Ah, the tale of MicroStrategy, or should I say, “Strategy” 🤔 – a company that has become the darling of the crypto world, thanks to its insatiable appetite for Bitcoin. And now, the plot thickens as the mighty BlackRock has decided to sink its claws into the company, increasing its stake to a whopping 5%! 💰

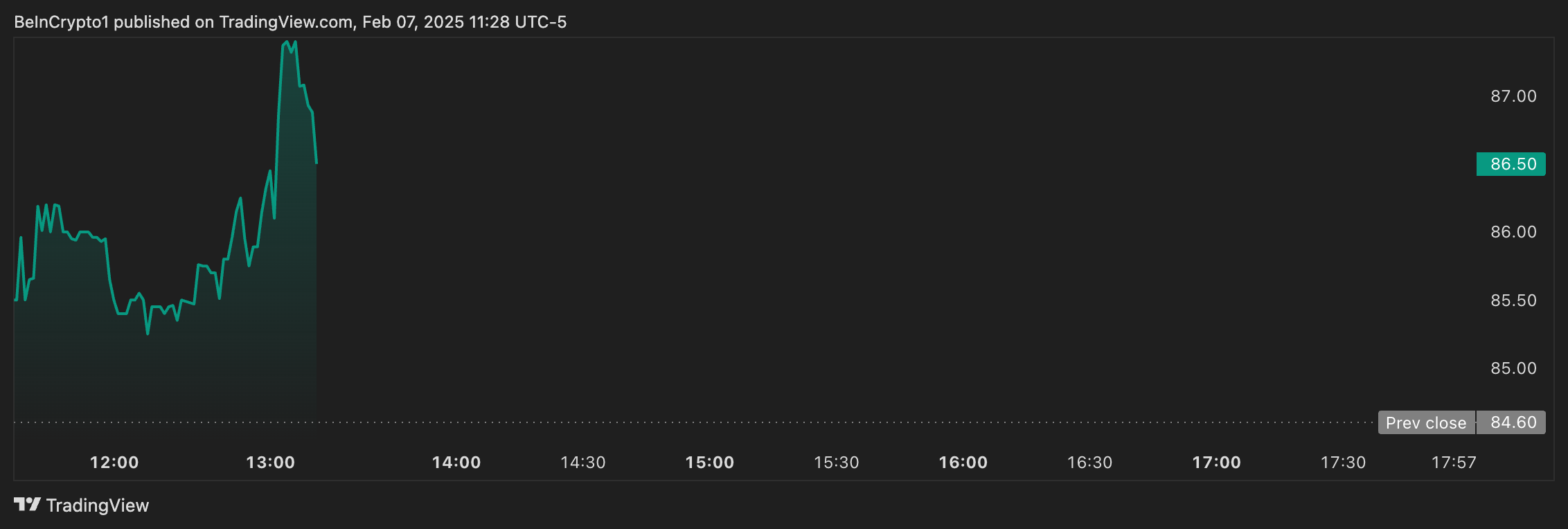

But wait, there’s more! 🤯 Strategy’s frequent Bitcoin acquisitions have made it a go-to option for institutional players seeking indirect Bitcoin investment. And let’s not forget the recent rebranding, where the company has incorporated the Bitcoin symbol into its official logo. Talk about a bold move, eh? 🤑

But hold on to your hats, folks, because the real juicy bit is the tax dilemma that Strategy is facing. Apparently, the company’s $18 billion in unrealized gains could be subject to the US corporate alternative minimum tax (CAMT), leaving them liable for billions in taxes starting in 2026. 🤯 Talk about a headache, am I right? 😂

And let’s not forget the recent slowdown in Bitcoin purchases, which may be a sign of a more conservative approach from the company. Maybe they’re finally realizing that the crypto market can be as volatile as a drunken sailor on a ship in a storm. 🤷♂️

“Last week, MicroStrategy did not sell any shares of Class A common stock under its at-the-market equity offering program, and did not purchase any Bitcoin. As of February 2, 2025, we hold 471,107 BTC acquired for ~$30.4 billion at ~$64,511 per Bitcoin,” Saylor claimed. 🤔

But fear not, dear readers, because BlackRock’s recent purchase offers some relief to Strategy as it continues to prioritize Bitcoin accumulation. 🙌 Who knows, maybe they’ll even come up with a way to dodge that pesky tax bill. 😉

An Unforeseen Tax Dilemma

Strategy recently disclosed a significant tax issue from its $47 billion ownership in Bitcoin holdings. The company’s $18 billion in unrealized gains could be subject to the US corporate alternative minimum tax (CAMT) enacted in 2022 under the Biden administration. 🤯

This tax, designed to prevent companies from minimizing taxable income, applies a 15% rate to adjusted financial statement earnings, potentially taxing gains even before assets are sold. 💸

While the Internal Revenue Service (IRS) has exempted unrealized stock gains, it has not yet extended this treatment to cryptocurrencies, leaving Strategy liable for billions in taxes starting in 2026. 🤑

BlackRock’s recent purchase offers some relief to Strategy as it continues to prioritize Bitcoin accumulation. 🙌 But who knows what other surprises are in store for this crypto-loving company. 🤷♂️

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2025-02-07 21:35