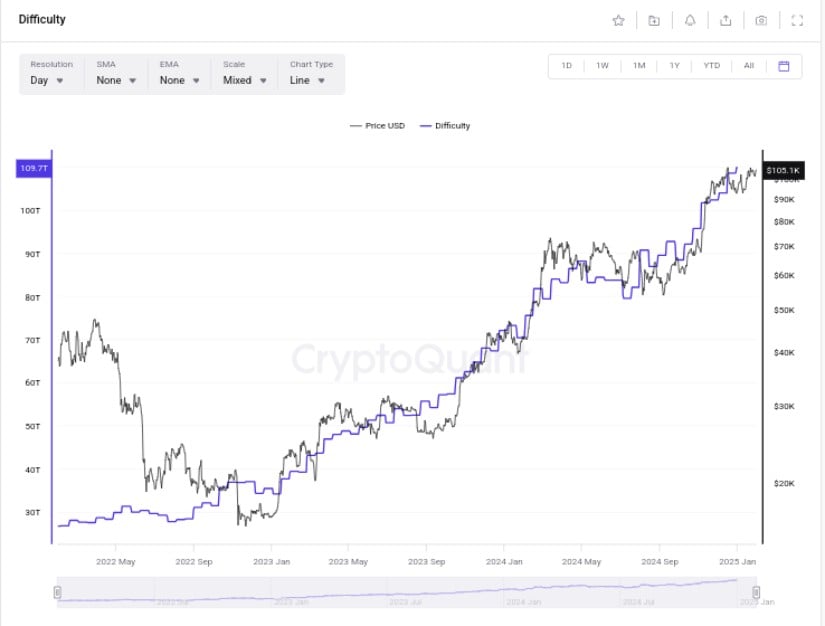

In the latest twist of fortune, which might well be the subject of a most diverting novel, the once bustling trade of Bitcoin mining has encountered a most unwelcome chill. The toil of these digital adventurers has been met with a reduction in the network’s mining difficulty, now at a mere 108 trillion—a figure that would surely confound our dear Mr. Darcy’s mathematical prowess.

And what of the computing power, you ask? The vaunted hashrate, that which miners hold so dear, has retreated to a paltry 832 exahashes per second. One might almost say it is in a state of decline, much like the fortunes of a spendthrift baronet. TheMinerMag, in its wisdom, reports a 2.12% decrease in difficulty, a most fortuitous adjustment for those whose coffers have been strained by the relentless pursuit of digital gold.

The Waning of Hardware Fancies

It appears that the American firms, once so eager to outfit their digital stables with the finest application-specific integrated circuits (ASICs), have now curtailed their enthusiasm. Their hardware preorders have dwindled, much like the social engagements of a young lady in reduced circumstances. This shift in priorities comes at a most inopportune moment, what with the Bitcoin halving having reduced the block subsidy—a most ungenerous turn of events.

In a manner most reminiscent of a heroine seeking to improve her situation, numerous mining enterprises have expanded their endeavors. They have ventured into the realms of high-performance computing services and artificial intelligence activities, no doubt in an attempt to secure their future by any means necessary. Some have even taken to hoarding Bitcoin, as though it were the most fashionable of investments.

The AI Market’s Alarming Turn

Alas, the mining stocks have not danced to the same tune as the Bitcoin enthusiasts. By the close of 2024, most publicly traded mining concerns found themselves in a most unenviable position, posting negative returns despite the cryptocurrency’s momentary rally. And then, to add to the distress, DeepSeek R1, an AI system from the Orient, has caused quite the stir by demonstrating remarkable capabilities at a fraction of the cost—surely a most unwelcome guest at the AI-centric companies’ ball.

The investors, in a state of shock most resembling that of a character in a Gothic novel, watched as approximately $1 trillion vanished from the share values of AI-centric companies. The advent of more affordable AI technology has, in one fell swoop, altered the landscape of advanced computing costs, leaving many to ponder the future profitability of their endeavors.

In this rather trying scenario, Bitcoin miners may at last find some respite from their ceaseless struggles. Yet, as technology continues its relentless march forward, the ability of the industry to adapt—to navigate the treacherous waters of both Bitcoin mining and beyond—remains of the utmost importance for any hope of future prosperity.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-31 12:15