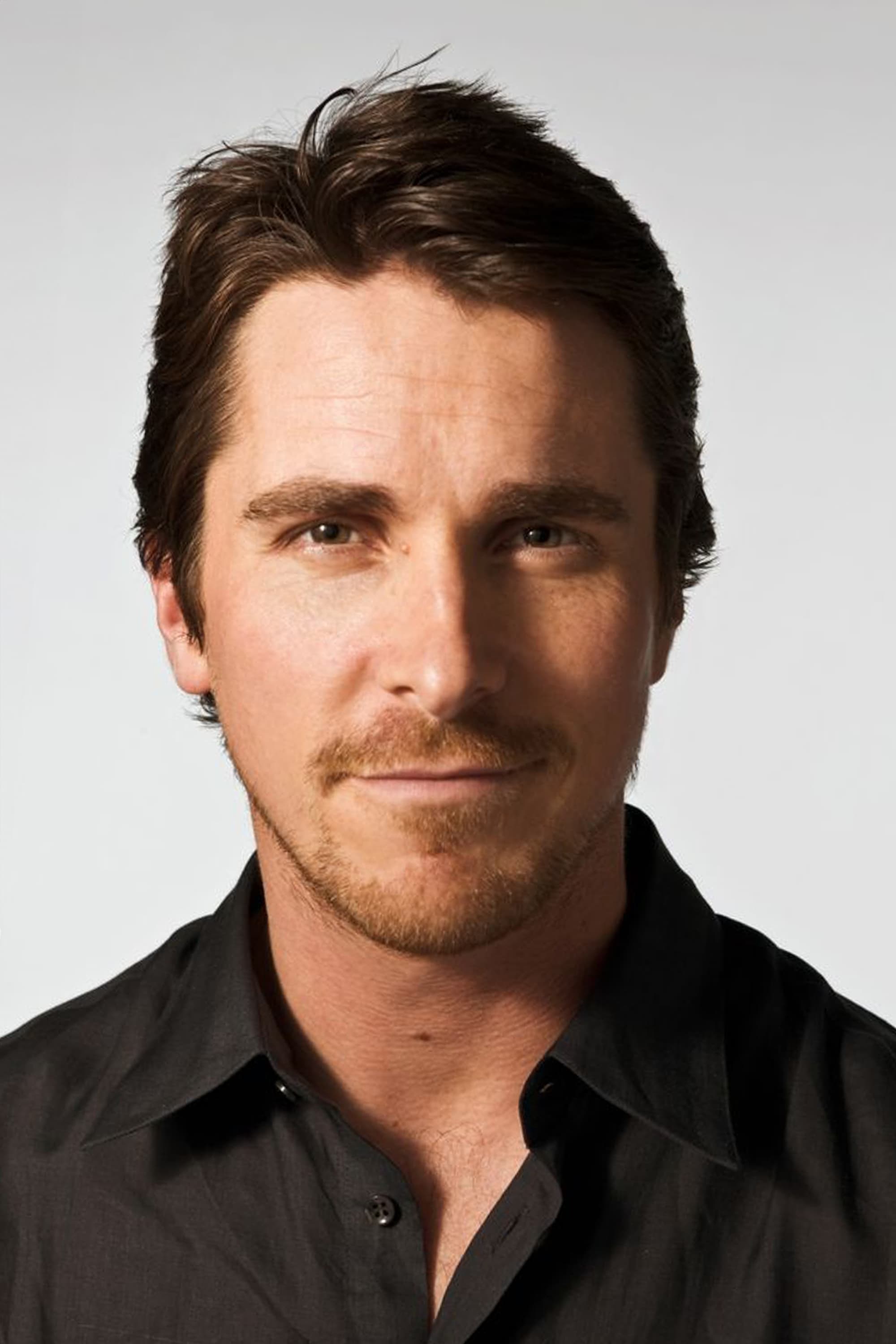

Christian Bale

Christian Bale is famous for dramatically changing his body and performing his own stunts for movies. For ‘The Dark Knight’ films, he learned a specific fighting style, Keysi, so he could do all the fight scenes himself. He’s also known for going to great lengths to get realistic shots – like insisting on filming on top of Chicago’s Sears Tower instead of using special effects. Bale believes that physically challenging roles are key to truly understanding and becoming a character, and he often pushes himself to his absolute limits to achieve this.

Buster Keaton

Buster Keaton was a groundbreaking comedian in the early days of silent films, known for his incredibly daring stunts – all done without the safety gear we have today. He’s famous for a scene where the front of a house collapses around him, and he doesn’t even flinch! Keaton carefully planned and performed complex, funny physical routines that needed perfect timing and a lot of courage. He often got hurt while filming, but would keep it a secret from everyone so he could keep working. Even now, his performances are considered the best example of physical comedy in film history.

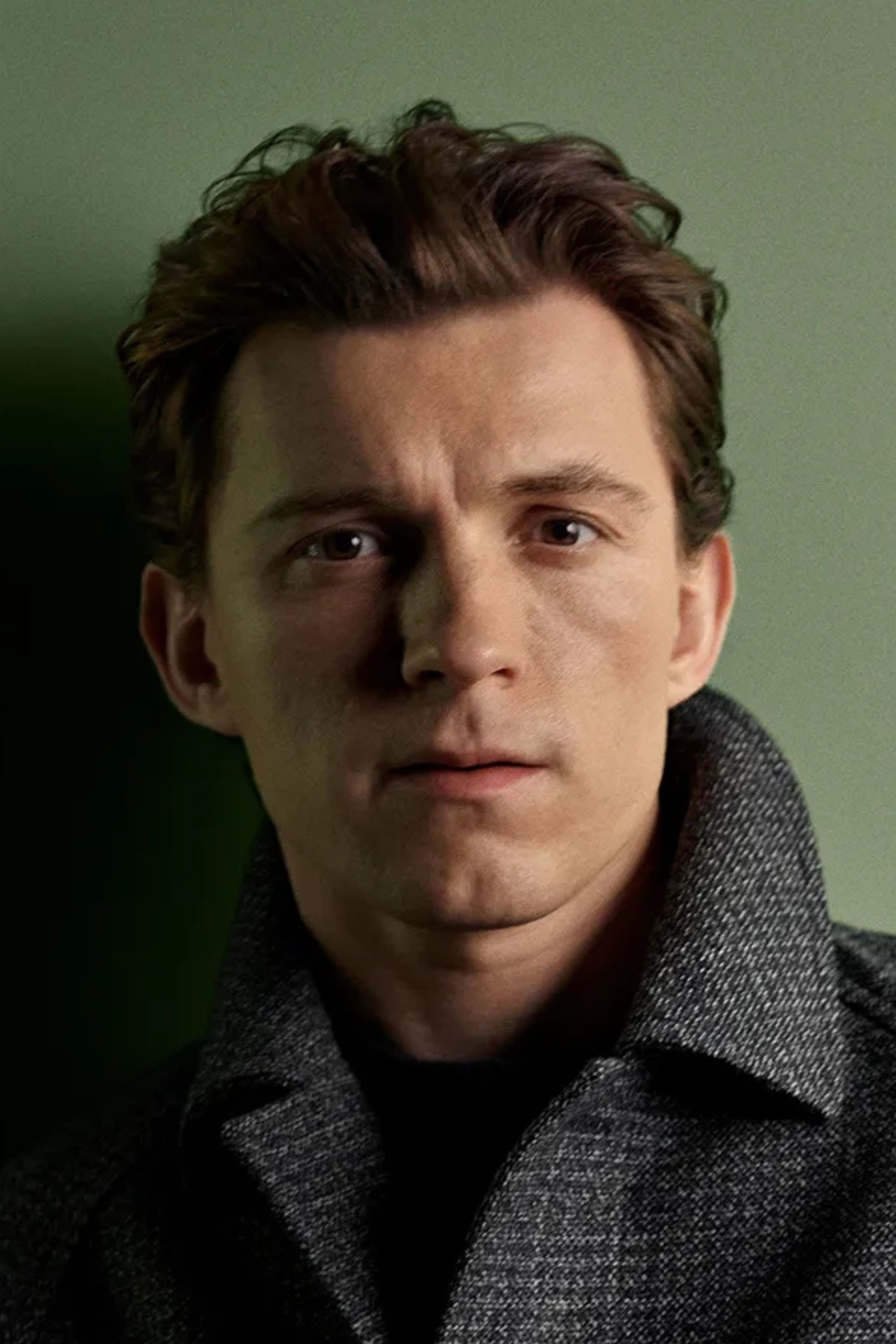

Tom Holland

Tom Holland’s skills in gymnastics and dance allowed him to do many of his own stunts as Spider-Man. He can easily perform flips and other acrobatic moves, capturing the character’s famous agility. Although a stunt team handles the most dangerous scenes, Holland does as much of the physical work as possible. His athleticism was actually key to him landing the role, as he impressed during auditions with his tumbling abilities. This physical energy really brings a youthful feel to his performance as Spider-Man.

Donnie Yen

Donnie Yen is a highly skilled martial artist known for his fast and precise movements in films. He’s famous for performing intricate Wing Chun techniques in the ‘Ip Man’ movies with very little help from stunt doubles. He often helps design the fight scenes himself, making sure every move is both realistic and technically correct. A respected actor in both Hong Kong and Hollywood, Yen’s dedication to martial arts makes him a truly believable action star.

Jet Li

Jet Li began his career as a champion martial artist before becoming a famous actor, known for doing his own incredible stunts. He first gained recognition in films like ‘Once Upon a Time in China’, where he displayed impressive traditional martial arts skills. Li was famous for performing complex wire work and fighting with weapons, demanding exceptional strength and balance. Even in Hollywood movies like ‘Lethal Weapon 4’, he remained very physically involved. His years as a competitive athlete were the basis for his successful career as an action star.

Jeremy Renner

Jeremy Renner put in a lot of training with martial arts and archery to convincingly play Hawkeye in the Marvel movies. He insisted on doing most of his own stunts and action sequences, even though it was dangerous. In fact, he broke both arms while filming the movie ‘Tag’ but kept working! Renner likes to perform his own physical stunts to better connect with his characters and keep the performances authentic. This commitment to action has made him a familiar face in today’s action films.

Matt Damon

Matt Damon was deeply involved in the action of the ‘Bourne’ films, doing many of his own fights and stunts. He trained in boxing and Eskrima to make the combat feel raw and believable. Working closely with stunt teams, he learned the precise moves needed to play Jason Bourne. This dedication helped create a more realistic and impactful style of action filmmaking. Damon is now known as a leading actor who champions practical stunt work.

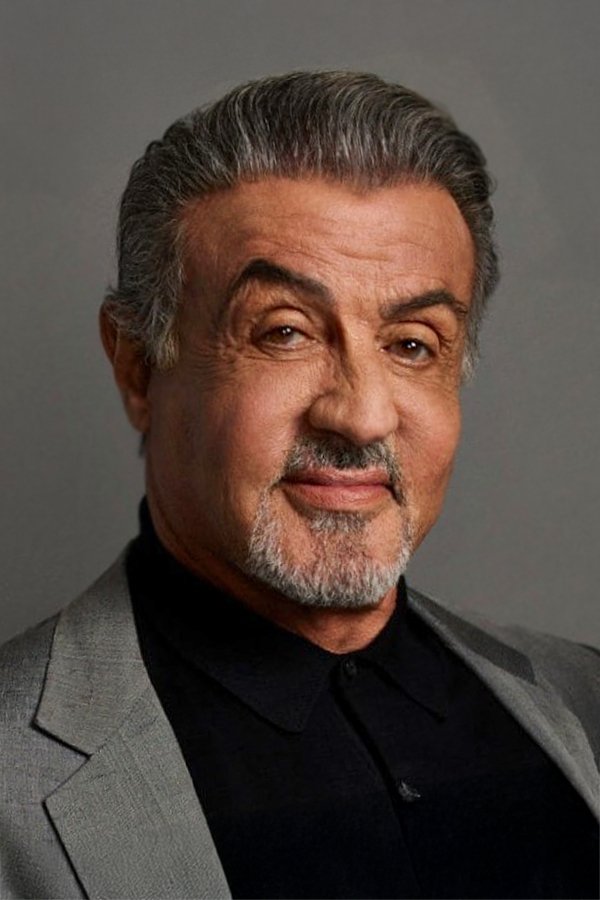

Sylvester Stallone

Sylvester Stallone has always been known for his dedication to physically demanding roles, starting with the original ‘Rocky’ and ‘Rambo’ films. He’s famous for pushing himself to the limit – he even took actual punches during the filming of ‘Rocky IV,’ which landed him in the hospital. Stallone often writes and directs his own movies to make sure the action feels truly intense. Over the years, he’s broken many bones and undergone numerous surgeries because he insists on performing his own stunts. His long and successful career is a testament to his toughness and determination.

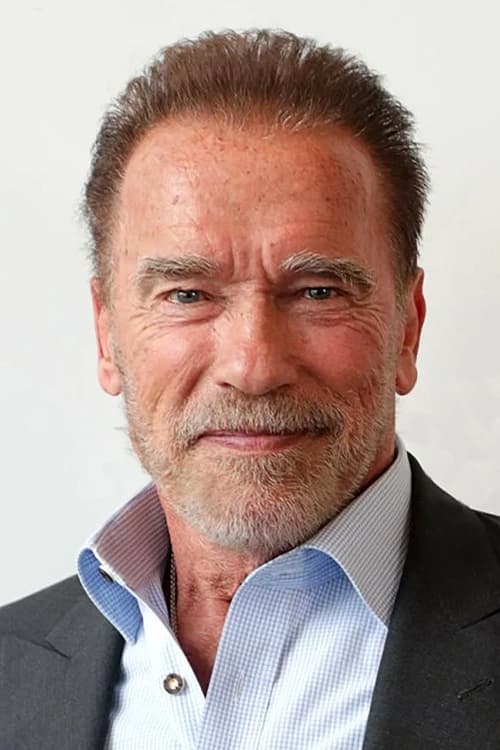

Arnold Schwarzenegger

Arnold Schwarzenegger’s background as a bodybuilder greatly influenced his early action movies. He famously used his strength to perform his own stunts, including lifting heavy weapons and fighting, like in ‘Conan the Barbarian’ where he did all his own horse riding. He continued this in the ‘Terminator’ films, insisting on performing many of his own stunts and handling weapons himself. Schwarzenegger often worked through pain to make the action sequences as powerful as possible. Because of his impressive physique, it was hard to find stunt doubles who could convincingly portray him on screen.

Viggo Mortensen

I’ve always been amazed by Viggo Mortensen’s commitment to his work. It wasn’t just about learning lines for ‘The Lord of the Rings’; he really became Aragorn. He even insisted on using a heavy, real steel sword, wanting to truly feel what it would be like to wield such a weapon. I was shocked to learn he lost a tooth and broke two toes during filming, but he just kept going! He also formed a real connection with his horses and did all his own riding, which is incredible. Honestly, his dedication was so impressive that the entire stunt team really looked up to him.

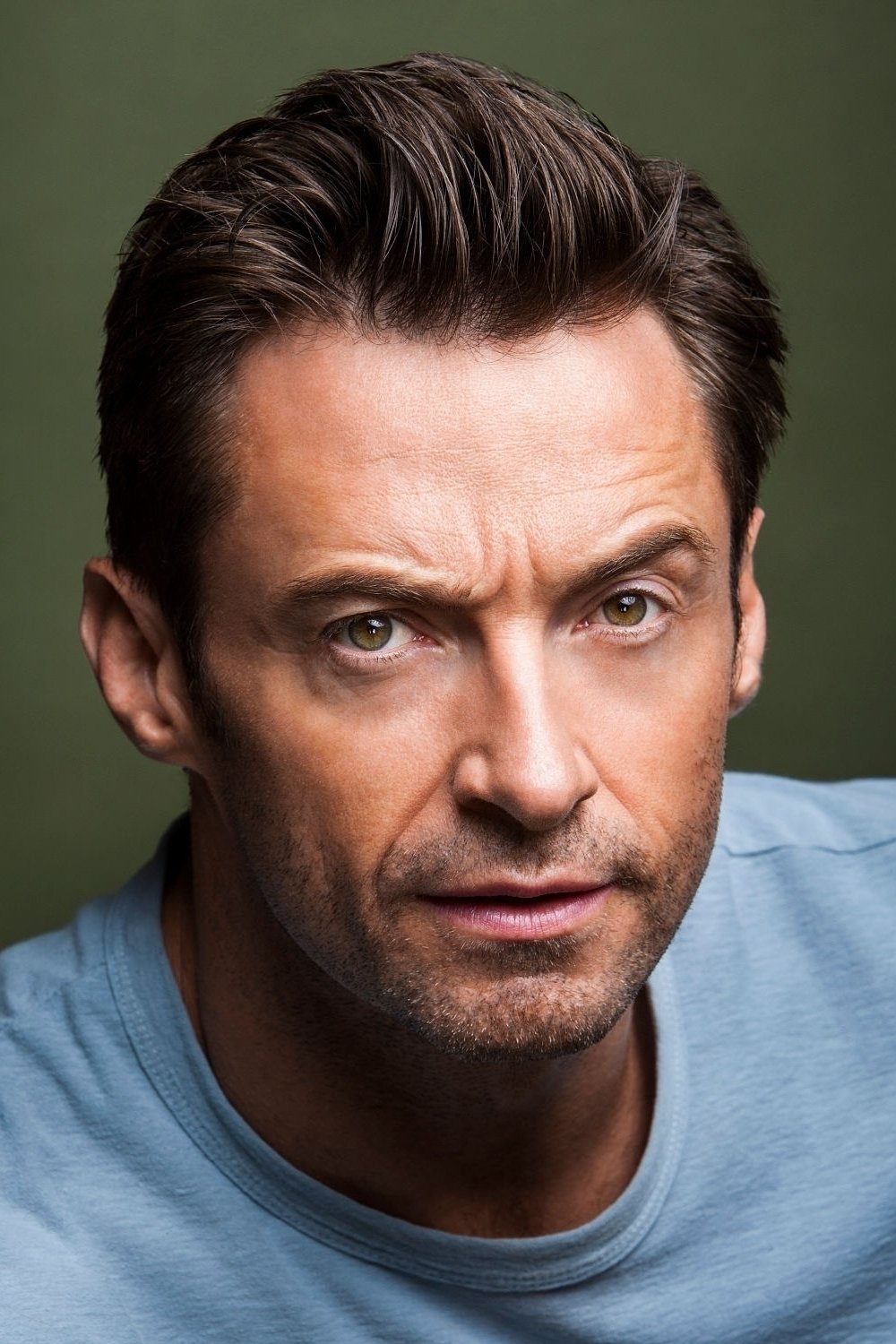

Hugh Jackman

For almost twenty years, Hugh Jackman dedicated himself to the intense physical requirements of playing Wolverine in the ‘X-Men’ movies. He followed a rigorous diet and workout plan to manage the demanding fight scenes. Jackman frequently did his own stunts, using wires and complicated moves, so the camera could stay focused on his expressions. He famously pushed his body to its limits in the film ‘Logan’ to deliver a powerful and heartfelt goodbye to the character. His dedication made him the perfect embodiment of Wolverine’s tough and physical presence.

Liam Neeson

Liam Neeson became known for action roles later in his career, and he’s committed to performing his own fight choreography. For the ‘Taken’ films, he trained extensively to learn close-combat techniques, handling most of the hand-to-hand fighting himself. Though he uses stunt doubles for particularly risky moments like falls or car accidents, Neeson feels that doing his own physical work makes his performances more engaging and believable for viewers. This dedication to authentic physicality has become a hallmark of his action roles.

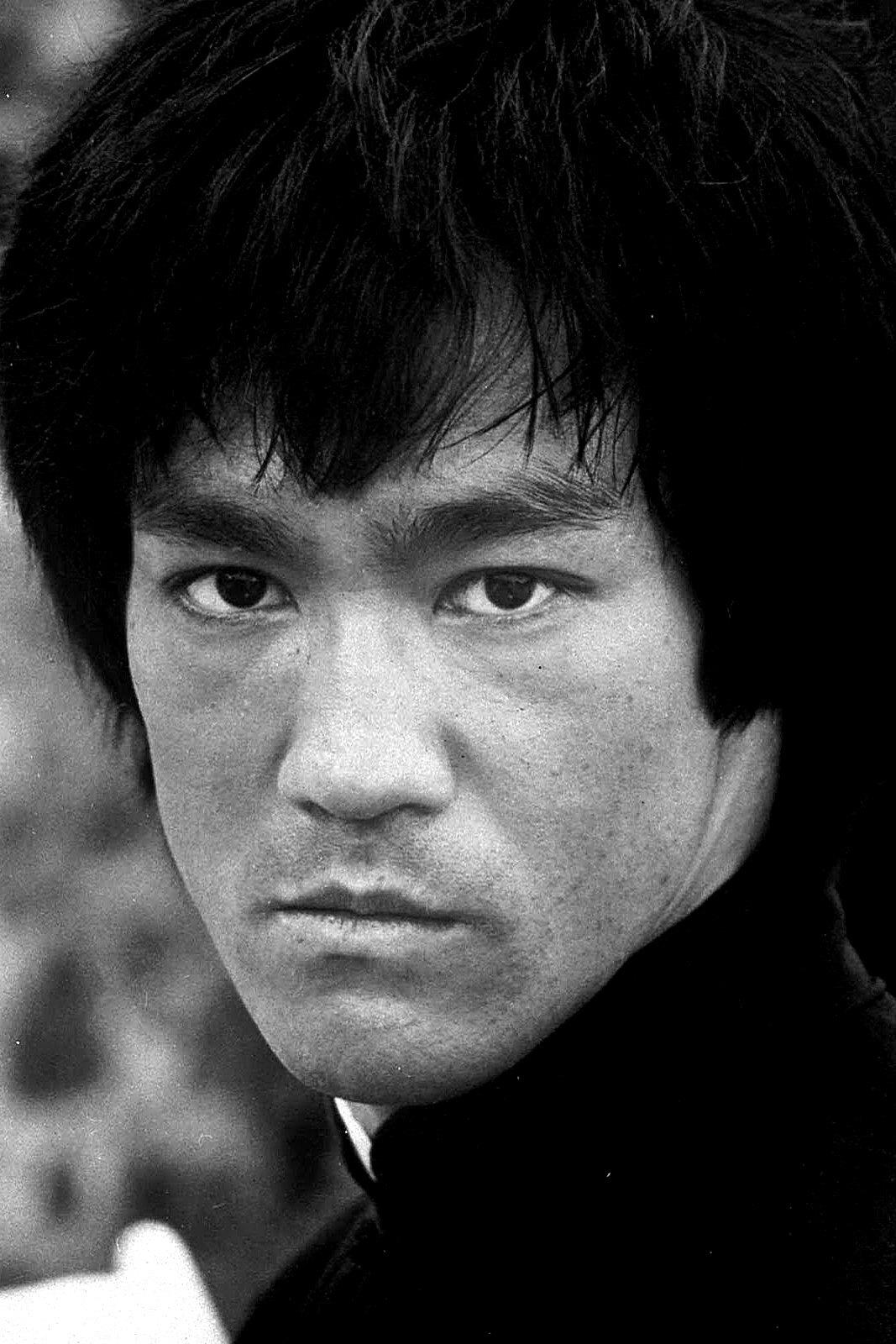

Bruce Lee

Bruce Lee was a dedicated and highly skilled martial artist who changed how fight scenes were filmed. He did all his own stunts and created the fight choreography for iconic movies like ‘Enter the Dragon’. He was so quick that filmmakers often had to modify their cameras just to capture his speed. Lee thought an actor should truly be a martial artist to make action sequences feel real. His ideas and incredible abilities continue to inspire action stars today.

Steve McQueen

I’ve always been a huge Steve McQueen fan, and it’s amazing to me how much of his own driving he did in movies like ‘Bullitt’! He really lived and breathed racing, and you can see it in those incredible chase scenes. The insurance companies tried to hold him back sometimes, but he pushed to do as many stunts as he could himself. It wasn’t just acting for him – he was a genuinely skilled driver and motorcyclist, which was pretty rare back then. That’s a big part of why he’s still such a cool and iconic figure – everything you see him do on screen feels real because it is real.

Burt Reynolds

Burt Reynolds was once a talented athlete and was known for doing his own stunts during his most successful years as an actor. He’s particularly remembered for a risky waterfall scene in the movie ‘Deliverance,’ which unfortunately led to an injury. While he worked with professional stunt performers, Reynolds often directed the action scenes himself, believing viewers could easily spot when an actor wasn’t performing the stunts personally. This willingness to take risks helped create his image as a fearless and rugged leading man.

Jean-Claude Van Damme

Jean-Claude Van Damme’s films, like ‘Bloodsport’, were known for his incredible physical abilities. A skilled karate and kickboxing practitioner, he performed all his own stunts, including impressive splits and high kicks, without needing a stunt double. He often created his own fight scenes to highlight his flexibility and power, which were major attractions during the action movie boom of the 1990s. Today, Van Damme is still considered a legend in martial arts films.

Scott Adkins

Scott Adkins is a talented martial artist famous for doing his own amazing stunts in movies. He’s best known for playing Yuri Boyka in the ‘Undisputed’ films, showcasing incredible, acrobatic kicks. Adkins frequently works on independent or lower-budget films, where his stunt skills are especially valuable. He’s also a strong voice for recognizing the work and importance of stunt performers, and his physical abilities have earned him a loyal fanbase.

Tony Jaa

Tony Jaa quickly became famous worldwide with the film ‘Ong Bak,’ performing all his own incredible stunts without relying on wires or special effects. His skills in Muay Thai and gymnastics allowed him to do seemingly impossible physical feats. He trained for years to safely perform the dangerous jumps and fight scenes. This commitment to real, practical action revolutionized Thai cinema, and he remains a prominent figure in action movies around the world thanks to his amazing physical abilities.

Iko Uwais

Iko Uwais, known for his role in ‘The Raid,’ brought the Indonesian martial art of Silat to international attention. He’s not only a leading actor, but also designs the incredible fight sequences in his films. Uwais performs all his own stunts, creating realistic and intense battles against numerous opponents. His speed and skill allow for extended, unbroken shots that showcase his impressive abilities. As a result, he’s become a highly sought-after performer in Hollywood, known for delivering authentic and powerful physical performances.

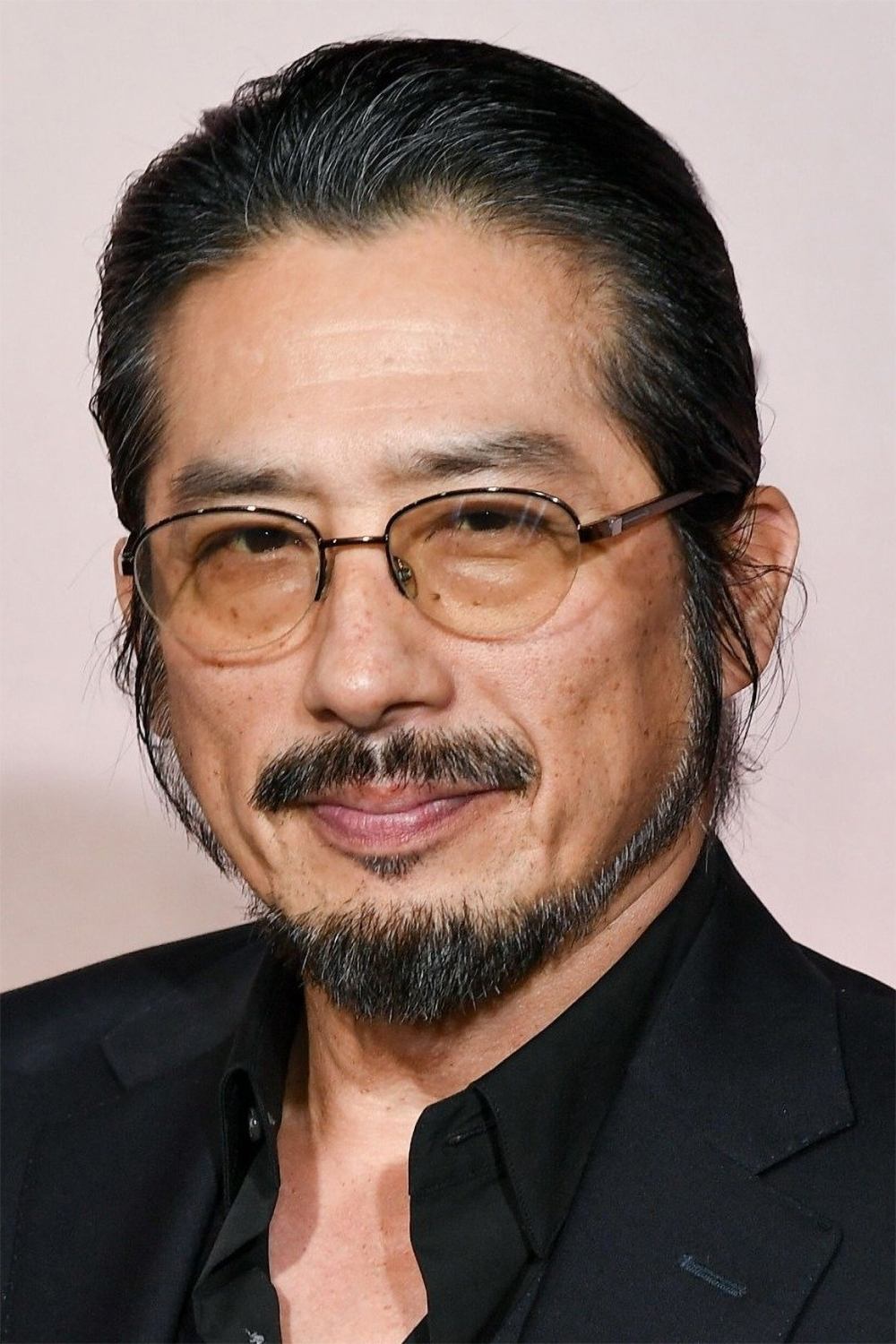

Hiroyuki Sanada

Hiroyuki Sanada is a skilled martial artist who has performed his own stunts throughout his career, starting in Japan. He’s known for doing his own sword fighting in movies like ‘The Last Samurai’ and ‘John Wick Chapter 4’. Sanada feels that how a character moves during a fight is just as crucial as what they say. He’s admired by fellow actors for his dedication and ability to perform difficult fight choreography beautifully. When he’s in a film, it usually means the action sequences will be very realistic and well-done.

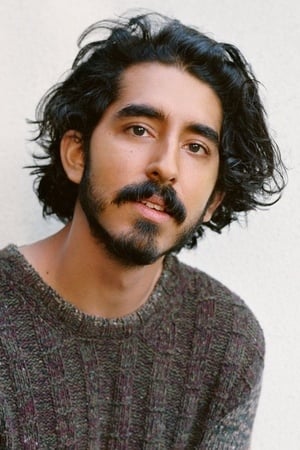

Dev Patel

For his first time directing, a film called ‘Monkey Man,’ Dev Patel completely transformed his body and trained extensively in martial arts. He insisted on doing all his own stunts, even during incredibly difficult fight scenes that resulted in several injuries. Patel wanted the action to feel gritty and realistic, so he put himself right in the middle of it all. His dedication to the physical challenges of the role was central to his vision for the film, and the project showcased a new side of him as a committed action star.

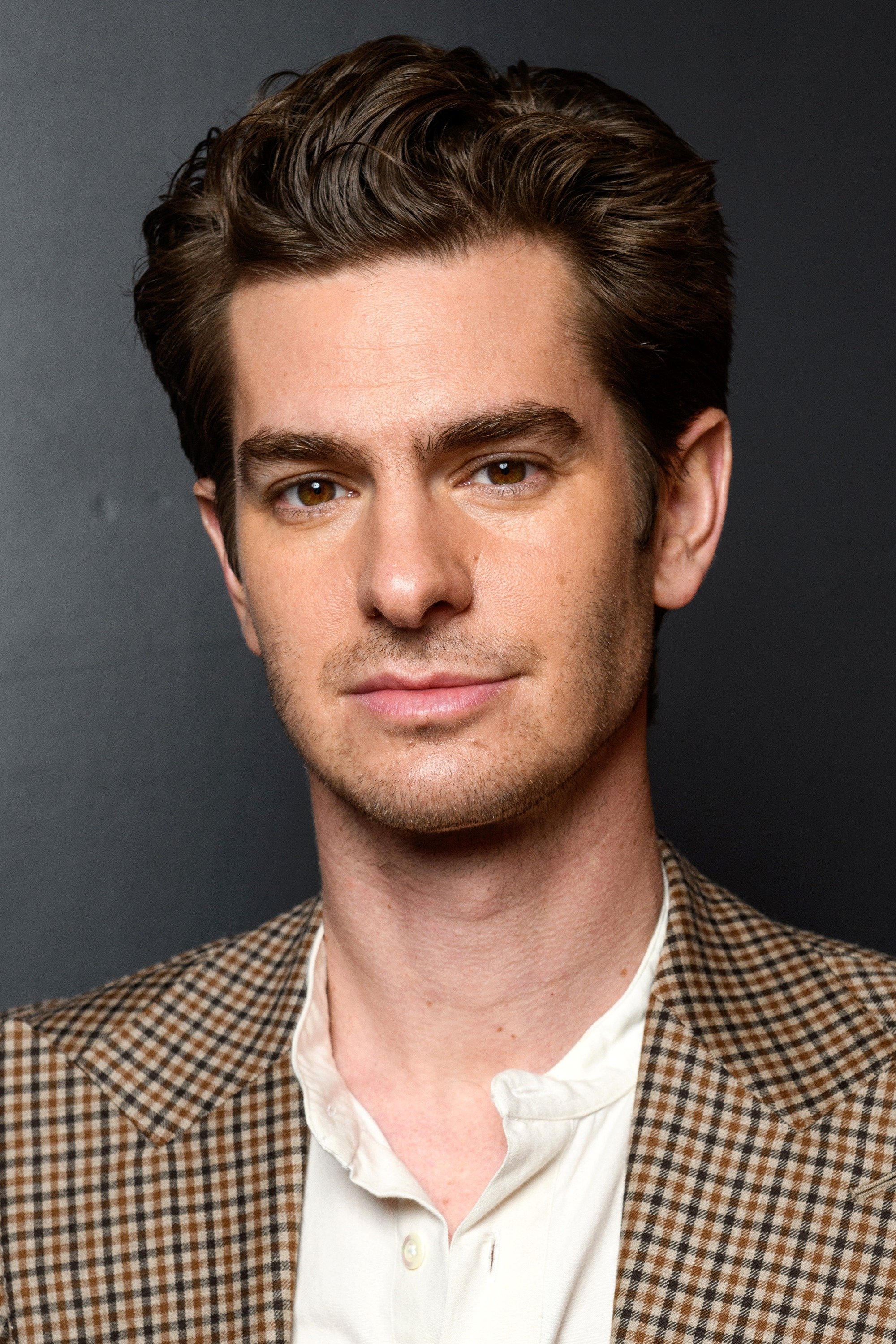

Andrew Garfield

Andrew Garfield was deeply committed to playing Spider-Man and did many of his own stunts. He trained for months in parkour and gymnastics to convincingly portray the character’s agile movements. While filming ‘The Amazing Spider-Man,’ he frequently insisted on performing his own wire work and flips. Garfield believed that his physical performance was key to making Spider-Man feel authentic, and his experience with physical theater allowed him to express emotions through his body even while wearing the mask.

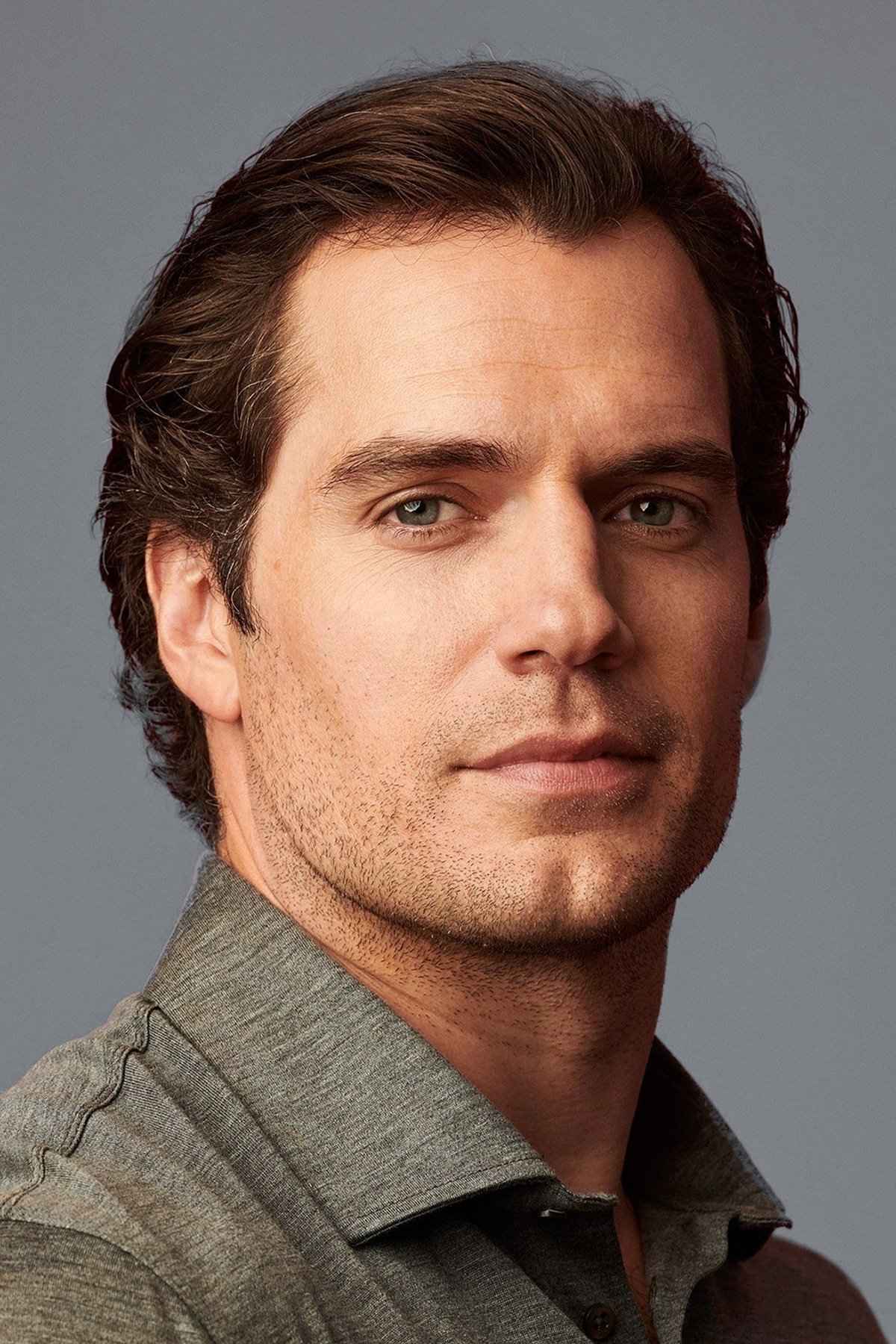

Henry Cavill

Henry Cavill is famous for being incredibly fit and doing his own daring stunts in action movies. For his role in ‘The Witcher,’ he insisted on performing all his sword fighting to make the scenes look realistic. He also did his own stunts in ‘Mission Impossible Fallout,’ including the thrilling helicopter chase. Cavill believes getting physically prepared helps him understand and embody his characters. This commitment to performing his own stunts has made him a popular actor with fans who love exciting action films.

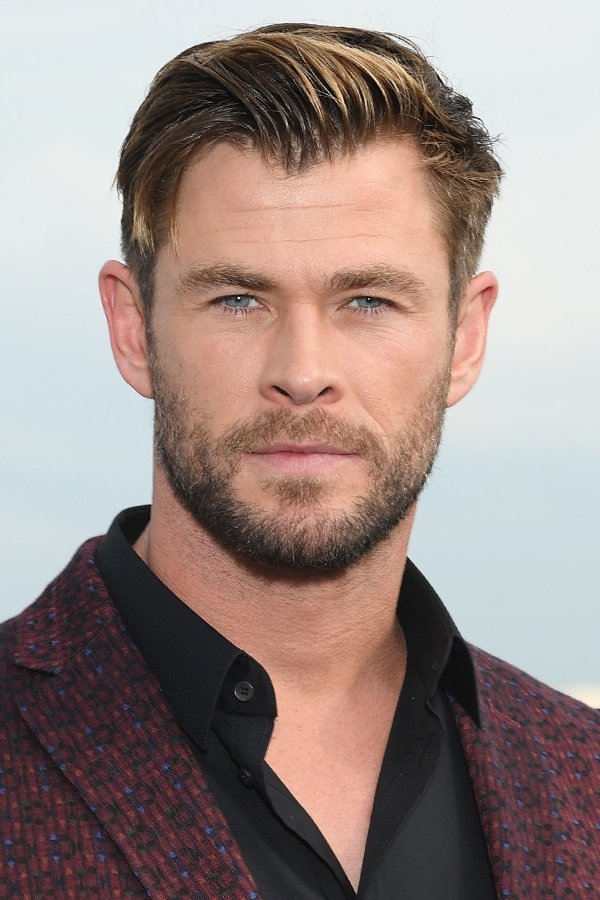

Chris Hemsworth

Throughout his roles as Thor and in the ‘Extraction’ films, Chris Hemsworth has done most of his own stunts. He even filmed a challenging twelve-minute scene for ‘Extraction’ that included car chases and fighting. To handle the physical demands of these roles, he trains hard in many different areas. While he works with a trusted stunt double, Hemsworth performs the majority of the action we see on screen. His athleticism and build make him very convincing in any action scene.

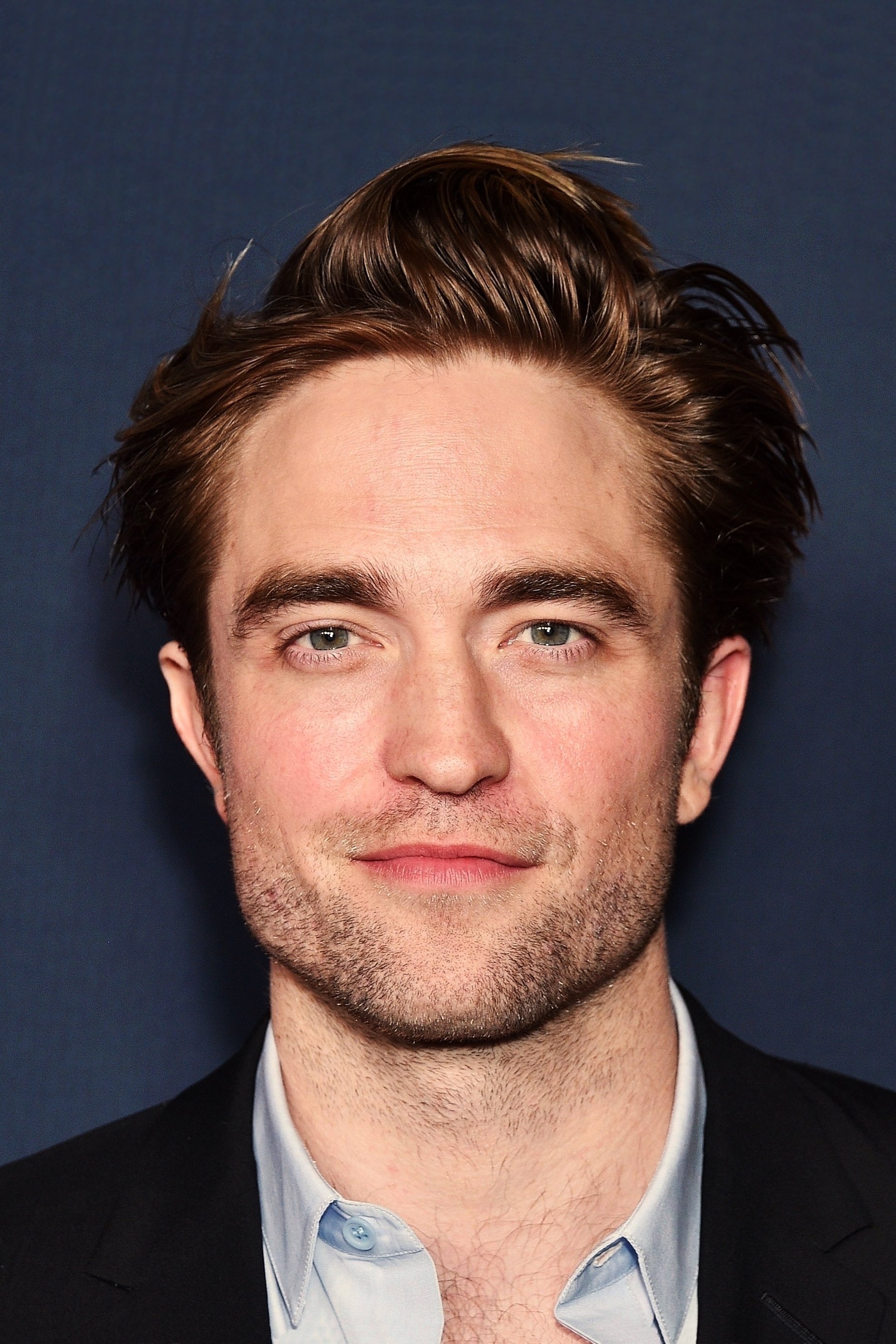

Robert Pattinson

Robert Pattinson fully committed to the physical demands of playing Batman in ‘The Batman’. He trained in martial arts like Brazilian jiu jitsu to make the fight scenes feel realistic and intense. Pattinson did a lot of his own stunts, wanting the character’s physical actions to reflect his inner turmoil. Throughout the film’s dark and rainy scenes, he was frequently right in the middle of the action. This dedication resulted in a Batman who felt more human, vulnerable, and believable.

Simu Liu

Simu Liu relied on his gymnastics and stunt experience to do many of his own stunts in ‘Shang-Chi and the Legend of the Ten Rings’. He trained for months in different martial arts to convincingly play a kung fu master. Liu was heavily involved in the challenging bus fight scene, which demanded perfect timing and coordination. He’s proud of doing his own action sequences and frequently shares his training with fans. Having worked as a stunt performer before becoming a leading actor gives him a special understanding of the film industry.

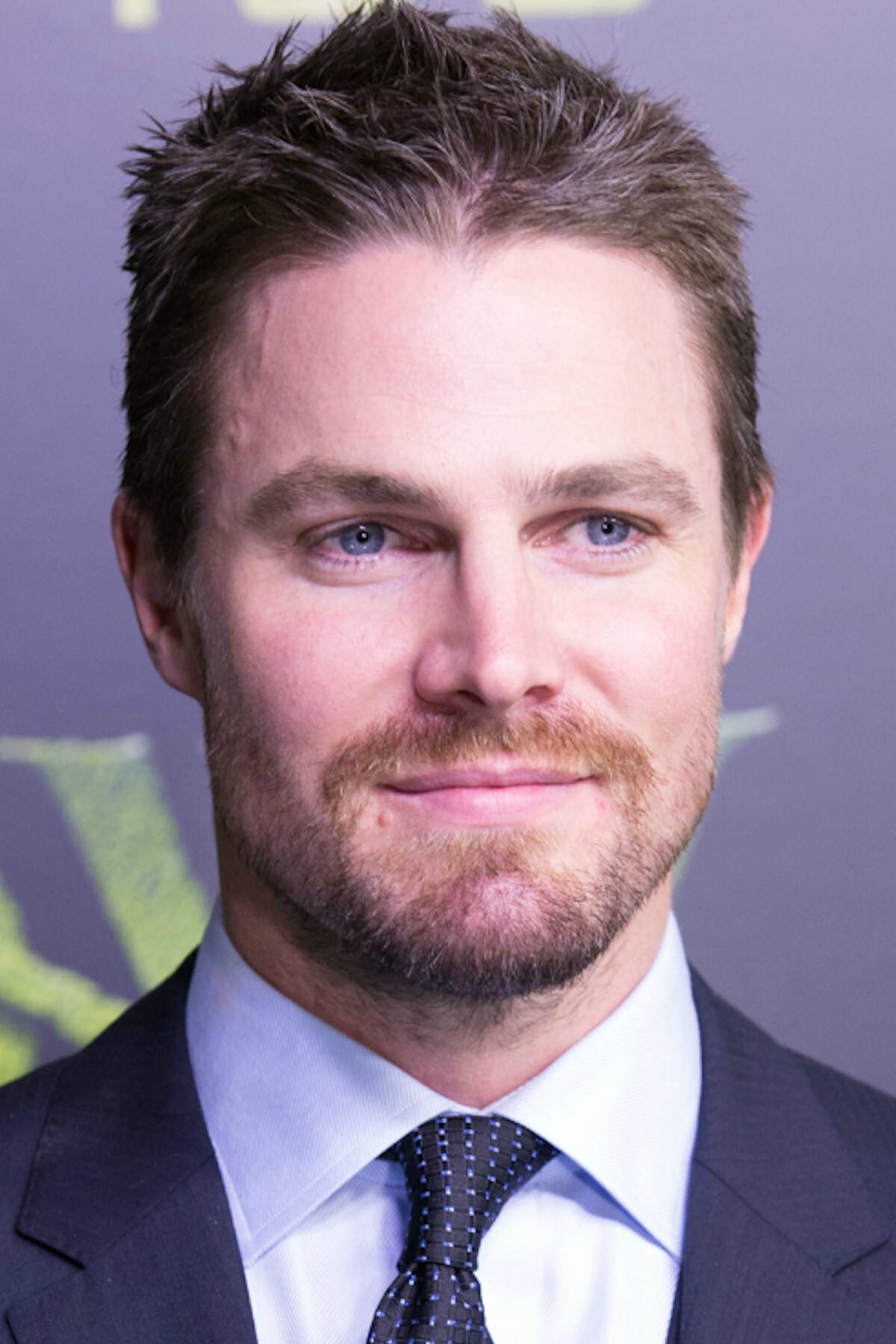

Stephen Amell

Stephen Amell gained recognition for playing the lead in the TV series ‘Arrow,’ and he was known for doing a lot of his own stunts. He famously completed challenging physical feats on the show, like the iconic salmon ladder. To further demonstrate his athleticism, Amell even took part in professional wrestling matches. Throughout the series’ run, he consistently advocated for practical effects and action sequences to maintain a sense of realism. This commitment to the physical demands of the role significantly contributed to the show’s popularity.

Alexander Skarsgård

Alexander Skarsgård completely transformed his body for his role in ‘The Northman’. He did all his own stunts during the film’s intense and realistic fight scenes, including one lengthy shot of a village attack. To make his movements authentic, he trained for months in combat techniques used in ancient times. Skarsgård also fully embraced the difficult shooting conditions, helping to create a truly believable Viking story. His dedication to the physical aspects of the role was key to the film’s powerful and primal feel.

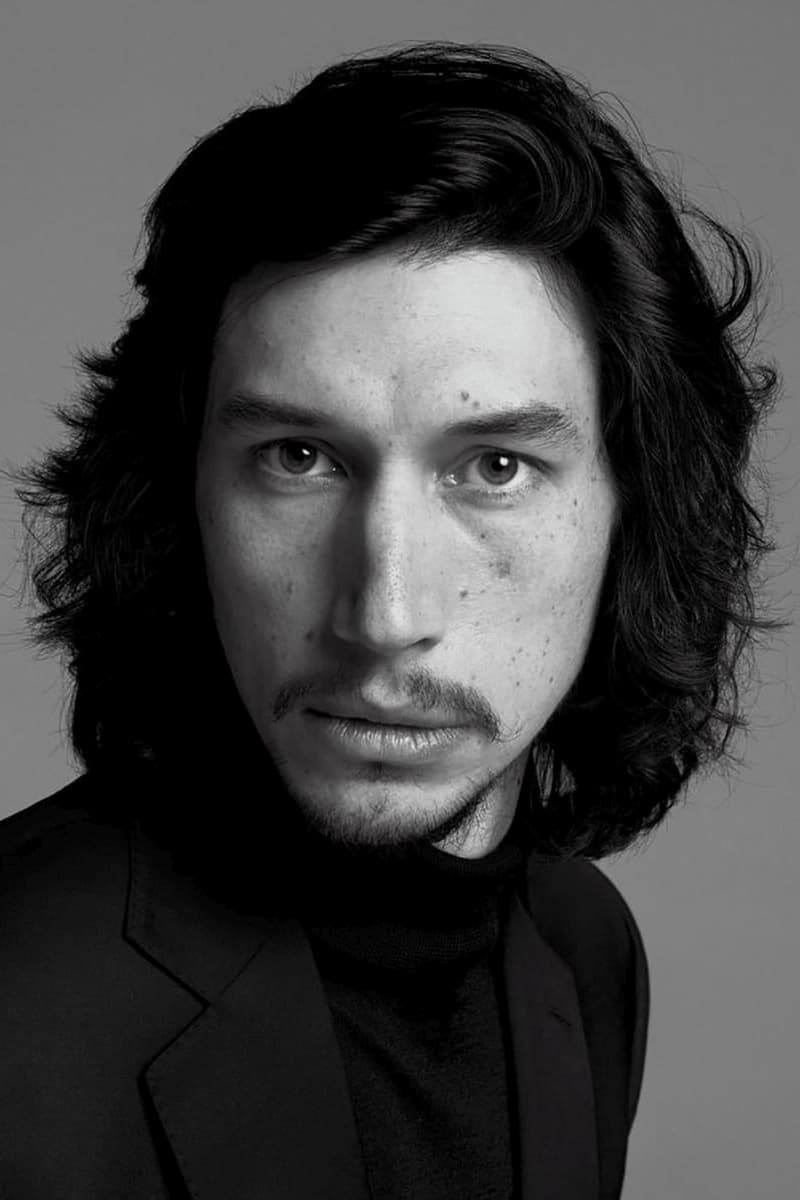

Adam Driver

As a movie fan, I’ve always been impressed with Adam Driver’s physicality in his roles. It turns out his time as a Marine really comes into play! He doesn’t just look convincing in action scenes – he actually does a lot of his own stunts. I mean, he swung that lightsaber himself in the ‘Star Wars’ sequels, which is amazing! And in ’65,’ facing all those prehistoric environments, he was doing his own stunt work too. You can just tell he has this incredible discipline and body awareness, a direct result of his military background, and it really shines through on screen. He brings a level of intensity and focus to those complex action sequences that’s seriously captivating.

Michael B. Jordan

As a critic, I’ve always been impressed by Michael B. Jordan’s commitment to his craft, especially in action roles. He doesn’t just play the part; he becomes it. Take the ‘Creed’ films – he did almost all of his own boxing, putting in thousands of hours training with actual boxers! And it wasn’t just boxing; for ‘Without Remorse,’ he insisted on performing his own underwater stunts and fight choreography. He really pushes himself, demanding a lot of his body to get the perfect shot. Honestly, that dedication has cemented his place as a top-tier action star for this generation – and it shows on screen.

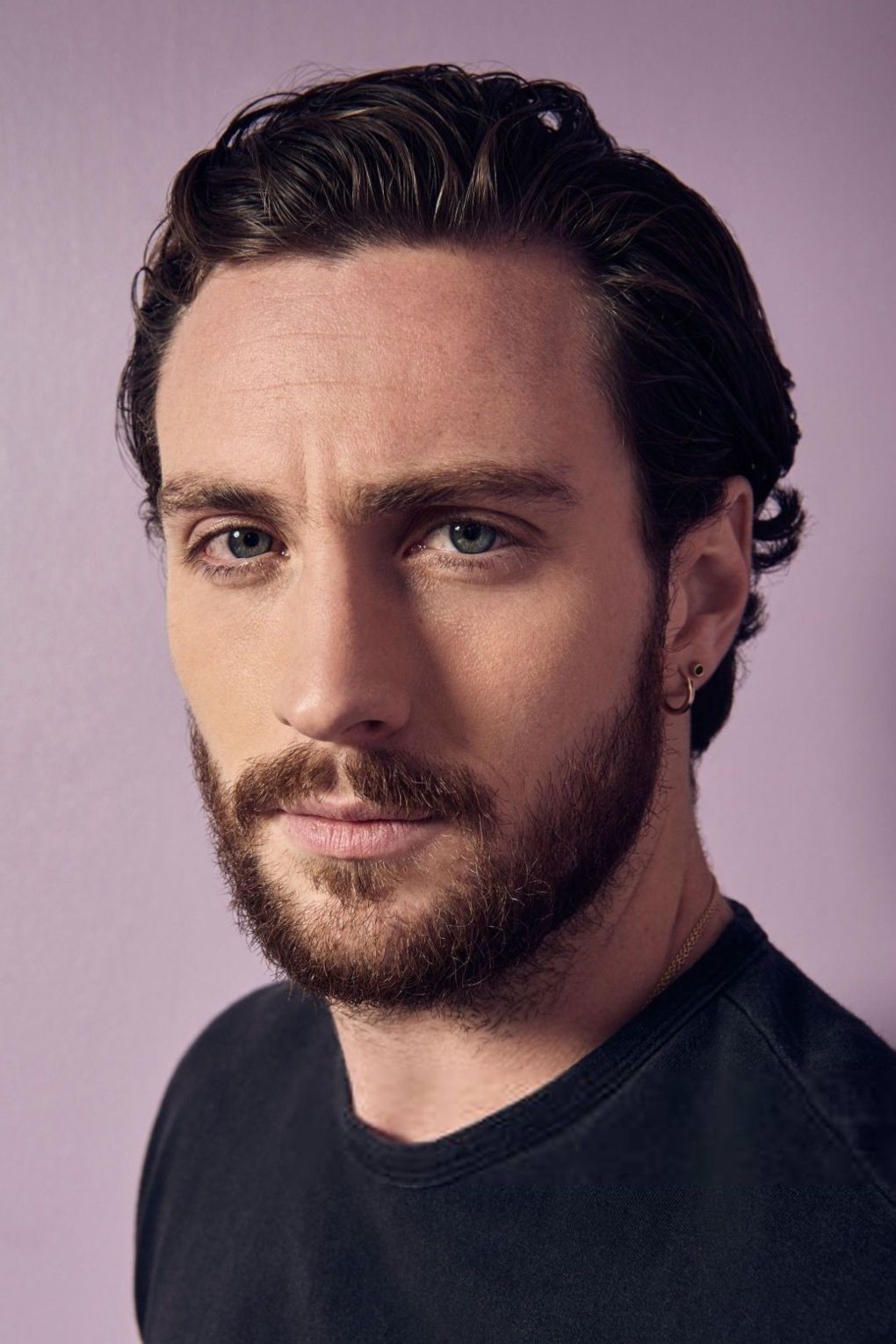

Aaron Taylor-Johnson

Aaron Taylor-Johnson is known for doing his own stunts in movies like ‘Kick-Ass’ and ‘Bullet Train’. He’s a very energetic actor who isn’t afraid to fully commit to physically demanding and comedic roles. For ‘Kraven the Hunter’, he reportedly did many of his own stunts to better embody the character’s animalistic qualities. Taylor-Johnson enjoys the challenge of these physical roles and trains with stunt teams to learn the required skills, allowing him to perform everything from impressive flips to realistic fight scenes.

Frank Grillo

Frank Grillo is a skilled martial artist and boxing fan who does most of his own stunts in movies. Because he’s physically capable and well-trained, directors often cast him in action-packed roles. He’s performed complicated fight scenes and intense action sequences in films like ‘The Purge’ series and ‘Boss Level.’ Grillo stays in top shape year-round to prepare for any demanding role. He also publicly supports and acknowledges the important contributions of stunt performers in the film industry.

Gerard Butler

Gerard Butler is well-known for doing his own stunts and fight scenes, most notably in the movie ‘300’. He and the other actors trained intensely to get in shape for the physically demanding roles. He continues this practice in the ‘Has Fallen’ films, performing much of his own action and fight choreography. Over the years, Butler has been injured several times, including a broken neck while surfing for a film shoot. His tough and physically imposing presence has made him a popular actor in action movies.

Mark Wahlberg

Mark Wahlberg is famous for being incredibly dedicated to fitness and doing his own stunts whenever possible. He believes it’s important to accurately portray the physical demands of his roles, like in ‘Lone Survivor’ where he performed all his stunts in challenging mountain conditions to pay respect to the soldiers he portrayed. He also insists on doing his own driving and fight scenes in movies like ‘The Italian Job’ and ‘Infinite’. Wahlberg sees getting physically prepared for a role as a crucial part of his job, and this ability has helped him become a leading man in many popular action films.

Will Smith

Will Smith is known for doing his own stunts in action movies like ‘Bad Boys’ and ‘I Am Legend’. He’s skilled at handling fast-paced chases and physical humor, which demands excellent coordination. For ‘Gemini Man’, he combined stunt work with advanced motion capture technology. Smith loves the excitement of being on set and pushes the limits of what’s safely allowed. His energetic and athletic performances have helped make him a global superstar.

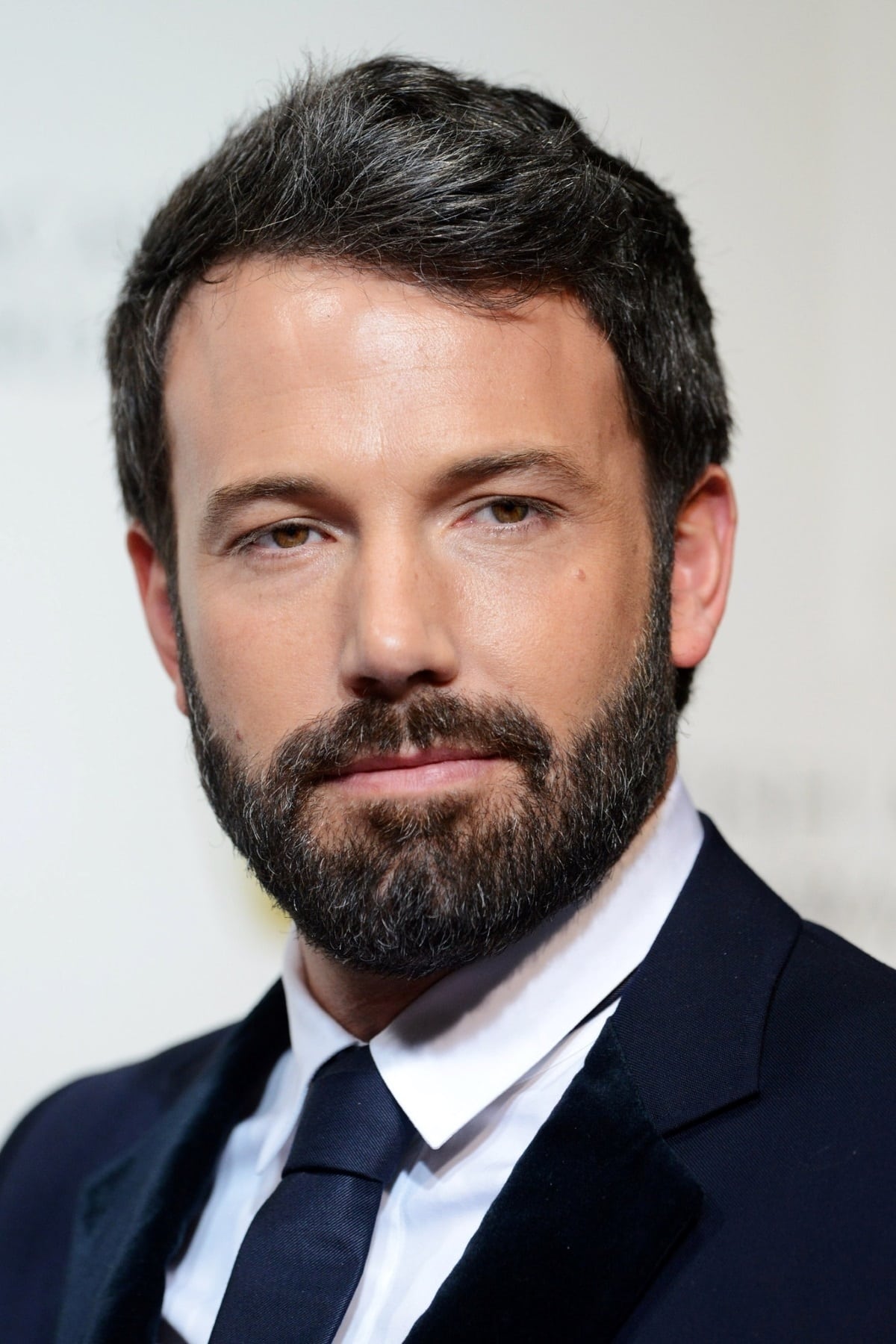

Ben Affleck

As a fan, I’ve always been impressed by Ben Affleck’s dedication to his action roles. He really threw himself into becoming Batman, doing a ton of the fight choreography himself and training in martial arts to make those battles feel incredibly real and impactful. And it wasn’t just Batman – he did a lot of his own stunts in ‘The Accountant’ too, playing a convincing assassin! He’s said that actually doing the physical work helps him connect with what his characters are going through, and honestly, it shows. He’s a big guy, and he uses that physicality to make every action scene believable and powerful.

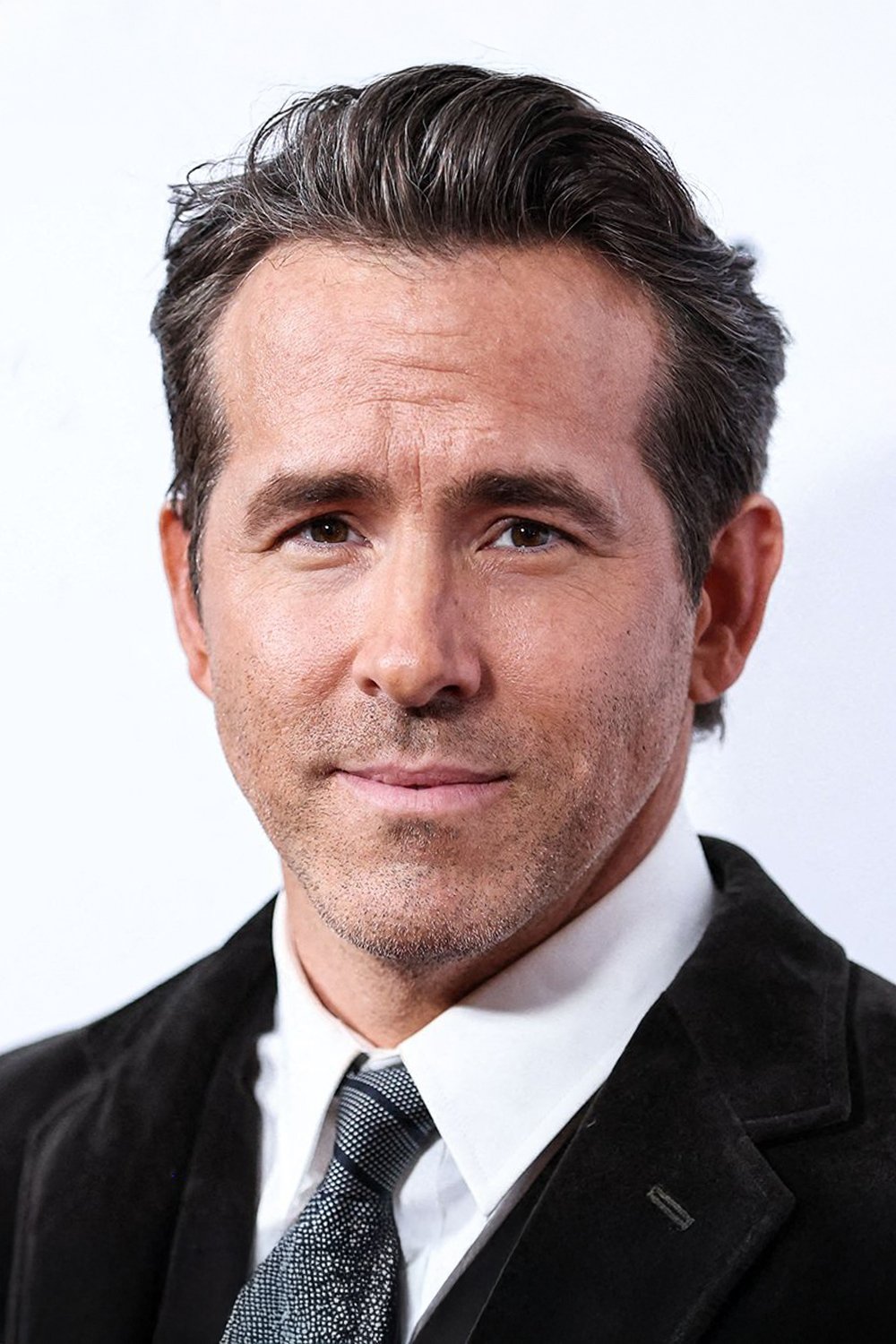

Ryan Reynolds

Ryan Reynolds is famous for playing Deadpool, and he does a lot of the character’s impressive stunts himself – including all the sword fighting and hand-to-hand combat. He’s skilled at physical comedy, which lets him combine action and humor effortlessly. Reynolds often spends months training to master the complex choreography needed for his roles. His commitment to the character has been a major reason why ‘Deadpool’ has become such a popular and successful film series.

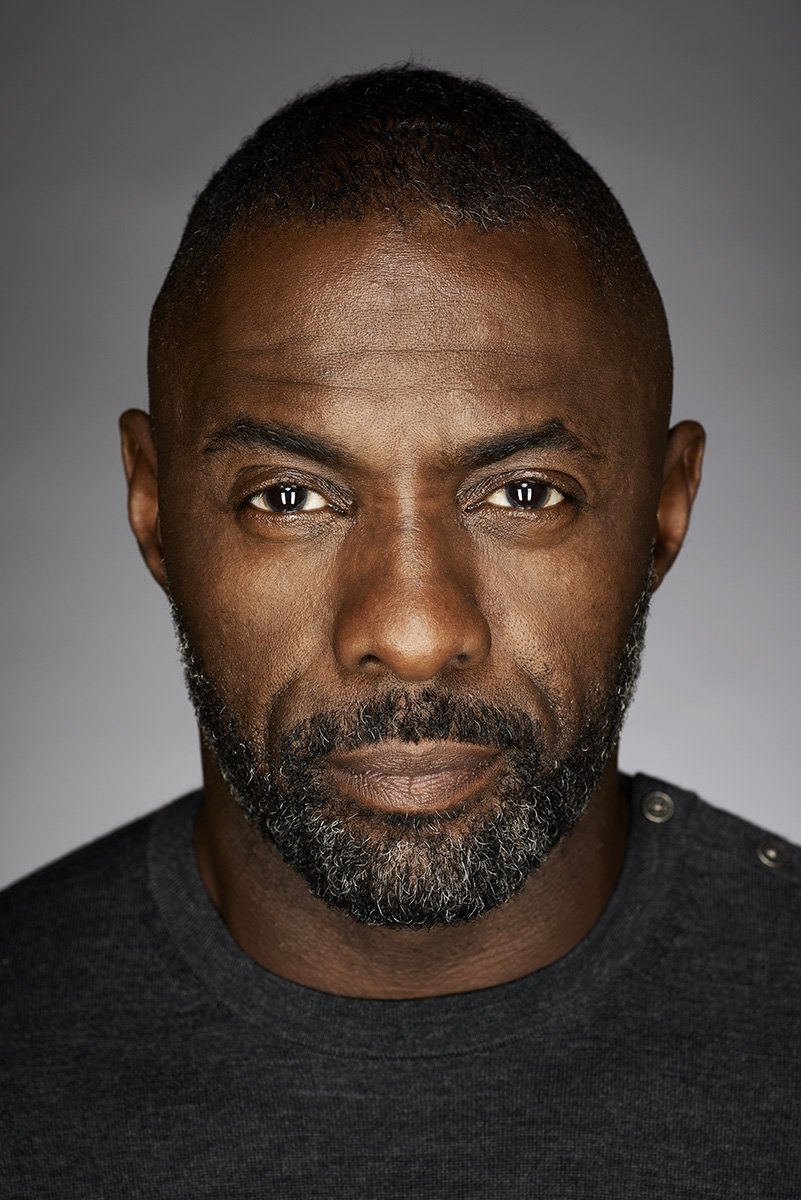

Idris Elba

Idris Elba is a skilled kickboxer, and he uses this talent in his acting, particularly in action films like ‘Hobbs and Shaw’. He did a lot of his own fighting and motorcycle stunts in that ‘Fast and Furious’ movie, and enjoys the physical demands of these roles. He also performed many of his own stunts during his work on the series ‘Luther’, which was known for its realistic and intense fight scenes. Elba’s strength and authentic abilities make him a convincing and powerful action star.

Tom Hardy

Tom Hardy is famous for fully committing to his roles, often using intense physical preparation and performing his own stunts. For movies like ‘Warrior’ and ‘Mad Max: Fury Road’, he’s known for rigorous training – he even learned and performed his own martial arts moves for ‘Warrior’. He also did a lot of his own stunt work in ‘The Dark Knight Rises’, including challenging fight scenes. Hardy consistently pushes himself physically to convincingly portray his characters, and that dedication shines through in every performance.

Jake Gyllenhaal

Jake Gyllenhaal is known for taking on demanding roles that require a lot of physical work, often doing his own stunts and fight choreography. He trained extensively in MMA for the recent ‘Road House’ remake and performed all the intense fight scenes himself. Similarly, he underwent a significant physical transformation and performed all the boxing sequences for ‘Southpaw’. Gyllenhaal finds the dedication and new skills needed for these roles rewarding, and his commitment to physically embodying his characters has been praised by critics.

Bradley Cooper

Bradley Cooper is known for his commitment to physically preparing for his roles. For ‘American Sniper,’ he trained for months with Navy SEALs and performed all his own tactical movements and weapon handling to accurately portray Chris Kyle. Similarly, he did his own stunts, including dangerous action scenes, in ‘The A-Team.’ Cooper feels that getting physically fit for a part is just as crucial as understanding the character’s emotions, and this dedication has allowed him to excel in both dramatic and action-packed films.

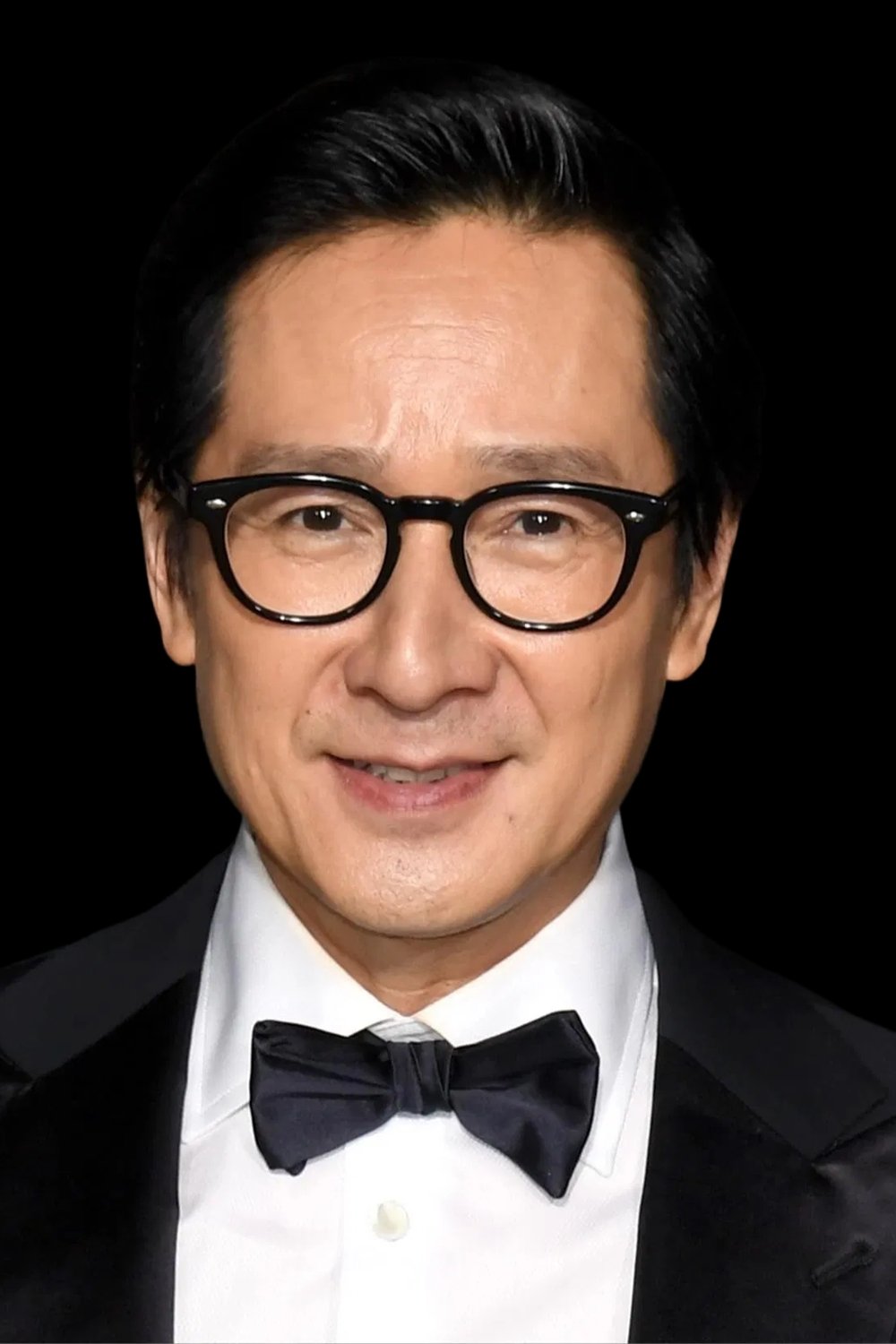

Ke Huy Quan

Ke Huy Quan started acting as a child and later worked behind the scenes as a stunt coordinator. He made a remarkable comeback with ‘Everything Everywhere All At Once,’ performing all his own impressive martial arts stunts, including the memorable fight with a fanny pack. His years of stunt work gave him the skill and precision to handle the challenging fight choreography. Quan’s return proved he’s not only a talented actor, but also incredibly physically capable, having developed these skills over many years. He’s now praised for both his acting and his action abilities.

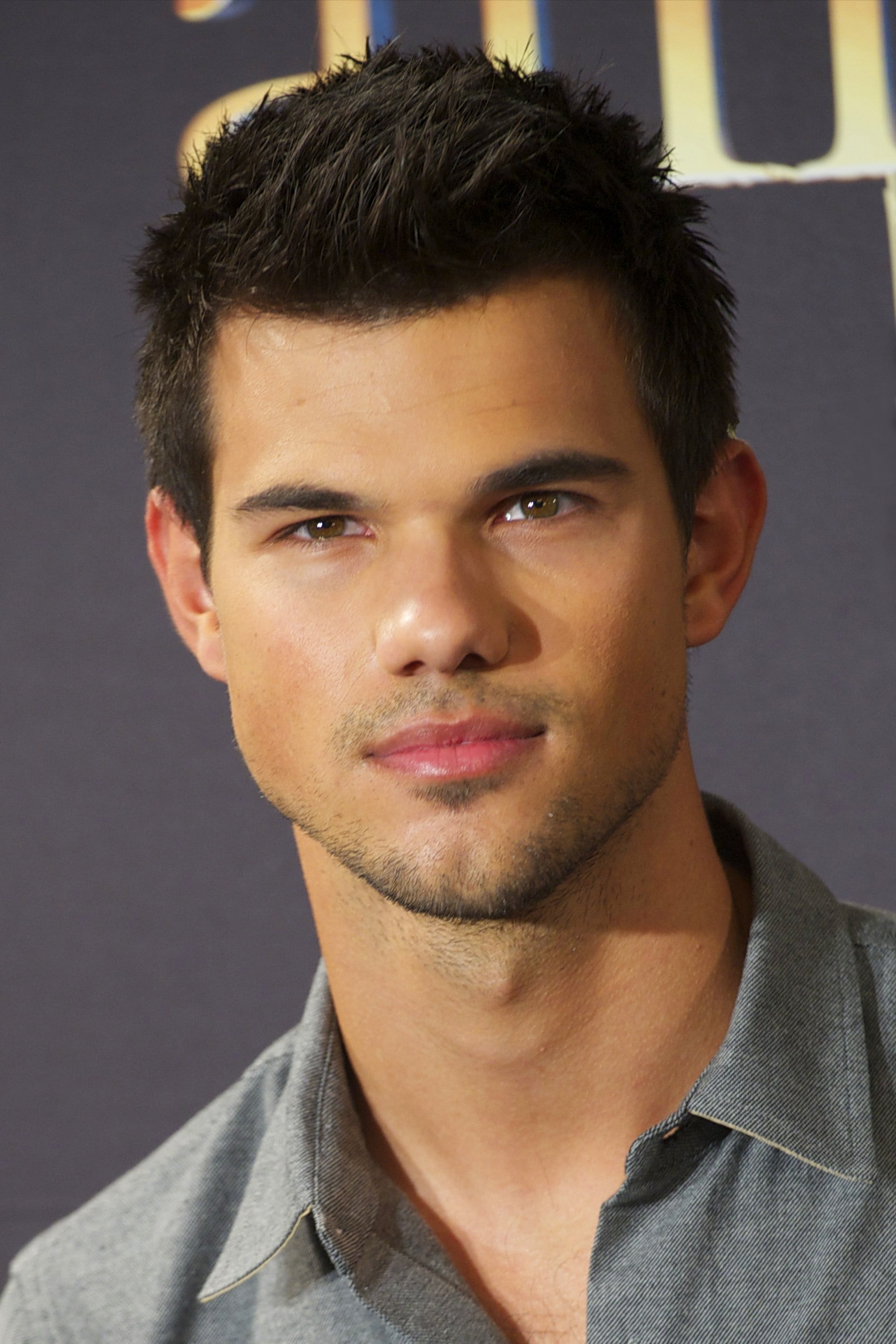

Taylor Lautner

As a movie fan, I’ve always been impressed by Taylor Lautner’s dedication to doing his own stunts. Before ‘Twilight’ blew up, he was a seriously skilled martial artist, and he brought that physicality to the role, doing things like backflips himself – they mostly used practical effects to enhance what he was already doing, which is awesome. He kept that up in ‘Abduction,’ even doing a stunt where he slid down the glass roof of a stadium! Honestly, his athleticism was a huge part of why everyone loved him as a young action star, and he’s still known and respected today for being the real deal when it comes to action sequences.

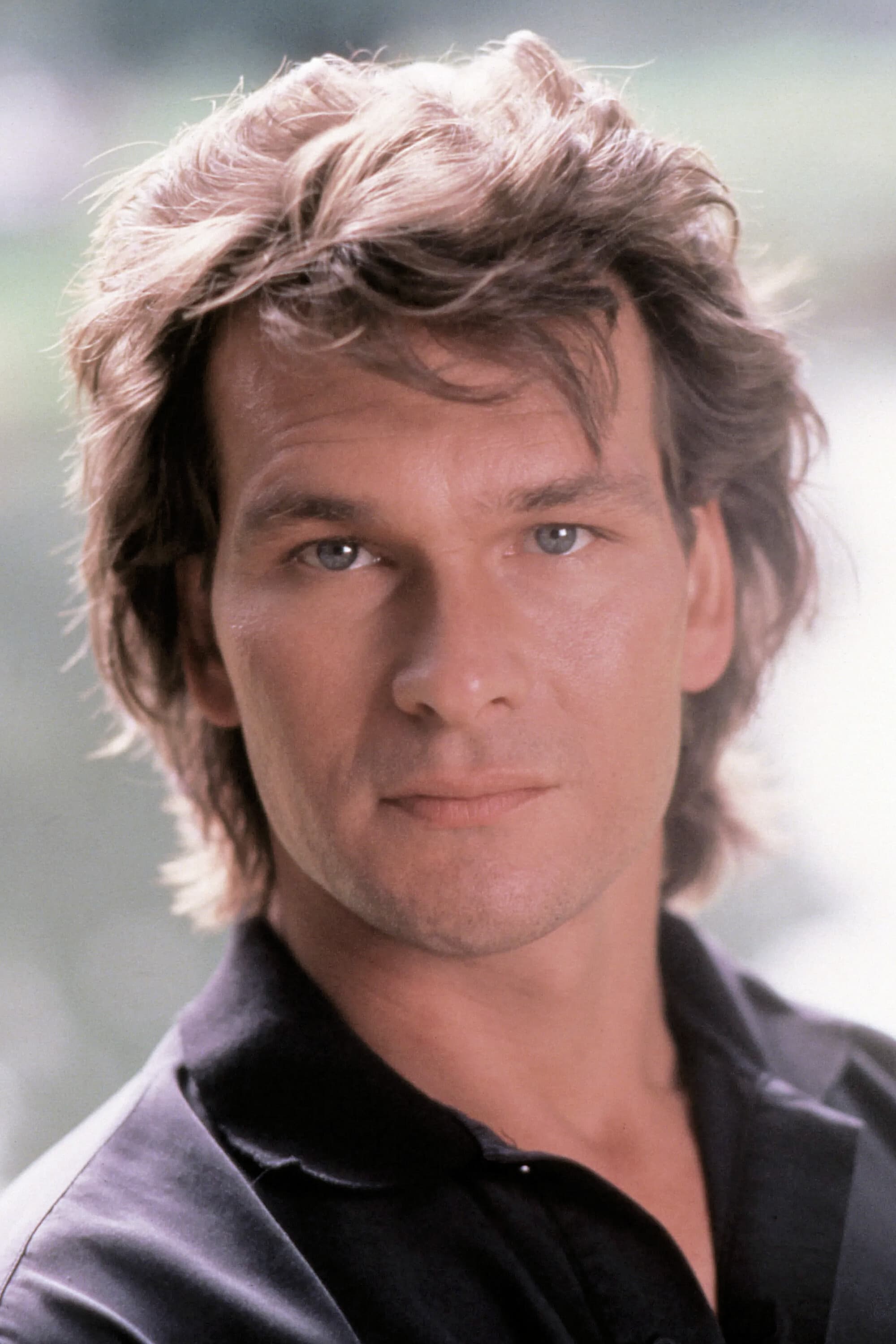

Patrick Swayze

Patrick Swayze was a skilled dancer and athlete, and he often did his own stunts, especially in films like ‘Point Break’. He famously insisted on doing his own skydiving, even though the filmmakers were worried. His dance training gave him excellent balance and coordination, which he used to make his action scenes look graceful and realistic. He also handled his own fight choreography and horseback riding in movies like ‘Road House’ and ‘Red Dawn’. Swayze will be remembered as a dedicated physical performer who brought passion and authenticity to every role.

Share your favorite actor from this list in the comments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 10 Underrated Films by Wyatt Russell You Must See

- Top 20 Overlooked Gems from Well-Known Directors

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- HSR Fate/stay night — best team comps and bond synergies

2026-02-15 06:21