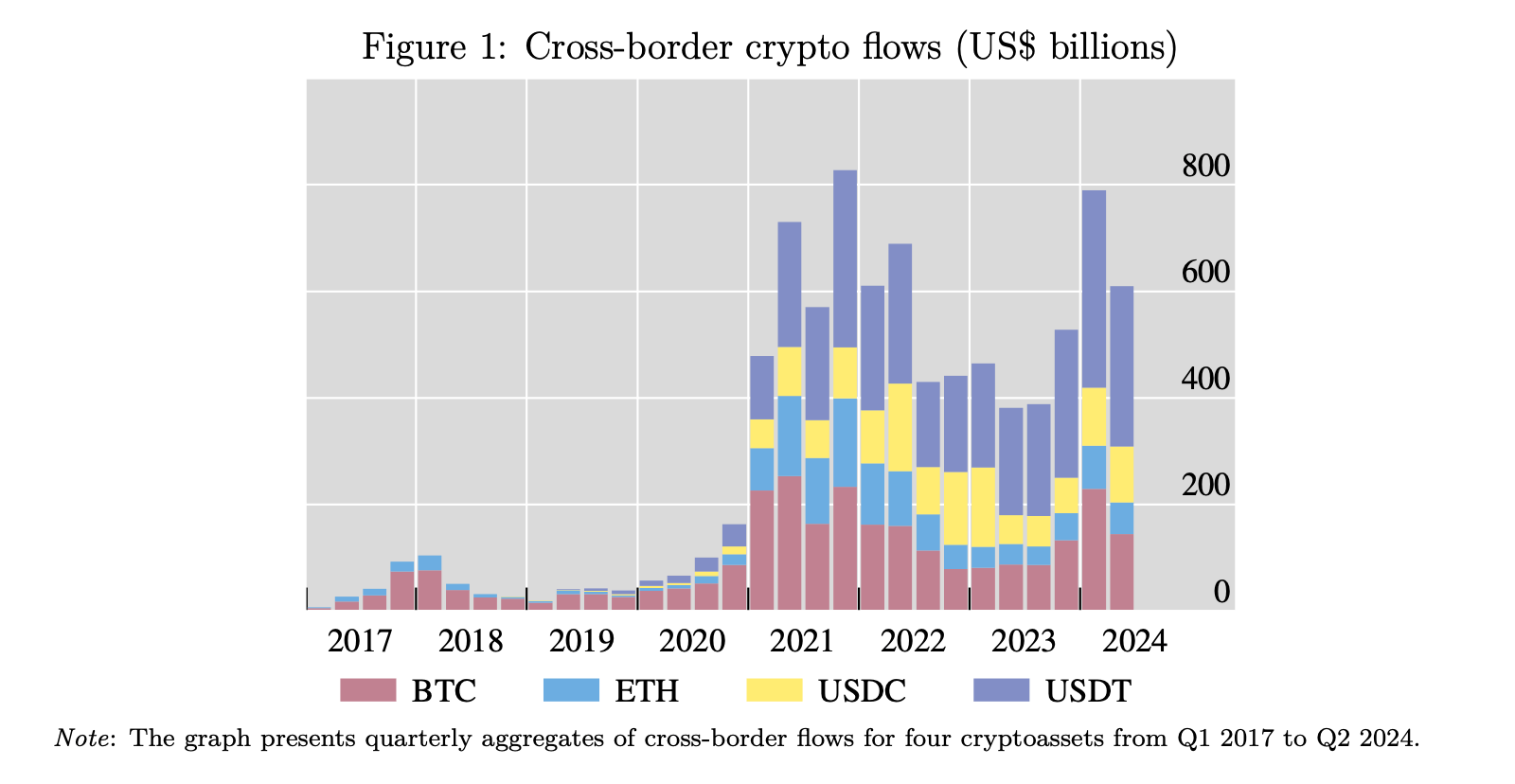

Good citizens, gather round: the wise heads at the Bank for International Settlements, sated with hearty bureaucratic tea and perhaps too many kalach buns, have set about counting not coins, but the ghostly flows of crypto-assets across our spinning ball of misery. Astonishingly, they claim cross-border shiny digital tokens soared to $2.6 trillion in 2021. That’s nearly half an oligarch’s weekly allowance and, frankly, enough to make any czar reconsider his rubles. 🤔💸

Panic and Pecunia! When Inflation Bites, the Masses Flee to Bitcoin, As If It Were a Coach to Petersburg

According to the venerable BIS (always ready to remind us that numbers are more terrifying when you know how to read them), those quixotic working papers (#1265 if you collect them) reveal crypto galloping about the globe, rivaling 12% of global goods trade. Stablecoins are strutting about like nouveau riche at a masquerade, grabbing almost half the pot. Imagine, behind these delirious numbers, the invisible hands of authors Auer, Lewrick, and Paulick—men of such caution that they probably count their own mustaches before leaving home. Their study scrutinized crypto transactions from 2017 to 2024, spanning 184 countries—almost as many as the number of varieties of bureaucrats in a Petersburg ministry.

Though the U.S. and U.K. still puff themselves up as crypto’s traditional grand dukes, the real action has sidestepped to places like India, Indonesia, and Turkey (pass the samovar, please). China, meanwhile, tried to shut the window, only for Turkey and Russia to jump through it, waving stablecoins like forged travel papers. Network density in crypto-land now makes the old banking system look like a sleepy provincial post office, but, as ever, the crowds are less refined—no monocles required to enter.

It seems crypto ebbs and flows according to financial weathervanes: when U.S. monetary policy grows stingier and the dollar flexes its muscles, the numbers lessen. Conversely, where inflation gnaws and local currencies wobble like drunken bureaucrats, crypto explodes in popularity. Stablecoins USDT and USDC are the people’s favorites for day-to-day traffic, while bitcoin (BTC) remains the wild performer, loved for its dazzling leaps and somersaults—entertainment for all, profit for a few! 🎩📈

Where remittances once meant forking over princely fees to grumpy clerks behind glass, crypto now smooths the path. The study found that in regions with outrageously overpriced traditional transfers, stablecoin and dainty bitcoin transactions (under $500—a sum only a minor civil servant might misplace) leapt by up to 25%. One might almost suspect some mischief.

“Cryptoassets are cropping up as a means of exchange,” chirp the authors—evidently shocked to find their study subject alive and kicking. “Stablecoins and half-penny bitcoin payments—they tempt the masses most where the old fiat currency is wobbling!” One imagines the ghost of a dusty accountant scowling in the margins.

The learned trio further scribble:

Furthermore, the monstrous cost of shipping pocket change via old-world banks is shadowed by a surge of stablecoins and modest bitcoin trickles crossing borders—outpacing the ambitions of postmasters from Helsinki to Hyderabad.

Iron bars and capital controls designed to keep fortune from bolting the stable have little effect in cryptoland; sometimes, clamping down only drives the horses to prance faster! The alluring cloud of pseudo-anonymity lets many slide unnoticed past the authorities, confounding regulators and giving headaches worse than a night out in Nevsky Prospect.

As crypto cozies up with traditional finance, the authors warn of possible storms on the steppe: for every innovative leap, looms the specter of market calamity—particularly for those emerging markets already teetering on enfeebled bureaucratic legs. May the policymakers polish their spectacles and gird themselves for the comical chaos ahead! 😅⚡

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

- 10 Shows Like ‘MobLand’ You Have to Binge

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-05-11 01:02