Observe, gentle readers, a spectacle most curious! ASML Holding (ASML 0.10%), a company whose very name trips lightly off the tongue, holds dominion over a realm vital to our modern age: the fabrication of those miniature marvels we call semiconductors. It boasts a monopoly, you see, upon a process—extreme ultraviolet lithography—that allows for the creation of chips so small, so densely packed with ingenuity, that they power everything from the frivolous distractions of our smartphones to the calculating engines of artificial intelligence. A grand position indeed, and one which, naturally, invites a certain… exuberance.

These advanced chips, you understand, are not merely faster; they are more efficient. They consume less power, allowing for more calculations per watt, and thus enabling the ever-increasing demands of our digital deities. AI, that ambitious pretender to human intellect, requires these chips in ever-growing quantities. And where does one find these essential components? Why, from ASML, of course! A most convenient arrangement, wouldn’t you agree?

Investors, ever susceptible to the allure of easy gain, have been acquiring shares of ASML with a fervor that borders on the comical. The stock has ascended a remarkable 96% in the past six months—a performance that would make even the most seasoned speculator blush. Yet, despite this prodigious climb, there remains, they say, room for further ascent. One is tempted to ask: how much higher must this edifice of speculation rise before gravity—or, perhaps, common sense—asserts itself?

The Orders Accumulate: A Stage Well-Set

On January 28th, ASML revealed its fourth-quarter 2025 results. Revenue increased by a respectable 16%, earnings by a more substantial 28%. But the truly noteworthy spectacle was the surge in bookings—those written promises of future revenue. A veritable avalanche of orders, one might say! Nearly 28 billion euros worth, a 48% increase over the previous year. ASML, it seems, is receiving more commitments than it can currently fulfill. A delightful predicament, to be sure, though one that invites a certain… pressure.

Management, in its pronouncements, speaks of “notable increase and acceleration” in capacity expansion plans amongst its clientele. CEO Christophe Fouquet, with a diplomat’s carefully crafted phrasing, notes an “improvement” in the semiconductor industry’s outlook, specifically as it relates to the construction of data centers and AI infrastructure. These customers, the likes of Taiwan Semiconductor Manufacturing and Micron Technology, are poised to significantly increase their capital expenditures, thus ensuring a continued flow of coin into ASML’s coffers. A virtuous cycle, wouldn’t you say? Or perhaps merely a self-fulfilling prophecy?

And let us not forget the burgeoning demand for memory chips! ASML’s customers are embracing its EUV manufacturing process, further solidifying its position as the indispensable provider. Analysts predict that ASML’s revenue will slightly exceed its guidance, reaching just over 37 billion euros—a 13% increase. A most gratifying projection, though one should always approach such pronouncements with a healthy dose of skepticism.

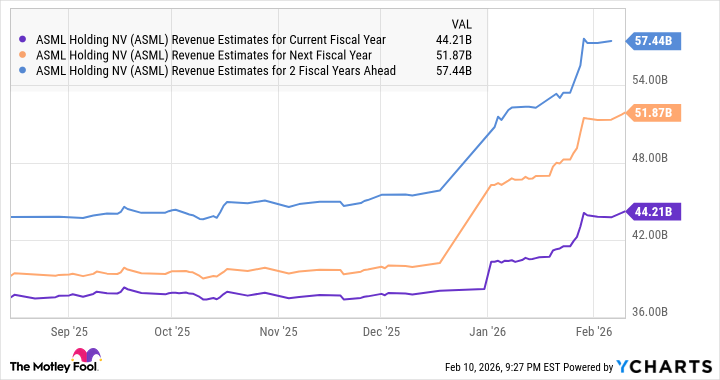

Indeed, projections for 2027 anticipate a revenue of $51.3 billion, a further 17% increase. A backlog of 39 billion euros at the end of 2025 already suggests a robust future. And Mizuho Financial Group predicts continued growth in wafer and fabrication equipment spending. One begins to suspect that ASML is not merely a company, but a machine—a relentless engine of profit, driven by the insatiable demands of the digital age.

The Price of Progress: A Most Ambitious Calculation

Let us indulge in a little arithmetic, shall we? Assuming ASML’s revenue increases by 18% in both 2026 and 2027, it could reach nearly $54 billion by the end of next year. Currently, the stock trades at 14.3 times sales—a premium, to be sure, but one that seems justified given the potential for accelerated growth. If ASML continues to trade at this multiple and achieves $54 billion in revenue, its market capitalization could soar to $769 billion—a 40% increase.

This, in turn, would bring the stock price tantalizingly close to $2,000. One suspects that this milestone could be reached within the next two years—or perhaps even sooner. Indeed, ASML’s guidance appears, if anything, conservative. Its actual growth could easily exceed expectations, paving the way for a dramatic surge in the stock price.

However, let us not be blinded by the allure of profit. Remember, dear readers, that the pursuit of wealth is often a fool’s errand. The true measure of a company lies not in its stock price, but in its contribution to the betterment of mankind. And while ASML undoubtedly plays a vital role in the advancement of technology, one cannot help but wonder if its relentless pursuit of profit is ultimately serving the greater good. A question, perhaps, for another day.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- HSR Fate/stay night — best team comps and bond synergies

- 10 Underrated Films by Ben Mendelsohn You Must See

- 10 Underrated Films by Wyatt Russell You Must See

2026-02-14 20:23