It has been roughly a year since the analysts at Goldman Sachs issued their somber decree, warning of meager returns for the S&P 500 over the next decade. They, like prophets lost to the tide of history, invoked the specter of inflated valuations, their voices cloaked in the hushed tones of inevitability, advising a retreat from the S&P 500’s clutches. Their prescription was to abandon the market’s cap-weighted giants like SPDR S&P 500 Trust (SPY) and Vanguard S&P 500 ETF (VOO), in favor of equal-weighted funds such as the Invesco S&P 500 Equal Weight ETF (RSP). A logical suggestion, no doubt, but one rooted in a conceptual purity, far too elegant for a market that wears its absurdities on its sleeve.

And now, as the calendar turns yet another page, let us glance back, not with the excitement of those who delight in profits, but with the sober contemplation of those who wish to examine the truth.

The S&P 500: An Ever-Crazed Carnival

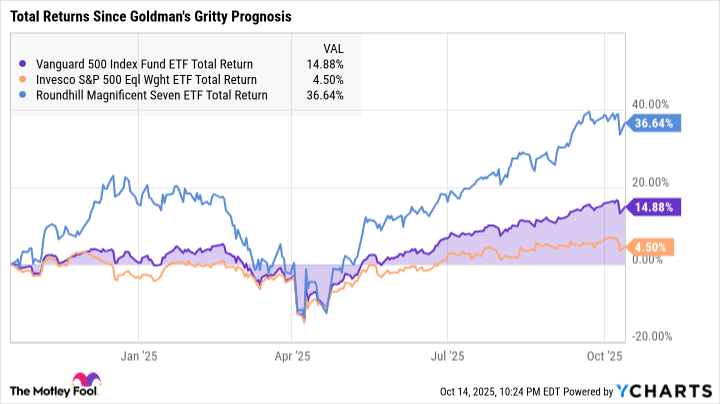

In the fifty-one weeks since Goldman’s prophetic utterances, the S&P 500 index has, predictably, continued its erratic dance. A total return of 14.9% has been logged, a victory for those enamored with the inflated value of an abstract financial construct. Yet, what does this return truly signify? The Roundhill Magnificent Seven ETF (MAGS), a beneficiary of the latest technological fervor, surged by a staggering 36.6%. Meanwhile, the equal-weighted S&P 500 tracker crawled upward by a mere 4.5%. This, then, is the market of today: uneven, unjust, and bloated with the weight of a few mighty titans.

Indeed, one might observe the rise of the Magnificent Seven, whose dominance, fueled by the AI boom, casts a shadow over the once-egalitarian ideal of a truly representative market. Nvidia, now the wealthiest company on Earth, dwarfs Apple in a display of grotesque inequality, as its market cap swells to $4.37 trillion, leaving the second-place company gasping in its wake.

And yet, despite this vertiginous growth, the S&P 500’s 14.9% return exceeds the meager 3% annual return Goldman had predicted. It seems that the market has disregarded its soothsayers, perhaps forevermore. Or has it?

Goldman Sachs: A Long-Term Vision, or a Temporary Misstep?

Perhaps it is premature to dismiss Goldman’s forecast. After all, they did not intend to speak to the transient madness of 2025. Their words were, as they often are, an echo of long-term prophecy, a warning for the next decade. A downturn, a recession, perhaps even a cataclysmic bear market-these are the forces which might vindicate Goldman’s pessimism. We must not be so quick to judge.

Still, I find myself inclined to agree with Goldman’s overarching sentiments. Yes, we are swept up in a feverish artificial intelligence boom, wherein a select few companies exert unparalleled influence over the broader market. But, as with all things, this cannot last. The question is not whether the AI-driven euphoria will wane-it is when. And when that inevitable moment arrives, who will remain standing? It seems to me that those who own equal-weighted funds may suffer less under the weight of systemic collapse.

My Own Reckoning with the S&P 500

As for my personal dealings, I have taken steps of my own in response to the looming uncertainties. A month ago, without the influence of Goldman’s words, I made the decision to hedge my bets. The concentration of power in the hands of a few companies was far too evident to ignore, and so, I took refuge in the seemingly more stable equal-weighted fund. But the market, in its capricious nature, has thus far not made much distinction between these two forms of investment. My humble position in the Invesco S&P 500 Equal Weight ETF has largely mirrored the performance of the traditional cap-weighted version. And yet, a small victory: when the market quivered under the weight of Friday’s uncertain news, the equal-weighted fund dipped less, a minor but notable divergence.

There are no grand revelations here. The Vanguard S&P 500 remains one of the most reliable vehicles for long-term investment, regardless of the economic tempests that may or may not arise. And yet, if history is any guide, the cap-weighted index is likely to outperform slightly over the course of a decade. But this is mere technicality; in a world dominated by the giants, the question remains whether we can trust such systems to endure.

For those still daring to invest, the prudent course may be to entertain the notion of adding a few equal-weighted shares to your portfolio. Whether or not Goldman’s dire prediction is proven true in time, one can hardly argue against the wisdom of preparing for a variety of potential futures.

In the end, we are all just players in a game designed by forces we cannot control, seeking solace in the faintest possibility of stability. 🧐

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-16 16:22