Oh, look! Bitcoin‘s price is taking a nosedive, and it’s not because of Trump’s latest tariff tantrum.

Analysts initially thought, “Oh, must be Trump’s fault,” but turns out, there’s a more “structured” reason for the crypto market’s hissy fit.

Crypto brainbox Kyle Chasse says it’s all about hedge funds unwinding their sneaky cash and carry trade. You know, the one that’s been holding BTC‘s price down like a bad hangover for months?

“Bitcoin’s crashing? Well, duh. The cash & carry party’s over, and BTC’s the drunk guy left at the bar,” he quipped.

The strategy was a bit like buying Bitcoin ETFs from BlackRock (IBIT) and Fidelity (FBTC) and then shorting BTC futures on the CME for a cozy 5.68% annual return. Some even used leverage to get double-digit returns. But now? It’s all falling apart like a bad soufflé.

The trade’s collapse led to a $1.9 billion Bitcoin sell-off in a week. That’s a lot of crypto coins changing hands! Meanwhile, hedge funds are unwinding positions faster than you can say “crypto crash.”

“Why’s this happening? Because hedge funds couldn’t care less about Bitcoin. They were just milking it for easy cash. Now, they’re bailing, and the market’s like, ‘Bye, Felicia!'”

Before the cash and carry truth bomb dropped, everyone was pointing fingers at Trump’s tariffs. But nope, it’s the hedge funds’ fault party this time.

Kyle Chasse sees a way out of this mess, though. More unwinding, more forced selling, and probably more volatility. Bitcoin’s price might swing like a pendulum on crack.

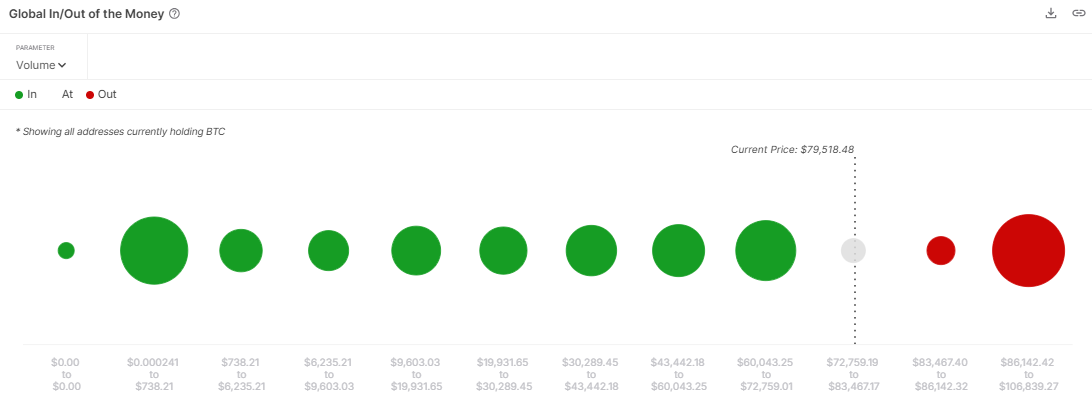

If Chasse is right, Bitcoin needs some real believers to step in and catch this falling knife. Technical analysis says the next target could be $70,000. Let’s hope it’s a soft landing!

At that price, 6.76 million addresses are holding 2.64 million BTC tokens. They might just be Bitcoin’s lifeline, preventing further price dives.

Chasse admits ETF-driven demand was partly real, but mostly just a quick buck for arbitrage players. Now, the market’s going through a painful reset. Get ready for a wild ride, folks!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-28 11:31