In these enlightened times, where the digital realm has entwined itself with the fiscal, one finds solace in software such as ZenLedger, which, with commendable diligence, assists in the arduous task of tax management. 📈

As the allure of cryptocurrencies grows, so too does the burden of taxation, a matter of such gravity that even the most stoic of minds might find themselves in a quandary. 🤯

Behold, a most thorough examination of ZenLedger, a paragon among crypto tax solutions. Let us scrutinize its virtues, its foibles, and whether it might be deemed a worthy companion for the discerning investor. 🧾

Key Observations:

- ZenLedger, with its alchemical prowess, transforms digital assets into tax reports with the swiftness of a well-practiced scribe. 📝

- A dashboard, nay, a veritable pantheon of wallets, all under one roof-most convenient for the discerning investor. 🏠

- From state to federal, it navigates the labyrinth of tax filings with the grace of a seasoned diplomat. 🕊️

- Its API, a fortress of compliance, stands as a bulwark against the chaos of regulatory tides. ⚔️

- DeFi and NFTs, once the domain of the eccentric, now find their place in ZenLedger’s embrace. 🖼️

The Verdict

ZenLedger, a most popular contender in the realm of crypto tax software, offers real-time portfolio tracking and the generation of forms with the precision of a mathematician. 🧮

Its interface, though daunting to the uninitiated, is a marvel of simplicity, akin to a well-ordered ballroom. 🕺

With downloadable forms and tools for tax optimization, it ensures users remain au courant with the ever-shifting tides of regulation. A most reassuring prospect for the cautious investor. 🧭

Onboarding & User Experience

To open an account with ZenLedger is as effortless as a well-timed dance step. The interface, a paragon of friendliness, invites users to join with their Google or Coinbase accounts, or even MetaMask-a most liberal approach. 🤝

Creating an account

To embark on this journey, one need only visit the website and click ‘Sign Up.’ A Google, Coinbase, or MetaMask account shall suffice, though a custom email and password are also welcome. 📧

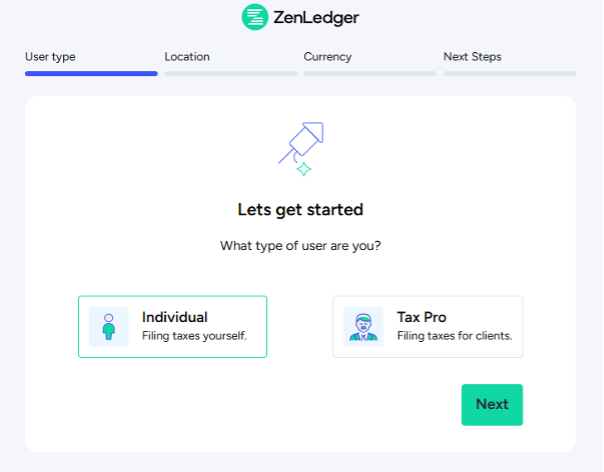

Upon confirmation of one’s email, the onboarding screen awaits, where details are inputted with the care of a meticulous scribe. 📖

Once all information is in place, the user may proceed to configure their settings-a task as simple as pie. 🥧

Key Account Settings

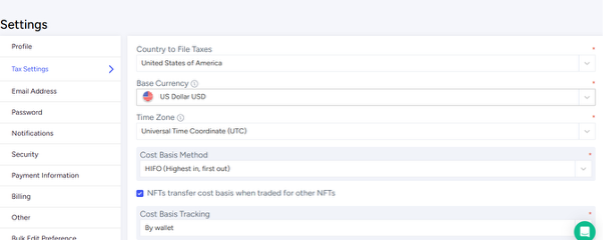

As with all such endeavors, customization of security and accounting settings is advised. Navigate to ‘Settings’ and adjust as one sees fit. 🔐

Under ‘Tax Settings,’ one may select their country, base currency, and accounting method-FIFO, LIFO, or otherwise. A most comprehensive array of options. 🗺️

Two-factor authentication, a most prudent measure, is recommended for the security-conscious. 🛡️

Interface, Dashboard, Accessibility

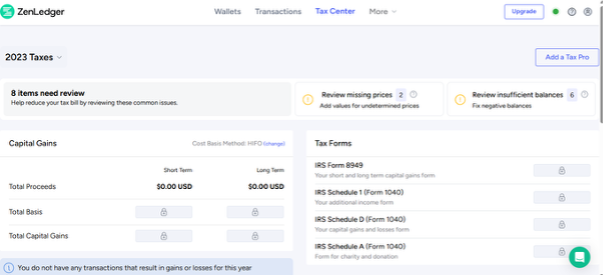

ZenLedger’s interface, a masterpiece of design, caters to both the novice and the seasoned trader. From the dashboard, one may toggle between wallets, transactions, and the tax center with the ease of a practiced hand. 🖱️

The Wallet Section, a repository of integrated accounts, and the Tax Center, a trove of insights, await the curious. 📊

Importing Wallets, Exchange APIs, and More

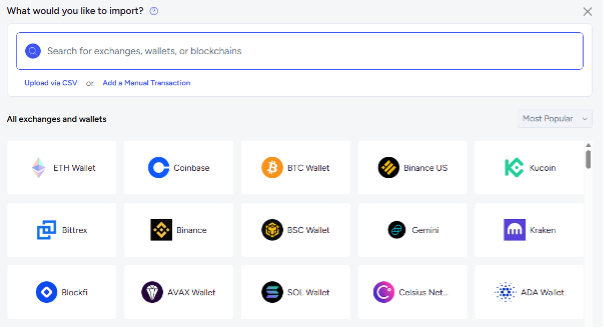

To import wallets and analyze tax data, one must navigate to the ‘Wallets’ page and select ‘Add Wallet/Exchanges.’ A choice between API connection or CSV upload awaits. 📁

Supported wallets and exchanges, a veritable who’s who of the crypto world, are listed, with the option to import non-supported ones via CSV. 📄

Supported Platforms

ZenLedger, in its benevolence, integrates most crypto exchanges, including;

- Coinbase

- Binance US

- Kucoin,

- Binance

And top wallets like:

Core Features & Integrations

ZenLedger, with its myriad features and integrations, is a most preferable choice for many. From its easy onboarding to its comprehensive tools, it ensures seamless tax filing. 🧩

Crypto Portfolio Tracker

This core feature, a necessity for most digital asset tax solutions, offers an overview of all holdings from connected wallets and exchanges. 📈

Who it’s best for: Traders who wish to keep tabs on their current holdings. 🧭

Pros:

- A very useful tool for account reconciliation. 📋

- Gives users an accurate overview across platforms. 🌐

- Done automatically to reduce manual efforts. ⚙️

Cons:

- Limited analytics since it is not built for trading. 🧩

- It is not optimized for mainstream investments. 🏦

Unlimited Transactions and Numerous Integrations

The tool allows for multiple wallets and exchanges, a boon for the professional trader. 📦

Who it’s best for: Professional traders with large amounts of transactions on multiple exchanges and wallets. 📈

Pros:

- No limit on transactions allowing better achievements. 🚀

- More range since all wallets are supported. 🌍

- Helps reduce errors since everything is connected. 🔧

Cons:

- Transactions might get bulky and overcrowded. 📦

- Only available for the Platinum Plan. 💳

Tax Calculation/ Form Generation

Needless to say, this is the crux of ZenLedger’s product offering. One may select the method of calculating the cost basis, and the platform takes over with its automated engine. 🧮

Who it’s best for: All traders because being tax compliant is important and at the top of each trader’s use cases. 🧾

Pros:

- Automatic tax calculation saves time. ⏱️

- Ability to handle very complex transactions. 🧠

- Wide range of downloadable crypto tax forms. 📄

Cons:

- Some details might be challenging for beginners. 🧒

- Missing transactions will produce wrong results. ❌

Tax Loss Harvesting

Tax loss harvesting, a most cunning strategy, allows one to sell assets at a loss and claim it on taxes. 📉

Who it’s best for: Small and active traders who want to maximize their tax positions. 📈

Pros:

- Traders can know which crypto assets are in the red zone. 🔴

- Helps towards long-term planning. 📅

- Automatic analysis of tax data. 🧮

Cons:

- There is often a limited analytical re-entry strategy. 🔄

- Potential sales are not automatic and need manual effort. 🧑💻

Security Features

ZenLedger prioritizes user account security through features designed to protect data. The software doesn’t hold funds or private keys of customers, ensuring connections use read-only API keys. 🔒

Who it’s best for: All traders who prioritize security and compliance with emerging global regulations. 🌐

Pros:

- Non-custodial control reduces security risks. 🛡️

- Designed to protect traders with large transaction data. 📦

- Removes compliance issues faced by many crypto users. 🧾

Cons:

- Compliance is more focused in the US than in other jurisdictions. 🇺🇸

Integrations

Integrations ease up the entire workflow for crypto tax solutions. ZenLedger has multiple integrations, each performing a key function in the process. 🤝

Who it’s best for: Accountants and tax experts who need fiat-like compliance in digital assets. 🧾

Pros:

- Reduced manual entry in workflow. 📝

- Helps reduce the risk of accounting errors. 🚫

- Boost productivity and ensure tighter compliance. 🚀

Cons:

- It might be complex for beginners. 🧒

- Some integrations are not available in the basic free version. 🚫

Pricing Plans

ZenLedger offers three plan categories, ranging from free to standard paid and professional. A most prudent choice for the budget-conscious. 💰

Free Plan

Cost: $0

Includes: Up to 25 transactions, detailed audit reports, tax compliance standards, tax loss harvesting, TurboTax integration, etc. The free plan is mostly used by beginners and expert traders to test the platform. While it’s good for onboarding, it is usually limited in terms of features. 🧑🎓

Silver Plan

Cost: $49/year

Includes: Up to 100 transactions, all detailed and audit reports, including other factors in the free plan. The silver package is the first boost from the free plan, and it is perfect for smaller traders with a few yearly transactions. 🧑💼

Gold Plan

Cost: $199/year

Includes: Up to 5,000 yearly transactions and all other benefits of the silver plan. This is the first plan to integrate DeFi/ staking and non-fungible tokens (NFTs). It is usually ranked as the most popular plan for most users because it expands the number of transactions, giving access to intermediate traders. 🎯

Platinum Plan

Cost: $399/year

Includes: Up to 15,000 transactions per year, DeFi compatibility, NFTs, etc. This plan further pushes up the number of transactions and includes other features in lower levels. Furthermore, it comes with an added customer support package. 📞

Premium Support Consultation

Cost: $275/60-minute consultation

This is the first option that the tax professional prepared plans and includes access to an expert. Tailored questions can be asked of the tax professional concerning your portfolio after booking the 60-minute consultation. 🧑⚖️

Tax Pro Prepared Plan – Single Year

Cost: $2,800/ year

The tax pro plan allows you to audit/calculate all tax-related functions with a professional. This is mainly for large corporations and traders having so many complex transactions. 🏢

Tax Pro Prepared Plan- Multi-Year

This is another professionally prepared plan for the long-term and the highest within ZedLedger. It is considered best for institutions and traders with very large volumes. 📈

Performance, Reliability & Support

ZenLedger is usually regarded as a reliable cryptocurrency tax software because of features that are helpful to individual and enterprise traders, and in my use of it, this more or less checks out. The performance of all features for filing tax and audit portfolios is key to the overall platform. Customer service and support for traders, especially those in Tax Pro plans, have also bagged positive reviews. 🎉

Performance

- High-end tax consultation plans: ZenLedger offers plans that allow users to meet with tax professionals for better workflow. 🧑⚖️

- Standard Compliance: The platform is known for strict standard guidelines in the United States. 🇺🇸

- Wider Integrations: ZenLedger has onboarded third-party accounting tools like TurboTax to aid the assessment of transactions and portfolios. 📊

- End-to-end data encryption: Security protocols are standard, particularly end-to-end data encryption that ensures privacy. 🔒

- Friendly interface: The platform uses a straightforward and friendly interface to drive adoption. 🧑🤝🧑

Cons:

- DeFi integration in higher plans: DeFi and NFT holdings can be onboarded but reserved for users with higher plans. 🚫

- Complex Features: Generally easy to understand, although some high-end features might be complex. 🧠

- Only United States tax forms can be downloaded. 🇺🇸

ZenLedger Alternatives & Comparison

Before choosing a crypto tax software, you have to weigh your options by comparing features, pricing, and pros and cons of different platforms. It is also important to check for compliance across jurisdictions and the ease of integrating wallets. 🧭

Alternatives to ZenLedger include CoinTracker, TaxBit, Koinly, CoinLedger, CryptoTrader, and more. 📚

Frequently Asked Questions (FAQs)

Is ZenLedger safe?

Yes, ZenLedger is a safe crypto tax software that deploys standard security practices. It uses end-to-end encryption to protect user data and implement strict read-only access for integrated wallets and exchanges. 🔐

Can I integrate with accounting software?

Apart from its own third-party integrations, users have export options to other accounting software. Exports are possible through CSV for wider analysis according to the customer’s preferences. 📤

Is ZenLedger free?

ZenLedger has a basic free plan that helps onboard users. The free plan is a good starting point for beginners; however, it is limited in terms of the number of yearly transactions and high-end features. 🧑🎓

Is it suitable for beginners?

Yes, because of the free plan and friendly interface that users enjoy. A new trader doesn’t need much complexity especially with digital asset tax systems. The smooth and flexible process makes it desirable for new entrants. 🧑🤝🧑

Conclusion: is ZenLedger legit?

ZenLedger is a legitimate crypto tax software used by several traders and institutions. It has been operational for years and has partnered with multiple web3 and traditional finance institutions in that period. The real function that gives it legitimacy is the accurate tax service it provides traders. Furthermore, security features have also bolstered the platform’s credibility. 🧾

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-12-29 13:17