So, everyone’s panicking about software stocks, right? Apparently, some tech wizard figured out how to build a whole operating system with a weekend project and a concerning amount of caffeine. It’s like when everyone suddenly decided they could bake sourdough during the pandemic. The market’s having a collective “Wait, anyone can do this?” moment. But let’s be real: cybersecurity isn’t something you want your nephew, bless his heart, “disrupting” in his spare time. Unless you enjoy explaining data breaches to shareholders, stick with the professionals.

And conveniently, those professionals have been on sale. Which, in the stock market, is basically like finding a designer handbag in the clearance bin. It’s suspicious, but you take it. I’m talking about CrowdStrike (CRWD 2.43%). They’re the folks who keep the bad guys out, and right now, they’re trading at a price that suggests everyone thinks the bad guys are winning. Which, frankly, is a depressingly accurate assessment of most things these days.

CrowdStrike: AI, or How We Learned to Stop Worrying and Love the Algorithms

What does CrowdStrike do? They’re like the digital bouncers for your company’s network. Every laptop, phone, smart fridge—anything that connects to the internet—is a potential entry point for hackers. CrowdStrike uses AI to figure out what’s normal activity and what’s someone trying to steal your intellectual property. It’s basically a digital lie detector, but for computers. And it works faster than HR.

They’ve already got AI built in, which is good, because apparently, the hackers are getting an AI upgrade too. It’s an arms race, only instead of missiles, it’s malware. And the stakes are, you know, all your data. CrowdStrike isn’t just endpoint security, though. They’re building a whole ecosystem of cybersecurity stuff. Forty-nine percent of their customers are buying six or more products. It’s like Costco for corporate paranoia.

Once you’re locked into their system, switching is…discouraged. It’s the same reason I’m still using the same streaming service even though they keep raising the price. It’s just easier. And the demand is going to keep growing. They predict the total addressable market could hit $300 billion by 2030. That’s a lot of firewalls. Which is why, when the stock price dips, it’s a chance to buy. Think of it as investing in the inevitable wave of digital disasters.

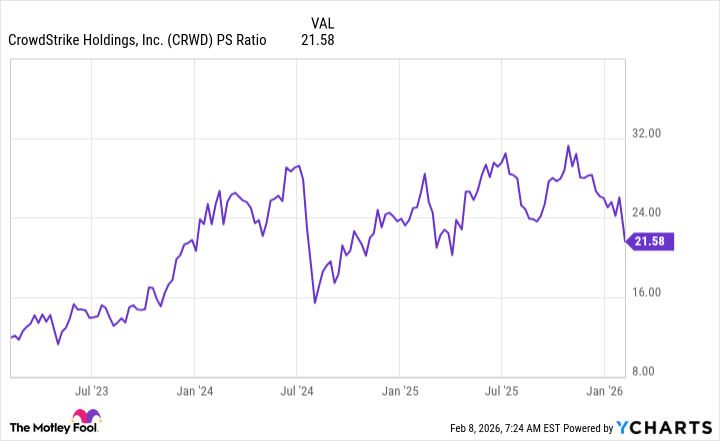

Right now, CrowdStrike is trading at about 22 times sales. It’s not exactly a steal, but it’s a lot more reasonable than it was a few months ago. Wall Street thinks they’ll grow 22% by 2027. Which, let’s be honest, is probably a conservative estimate if the AI-powered cyberattacks keep escalating. I’m not saying this is a guaranteed win. I’m just saying it’s a rare opportunity to invest in a company that’s actively trying to prevent the digital apocalypse. And frankly, that feels like a pretty good bet right now.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

2026-02-12 20:32