It is a truth universally acknowledged, that a manufacturer in possession of a good name, must be in want of a future. The automotive world, presently occupied with the novelty of electric carriages, finds itself in a state of some agitation regarding the pace of this transition. China, it is observed, advances with a dispatch that leaves many of its competitors in a position bordering on the uncomfortable. Roughly half of their new conveyances now operate without the benefit of combustion, a statistic which, while impressive, does little to soothe the anxieties of those accustomed to more established methods.

The discerning investor, when contemplating opportunities in this evolving landscape, frequently directs their attention to names such as Tesla and BYD. However, a more subtle observation suggests that the most advantageous position may be held by a party one might least expect: the estimable house of Ferrari. Indeed, to suggest Ferrari as a purveyor of electric vehicles may strike some as a rather eccentric notion, yet a closer inspection of their recent endeavors reveals a strategy of considerable prudence.

A Change of Course?

Few, perhaps, consider Ferrari as a player in the electric vehicle game, a circumstance which, one suspects, is entirely to their advantage. A certain degree of obscurity allows them to proceed with their innovations without attracting the excessive scrutiny that often accompanies more flamboyant enterprises. Over the past few years, a notable shift in their production mix has occurred.

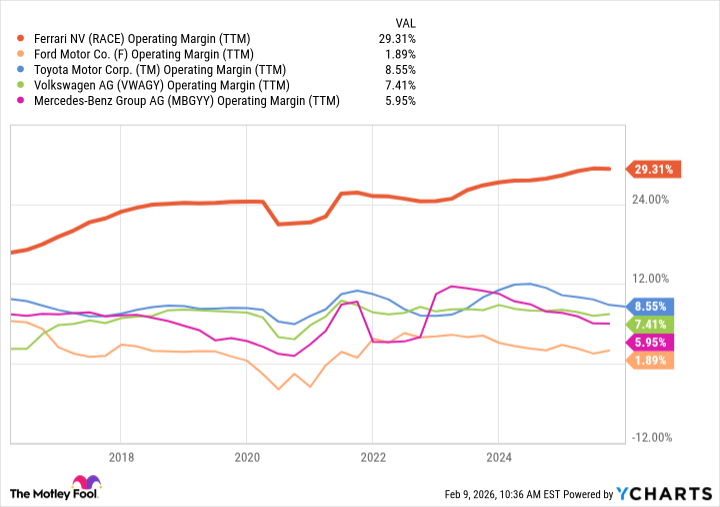

In 2022, a considerable proportion – seventy-eight per cent – of their output relied upon the traditional internal combustion engine, with the remaining twenty-two per cent adopting hybrid technologies. By the first half of 2025, this balance had altered significantly, with fifty-five per cent employing combustion and forty-five per cent benefiting from hybrid assistance. While the fully electric carriage remains, as yet, less lucrative than its gasoline-powered counterparts, Ferrari’s progress in hybrid technology has not diminished their profitability, a circumstance which speaks volumes regarding their management.

Ferrari is not merely accelerating its hybrid production; it is doing so with a degree of finesse that suggests a thorough understanding of both the market and its own capabilities. The company is, with commendable caution, assessing the appropriate moment to unveil its first fully electric vehicle, christened the ‘Elettrica.’ Whether investors approve or not, this introduction will undoubtedly prove pivotal in determining Ferrari’s future trajectory. To rush into the fully electric market would be a costly error, as several competitors are discovering; to delay too long, however, could prove equally detrimental, potentially jeopardizing their ability to cultivate a new generation of enthusiasts.

As Mr. Brian Lum of Baillie Gifford observed in Barron’s, “Luxury electric carriages are still in a nascent stage of development.” He further noted, with a degree of perspicacity, “It is essential to nurture the next generation of Ferraristi, and electrification should aid in this endeavor.” A sentiment which, while elegantly phrased, merely confirms the obvious: that securing a loyal clientele is paramount.

A Prudent Acquisition?

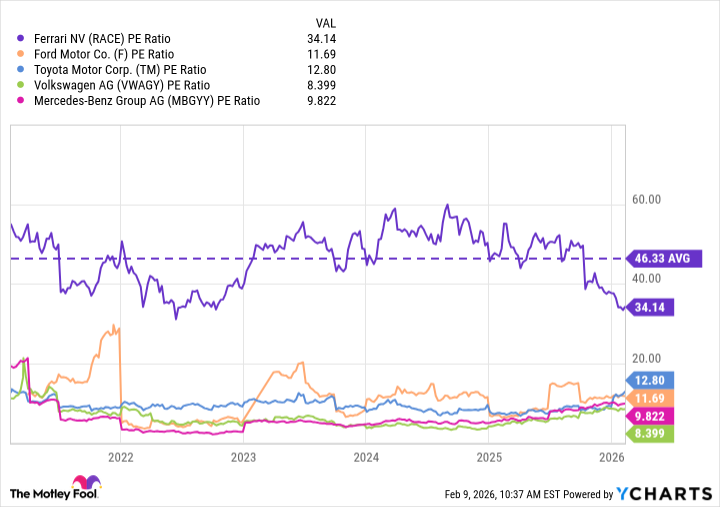

Ferrari, as an automotive manufacturer, occupies a singularly advantageous position. The demand for their products remains fiercely robust, a waiting list of discerning customers eagerly anticipates each new model, their profit margins are the envy of their rivals, and their racing heritage lends an air of distinction that few can match. Such advantages, naturally, come at a price – a premium valuation that reflects their exceptional standing.

Recent months, however, have presented investors with a rare opportunity to acquire shares at a somewhat reduced valuation, following guidance from the company that, while perhaps deliberately conservative, failed to meet the excessively optimistic expectations of certain analysts. It is a common, and often overlooked, tactic: to underpromise and overdeliver. For the discerning investor, Ferrari may not be the first name that springs to mind when considering electric vehicle stocks – but perhaps, upon closer inspection, it ought to be.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- HSR Fate/stay night — best team comps and bond synergies

- 10 Underrated Films by Ben Mendelsohn You Must See

- 10 Underrated Films by Wyatt Russell You Must See

2026-02-14 20:32