It is a truth universally acknowledged, that a company in possession of good fortune, must be in want of continued prosperity. And so it has proved with the recent expansion of the esteemed one-trillion-dollar club. Walmart has lately joined the ranks of Nvidia, Alphabet, Apple, Microsoft, Amazon, Meta Platforms, Broadcom, Tesla, and Berkshire Hathaway – a gathering of considerable consequence. Eli Lilly, though prone to a temporary withdrawal, maintains a precarious foothold, while JPMorgan Chase appears on the very verge of admission, requiring but a modest advance to secure its place.

One observes, with a degree of quiet satisfaction, that ExxonMobil has begun to distinguish itself amongst the more hopeful candidates. I had ventured, some time ago, to suggest that ExxonMobil, alongside Visa, Oracle, and Netflix, possessed the potential to reach this enviable valuation by the year 2030. Yet, the company has demonstrated a most agreeable haste, advancing with a vigor that exceeds even the most optimistic predictions. Indeed, the current year finds ExxonMobil up nearly twenty-four percent, its market capitalization now exceeding six hundred and twenty-two billion dollars – a circumstance that demands a renewed consideration of its merits.

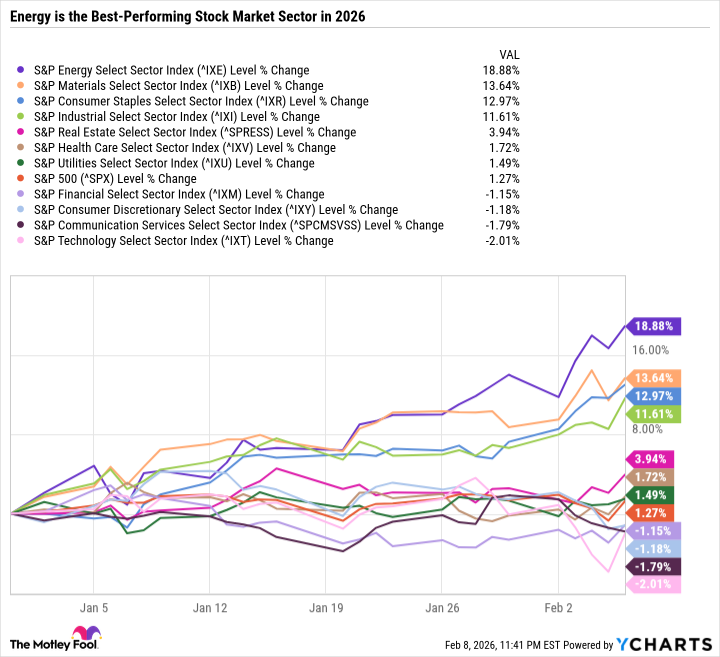

The explanation for this fortunate turn of events is not, perhaps, entirely mysterious. A general elevation of fortunes within the energy sector has, undoubtedly, contributed to ExxonMobil’s success, though it is a company that, unlike some, does not rely upon fleeting enthusiasms.

As the chart plainly illustrates, materials, consumer staples, and industrials have also experienced a degree of favor. One cannot help but notice, however, that the more speculative sectors – technology and communication services – have suffered a slight diminution of esteem. The prevailing sentiment appears to be a cautious one, a questioning of valuations that had, perhaps, ascended to an unsustainable height. The considerable expenditures announced by Amazon, exceeding one hundred and thirty-nine billion dollars in cash from operations, are viewed with a discerning eye, a recognition that even the most promising ventures require a foundation of sound financial management.

ExxonMobil’s Steadfast Course

ExxonMobil, it must be observed, benefits from the increasing demand for energy, a demand that is, in part, fueled by the current preoccupation with artificial intelligence. Yet, the company’s strengths extend beyond this mere coincidence. It possesses a resilience, a solidity, that sets it apart from those enterprises reliant upon the latest innovations. Its assets are not ethereal, but tangible, its business model insulated from the vagaries of fashionable speculation. It is a company that profits from improvement and efficiency, rather than from the precarious hope of disrupting established order.

ExxonMobil anticipates an average earnings growth of thirteen percent, coupled with double-digit cash flow growth through 2030. This is not a forecast predicated upon a fanciful rise in oil prices, but upon a realistic assessment of its capabilities. The company’s efficiency gains are rooted in its advanced assets – its operations in the Permian Basin, its liquefied natural gas ventures, and its offshore developments in Guyana. These projects, particularly, are expected to contribute significantly to its future prosperity.

Furthermore, ExxonMobil has wisely invested in low-carbon technologies, such as carbon capture and storage, and maintains a substantial refining and marketing business, which has lately enjoyed a considerable increase in earnings. The energy products segment grew from $4.03 billion to $7.42 billion – an increase of eighty-four percent – a circumstance that cannot fail to please discerning investors. Even a decline in upstream earnings, from $25.39 billion to $21.35 billion, was mitigated by a nine percent increase in oil equivalent barrels produced.

A Prudent Investment, Despite Recent Advances

Even after its recent ascent, ExxonMobil remains a solid, if not entirely unreservedly, recommended purchase. It is a reliable source of dividends, having raised them for forty-three consecutive years, offering a yield of 2.8 percent. Its price-to-free cash flow ratio of 27.2 and price-to-earnings ratio of 22.3 are, admittedly, somewhat elevated compared to its ten-year median. However, it is fair to observe that ExxonMobil is a far higher-quality company today than it was in former years.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- 10 Underrated Films by Ben Mendelsohn You Must See

- Target’s Dividend: A Redemption Amidst Chaos

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

2026-02-12 04:13