My dear friend, the Bitcoin nouveaux riches have recently demonstrated a peculiar fondness for extravagance so grandiose, even Wildean dandies would blush. According to those delightful archivists of digital excess, on-chain data now shows our freshly-minted short-term whale acquaintances have entered this ball at three times the price paid by those stately old-money whales who have been nursing their BTC since before the invention of crypto ennui. 🎩🐋

The New Bitcoin Whales and Their Decadent $91,900 Cost Basis

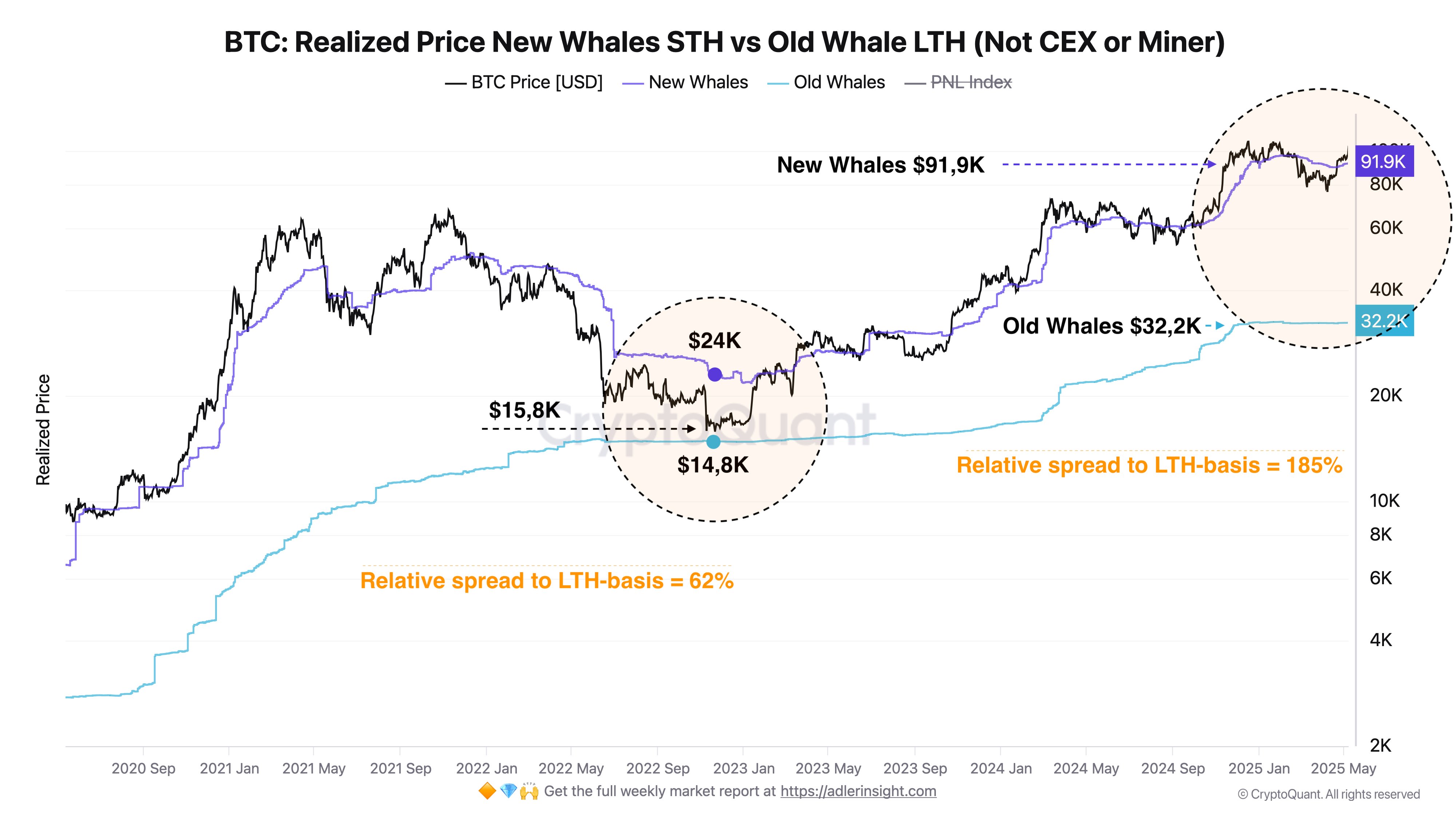

Allow me to set the scene conjured by the ever-observant Axel Adler Jr.—the Wilde of on-chain data, if you will. The metric of “Realized Price”—a term as loaded as a Mayfair parlor—silently chronicles the sum at which the average enthusiast enters this most fashionable revolution.

Should this realized price ascend above the current spot, one can assume a roomful of digital aristocrats nursing unrealized losses, like guests at a party where the only thing being served is regret. Of course, when the metric lounges comfortably below, profit and smugness are positively rampant.

But let us not concern ourselves with the vulgar entirety; no, today we examine only the finest specimens: whales (those rare creatures holding more than 1,000 BTC—a mere trinket valued at just over $100 million). Within this coterie, there are the Short-Term Holders (those who bought within the last 155 days, or as I call them, ‘The Impulsive’) and the Long-Term Holders (venerable sages who bought before the world knew Bitcoin tickled the aristocracy).

Marvel, if you will, at the following plot—a veritable Dickensian tale charted on a blockchain, showing how these two groups have fared over the last several years:

Observe! Today’s fresh-faced short-term whales sport an average entry price of a dizzying $91,900. With Bitcoin’s recent escapades, their collective mood must be positively ebullient—green as envy itself.

Alas, their joy is surely dimmed by the knowledge that the battle-scarred long-term whales loll about with a cost basis of $32,200. The spread? A staggering 185%—enough to make even the boldest gambler splutter into their absinthe.🍸

According to our analyst, this is either a sign of supreme confidence or an acute outbreak of FOMO, with investors rushing in at prices even Wilde himself might call vulgar. Contrast this with 2022, when the gap was a modest 65%—ah, the thrift of bear markets! The only thing more fickle than a crypto whale’s fortune is society’s taste in art.

So, will these freshly-minted titans keep buying up every passing Bitcoin like peacocks collecting rare jewels? Will the gap widen to some obscene bauble, à la 2021’s legendary 437%? The only certainty is that the entire business feels rather like a dinner party thrown by Wilde’s most flamboyant characters: opulent, irrational, and absolutely irresistible.

The Price Waltz

Meanwhile, Bitcoin, ever the darling of spectacle, is pirouetting around the $103,000 mark once again. The audience, as ever, is holding its breath—some for profit, others just for the drama.💃

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gold Rate Forecast

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All 6 ‘Final Destination’ Movies in Order

2025-05-10 06:17