Bitcoin, that digital deity of the modern age, has once again ascended above $85,000, its dominance creeping toward a four-year zenith. In this circus of speculative fervor, altcoins with a penchant for BTC correlation are poised to prance about like over-caffeinated ponies. Tokens with a semblance of utility, a dash of adoption, and a sprinkle of bullish indicators might just double—or even triple—their worth in this merry-go-round of madness. 🎪

Table of Contents

Sui, XRP, and Fartcoin: The Unholy Trinity

Sui (SUI), XRP (XRP), and Fartcoin (FARTCOIN)—yes, you read that correctly—are the three musketeers of this crypto carnival. On a fateful Tuesday in April, SUI announced its grand integration with the Babylon Bitcoin staking protocol, allowing Bitcoin holders to secure the Sui network without relinquishing their precious BTC. A bold move, indeed, for a token that’s been in a downward spiral since its January peak. 📉

Sui is becoming a Bitcoin Secured Network (BSN) on the Babylon protocol, expanding its BTCfi reach.

Babylon and @SuiNetwork deepen technical ties expanding Sui’s growing connection with Bitcoin into the next frontier.

Read the full article 👉

— Babylon (@babylonlabs_io) April 15, 2025

Bitcoin, meanwhile, hovers near the $85,000 support, eyeing a triumphant return above $90,000. SUI, despite its recent 5% gain, remains a shadow of its former self, down 48% from its January peak. Yet, hope springs eternal, as SUI could rally 25% and test resistance at $2.6069. A daily candlestick close above this level could pave the way for a 201.84% gain—or, in layman’s terms, a 3x bonanza. 🎰

XRP, the perennial underdog, has been buoyed by the end of the SEC vs. Ripple lawsuit, ETF filings, and Ripple’s stablecoin launch. Bitcoin’s rally to $100,000 in December 2024 saw XRP hit $3, and it’s been a rollercoaster ever since. A 42% rally could push XRP to test the $3 milestone once more. 🎢

Fartcoin, the meme token that defies all logic, has amassed a market cap of over $834 million. Trading near key resistance at $0.9074, a 54% rally could see it test $1.2911. The MACD signals further gains, and the RSI reads 63—just shy of the “overbought” level. Who knew flatulence could be so profitable? 💨

Altcoin Season: A Mirage or a Mirage?

Bitcoin dominance is nearing 64%, a four-year peak, suggesting that an altcoin season—where 75% of the top 50 altcoins outperform Bitcoin—is unlikely. However, altcoins with high BTC correlation, utility, and traction among market participants could still yield gains. Solana (SOL), Dogecoin (DOGE), and SOL-based meme tokens favored by institutional investors and whales might see inflows, catalyzing gains in this Bitcoin bull run. 🐋

Bitcoin and Gold: A Love-Hate Relationship

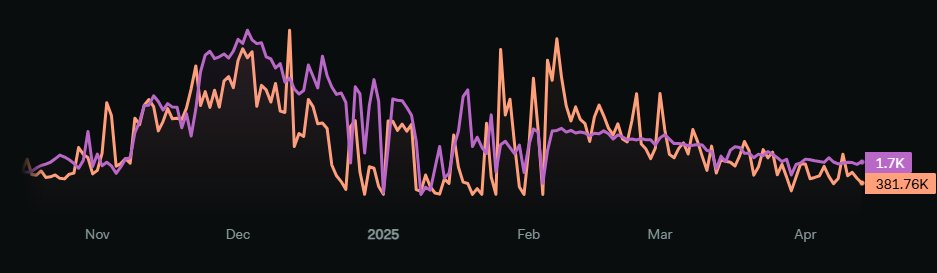

The debate over whether Bitcoin will reclaim its position alongside Gold as a “safe haven” rages on. Gold’s steady climb amidst global uncertainty contrasts with Bitcoin’s volatility. Between November 2022 and November 2024, Bitcoin and Gold enjoyed a tight correlation, but the relationship has frayed in 2025. Gold gained 16% in late March, while Bitcoin wiped out over 6% of its value. Will Bitcoin regain its edge as an inflation hedge? Only time will tell. ⏳

Trump’s Crypto Crusade: The End of Cycles?

Previous crypto market cycles followed a four-year pattern, but the rapid institutional adoption of Bitcoin and top cryptocurrencies threatens to disrupt this rhythm. The U.S. Strategic Crypto Reserve and policies to amass Bitcoin could forever alter the market landscape. As one analyst noted, the $70,000 to $75,000 range is a critical inflection point for Bitcoin’s price discovery. 🎯

The $70K–$75K Range

Bitcoin has stalled under all-time highs. Why? @_Checkmatey_ explains why the $70K–$75K range is a critical inflection point, both psychologically and structurally, for BTC price discovery.

— Galaxy (@galaxyhq) April 14, 2025

Traders: Bearish, Cautious, and Confused

The Crypto Fear & Greed Index reads 38, indicating a bearish mood among traders. However, sentiment has improved slightly, and investors may soon “buy the dip” if Bitcoin holds steady around $85,000. James Toledano, COO at Unity Wallet, noted that while U.S. recession fears have intensified, Bitcoin’s appeal as a decentralized asset grows amidst traditional market volatility. Trump’s policies, though uncertain, may paradoxically fuel Bitcoin’s rise. 🎭

“Despite these headwinds, Bitcoin is up over 25% over the past six months and is currently edging toward $86,000 although it appears to be shying away. Analysts argue that recessionary fears and global economic tensions may be driving more interest in decentralized assets like Bitcoin, but if a recession does hit and bites hard, will people want to speculate in volatile assets?

It does however feel that Bitcoin’s appeal as a decentralized asset grows, especially as traditional markets face volatility. While Trump’s policies have introduced significant macroeconomic uncertainty, they may paradoxically be fueling Bitcoin’s recent rise—though the risks remain elevated for all markets, crypto included.”

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-04-15 23:48