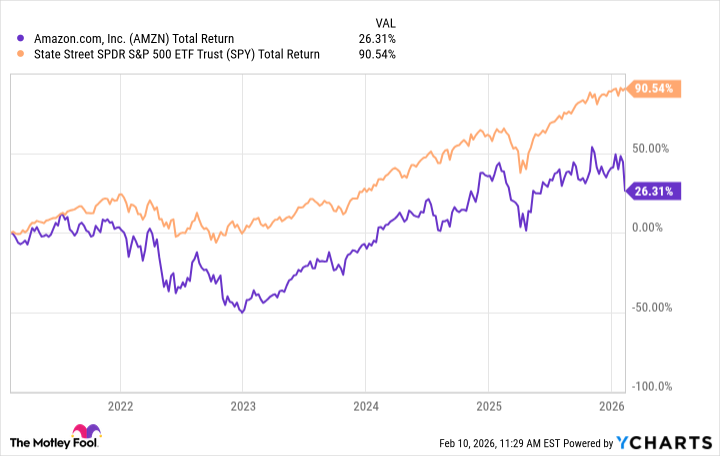

Amazon (AMZN 0.39%). Yes, that Amazon. The one that delivers everything from aardvark grooming kits to zythums (a remarkably obscure ancient beverage, and frankly, why wouldn’t you?). It’s been, historically, rather good at the whole ‘stock market’ thing. Although, recently, it’s been performing with the enthusiasm of a slightly damp sloth. Over the last five years, it’s been…underperforming. A mere 26.3% gain versus the S&P 500’s rather boisterous 90%. One suspects the market has momentarily forgotten that Amazon isn’t just a shop; it’s a logistical paradox wrapped in a customer service algorithm.

The stock took another tumble after the latest quarterly earnings report – trading around $200, which is, incidentally, approximately the price of 17,392 moderately used paperclips. Wall Street, in its infinite wisdom, seemed disappointed. They’re focusing, as usual, on the short-term noise, missing the fact that Amazon is building a future that’s likely to involve robots, drones, and possibly, the colonization of a small moon. (Don’t ask. It’s complicated.)

Here’s why this recent dip is, in the grand scheme of things, a rather splendid opportunity.

Steady E-Commerce Margin Expansion

Everyone’s currently fixated on Artificial Intelligence (AI), which is all very well, but let’s not forget the slightly less glamorous, yet remarkably profitable, business of actually selling things. Amazon’s North American sales grew 10% last year, reaching $426 billion. That’s…a lot of stuff. Enough stuff to fill several moderately-sized planets, probably.

More importantly, profit margins are expanding. They’ve reached a record 9% in North America, and 6.9% for the year. This is largely due to the cunning deployment of high-margin advertising and subscription services. It’s a bit like discovering that your slightly eccentric aunt has been secretly running a highly successful artisanal cheese empire. Unexpected, but delightful. Last year, this translated into close to $30 billion in operating earnings.

With continued growth and margin expansion, earnings should grow even more strongly in 2026 and beyond. A 10% operating margin on $500 billion in revenue equals $50 billion in operating income. Perfectly achievable, assuming the laws of physics remain reasonably cooperative.

Huge Potential in AI Infrastructure Spending

Amazon Web Services (AWS), its cloud infrastructure business, is growing at an alarming rate. And AI spending is, naturally, accelerating that growth. It’s a bit like feeding a particularly enthusiastic digital monster. The more you feed it, the faster it grows.

Management plans to spend $200 billion on capital expenditures in 2026, primarily on AWS investments. This will, admittedly, dent short-term free-cash-flow. But it will lead to sustained revenue growth for AWS over the next few years. Think of it as a temporary inconvenience in the pursuit of long-term digital domination.

AWS revenue grew 24% last year, reaching $129 billion. If they can maintain that growth over the next three years – and these massive capital investments suggest they might – then AWS revenue will approach $250 billion. With segment profit margins sustainably over 30%, this would yield $75 billion in operating earnings from AWS alone. Which, when you think about it, is enough to buy a small country. (Terms and conditions apply, naturally.)

Why Now Is the Time to Buy Amazon Stock

Investors are worried about short-term cash-flow hits and Amazon’s ability to keep investing in AI growth. They’re missing the big picture. They’re focusing on the leaves when they should be admiring the forest. (A forest that’s likely to be populated by delivery drones, naturally.)

If AWS can grow to $75 billion in earnings while North American retail reaches $50 billion, that’s $125 billion in combined operating earnings. Sprinkle in some earnings from the international retail business – which now has over $150 billion in revenue – and consolidated earnings may reach $150 billion in the next few years. It’s all rather impressive, really.

Today, Amazon has a market cap of $2.2 trillion, which would give it an earnings ratio of under 15 based on these estimates. This makes Amazon stock cheap today. A rather nice buy for investors through 2026 and beyond. (Disclaimer: Past performance is not indicative of future results. Especially when dealing with companies that may or may not be planning to colonize the moon.)

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- Brent Oil Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- HSR Fate/stay night — best team comps and bond synergies

- 10 Underrated Films by Ben Mendelsohn You Must See

- 10 Underrated Films by Wyatt Russell You Must See

2026-02-14 19:24