![]()

The currents of speculation, ever restless, have lately focused upon the realm of artificial intelligence, a domain promising both boundless opportunity and, perhaps, a subtle erosion of that which defines us as human. Wall Street, ever eager to chase the shimmering mirage of quick profit, has thrown its weight behind these ventures, inflating valuations to levels that seem, to a dispassionate observer, divorced from any firm grounding in reality. A bull market, born of hope and fueled by excess, has taken hold, and within it, certain companies have risen to prominence, their fortunes mirroring the capricious nature of public sentiment.

Yet, amidst this frenzy, a peculiar stillness surrounds Micron Technology. It is not a company shouting its virtues from the rooftops, nor is it one indulging in the gaudy displays of its more celebrated peers. Rather, it operates with a quiet diligence, a steadfast commitment to the foundational elements of this new technological age. And it is this very quality – this unassuming strength – that warrants a closer examination, a patient unraveling of its potential.

The tale of Micron, stretching back to its inception in 1984, is not one of overnight sensation, but of gradual accretion, of painstaking innovation. Over the decades, its stock has risen, not in explosive bursts, but in a steady, almost imperceptible climb – a gain of some 28,700% – a testament to the power of consistent effort and prudent management. But to view this merely as a historical footnote would be to miss the deeper significance. For it is in the present moment, in the burgeoning demand for memory and storage, that Micron’s true potential begins to unfold.

The prevailing narrative, so readily embraced by the financial press, focuses on the architects of the intelligence itself – Nvidia and Advanced Micro Devices, crafting the ‘brains’ of these new machines. Broadcom, too, receives its due, building the specialized infrastructure that supports their operation. But the foundation upon which all this rests – the memory that holds the knowledge, the storage that preserves it – is often overlooked. And it is here, in this essential, yet unglamorous realm, that Micron reigns supreme.

For too long, Micron has been defined by the cyclical whims of consumer electronics – the endless upgrades of smartphones and personal computers. A company tethered to the fleeting desires of the masses. But the dawn of artificial intelligence offers a path to liberation, a chance to transcend these limitations. The demand for high-bandwidth memory – HBM – is surging, driven by the insatiable appetite of AI developers. And Micron, with its expertise in this critical component, is uniquely positioned to capitalize on this trend. The allocation of capital is shifting, moving away from mere processing power and towards the storage and retrieval of information – a subtle, yet profound, change in the dynamics of the market.

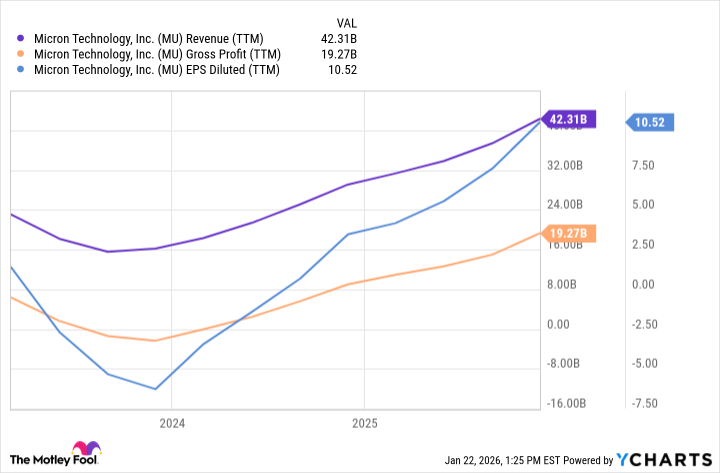

The numbers, while impressive, tell only part of the story. Micron’s revenue has begun to accelerate, but it is the improving profit margins that truly capture the attention. The total addressable market for HBM is expected to grow at a remarkable 40% compound annual growth rate, reaching $100 billion by 2028. And within this expanding universe, Micron is poised to claim a substantial share. One might ask, however, if such growth is sustainable, if the current euphoria is merely a temporary delusion. The answer, as always, lies in a careful assessment of the underlying fundamentals, a sober recognition of the risks and opportunities that lie ahead.

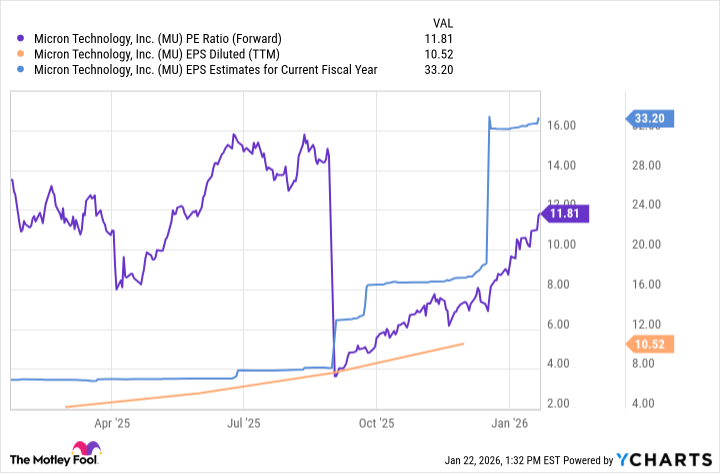

Yet, the market, in its infinite wisdom (or perhaps its infinite folly), has yet to fully recognize Micron’s potential. Despite generating $10 in earnings per share last year, and with consensus estimates projecting $33.20 this year, the stock trades at a rather modest price-to-earnings multiple of 12. Nvidia and Broadcom, basking in the glow of public adoration, command multiples that are double, even triple, this figure. Is this a mere quirk of market sentiment, a temporary mispricing? Or does it reflect a deeper skepticism, a lingering doubt about Micron’s ability to maintain its momentum? The discerning investor will weigh these factors carefully, seeking to separate genuine value from fleeting speculation.

If Micron’s forward P/E were to double – a not unreasonable expectation, given its compounding earnings profile – the stock could reach $780 per share by year-end – a 100% increase from current levels. Such a gain, while substantial, would merely reflect a more accurate assessment of the company’s intrinsic value. To those accustomed to the rapid-fire gains of the tech sector, this may seem a modest return. But for the patient investor, seeking long-term stability and sustainable growth, it represents a compelling opportunity.

In a world consumed by fleeting trends and ephemeral promises, Micron Technology stands as a testament to the enduring power of foundational strength. It is not a company seeking to dazzle with innovation, but to quietly and diligently build a better future. And in this age of artificial intelligence, that is a bargain indeed – a rare opportunity to invest in the very infrastructure upon which this new world will be built. It is a company for those who understand that true progress is not measured in short-term gains, but in the enduring legacy of value created.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

- Ephemeral Engines: A Triptych of Tech

2026-01-27 04:03