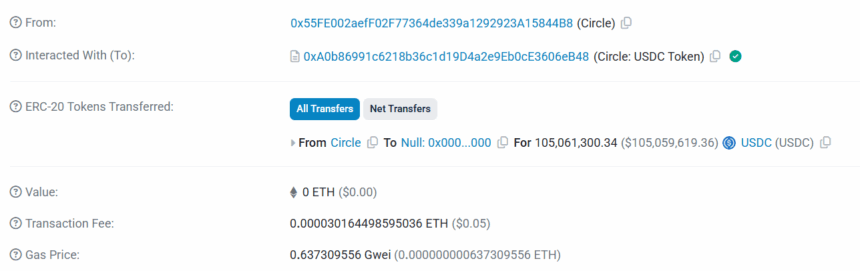

On a cool evening in the Ethereum quarter, as the sun dipped below the horizon of candlestick charts, the enigmatic financiers at Circle performed a dance so daring that even the Cat Behemoth would have applauded (if cats cared for stablecoins, which, alas, they do not). With a flick of their digital wand, 105,061,300 USDC — yes, every last digital penny, enough to buy a modest palace in Moscow or perhaps several, depending on exchange rates and Kremlin moods — was sent swirling into the cosmic abyss.

The audience? The ever-watchful eyes of Whale Alert, those tireless observers who never sleep but always tweet. The theater? Ethereum’s grand Null Address, strangely reminiscent of Moscow’s Black Gate or maybe Kyiv’s deepest Metro tunnel — a place where wallets (and sometimes souls) are sent to vanish, irretrievable as last year’s social media scandals.

Gossips and graph-watchers shuddered. What does it mean for Circle’s beloved USDC, fat as a burgher with its circulating supply of 61.57 billion tokens? Will DeFi tremble in its boots, or simply shrug and order another latte? The word on the street: liquidity could thin, trading volumes might evaporate like vodka at a writers’ gathering, and the DeFi elite may have to actually talk to each other till volumes bounce back.

Still, USDC grins like a sly bureaucrat at a bank audit — present on blockchains far and wide: Ethereum, Solana, Avalanche, Arbitrum, and goodness knows where else. Some say it even moonlights on Mars and the astral plane, though such rumors are currently unsubstantiated.

How Does a Coin Meet Its End? 💀

Ah, the oldest trick in the financial almanac: redemption. Those Circle wizards escort their USDC to a Circle Mint account (undoubtedly hidden in a smokey room behind velvet curtains). They mutter a few regulatory incantations, and out pops the eternal US dollar, whilst the hapless tokens are marched off the blockchain, never to be seen again. You might think this resembles a certain minting escapade of 250 million USDC on Solana last August, and you would be as correct as an accountant in April.

But why execute such an operatic gesture? Is it liquidity maintenance, shrewd market strategy, or appeasement of those large shadowy investors who, like Woland himself, prefer deals discreet and swift? Perhaps it’s all three, or maybe the Circle higher-ups just enjoy a little melodrama with their coffee.

As for the reserves, rest easy: BlackRock guards them tighter than a Soviet general’s vodka supply — all US dollars, all accounted for (at least, that’s the story, and they’re sticking to it with the stubbornness of a Muscovite in winter).

Read More

- Snowbreak: Containment Zone Katya – Frostcap Guide

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

- Blue Lock: Is Kaiser Yoichi Isagi’s True Rival? Explored

- Jennifer Aniston Only Agreed to ‘Friends’ Reunion After Brad Pitt’s Advice

- 30 Best Couple/Wife Swap Movies You Need to See

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Luck stat in Oblivion Remastered, explained

2025-04-30 23:37