Ah, the American financial landscape, trembling beneath the thundering footsteps of titans in tailored suits—Bitcoin Spot ETFs. Once, we huddled in communal kitchens fretting over bread rations; now funds pour into digital coins with a fervor bordering on religious ecstasy. The market is “ravaged by bullish sentiment”—if only storms in Siberia could be so generous. Last week, investors, flush with hope or perhaps sleep deprivation, hurled almost $2 billion into Bitcoin ETFs. Their optimism grows fatter every day, like a commissar’s belly at the winter rations desk.

There has been a “rebound”… indeed, Bitcoin limped from $84,000 to $97,000 in just two weeks. One could almost hear the ghost of Dostoevsky muttering, “If only Raskolnikov had access to a blockchain, perhaps the pawn-broker would’ve received payment in Satoshis and lived happily ever after.” Demand for these shiny tokens just might suggest a future with less suffering—and considerably more yacht parties.

Bitcoin ETFs Enter May—The Party Hasn’t Ended Yet

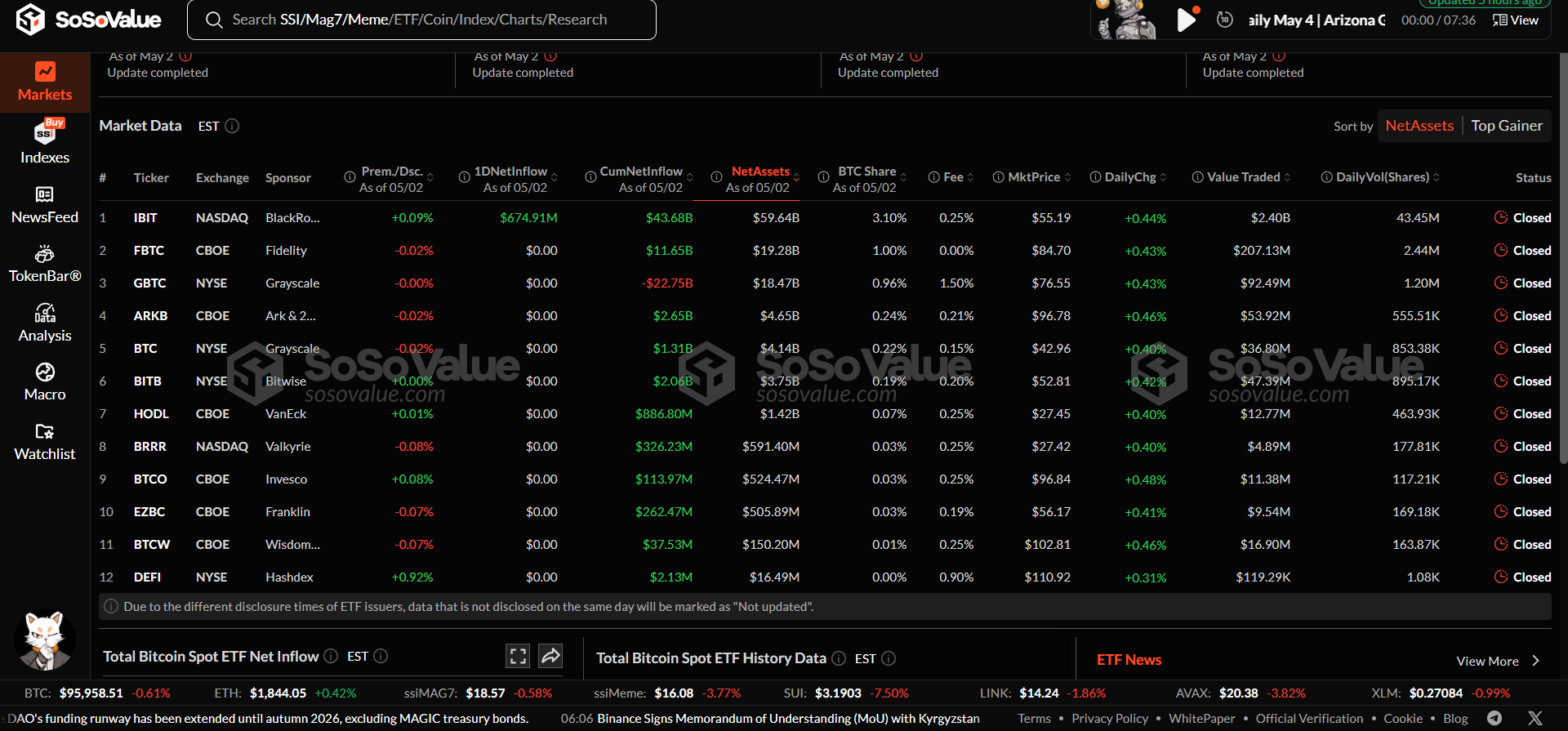

Per a source with a name to inspire great trust, “SoSoValue,” US Bitcoin Spot ETFs just scooped up $1.81 billion in net inflows as May creaked into being. The institutions weren’t mere onlookers—they were the hungry wolves. BlackRock’s IBIT gorged itself with $2.48 billion alone, earning the right to strut, chest puffed, in the snowdrift while lesser funds scavenged for leftovers. On May 2nd, IBIT took every single deposit; on Wall Street, dominance means you hold the only bowl of soup and the rest pretend they’re not hungry.

Elsewhere, Grayscale, VanEck, and Invesco managed between $10 million–$41 million—mere crumbs. Fidelity’s BTCO? It bled $201.90 million: apparently the gulag of ETFs, where enthusiasm goes to evaporate. Even Grayscale’s GBTC and Bitwise BITB lost cash, while Franklin Templeton, Wisdom Tree, Hashdex and Valkyrie didn’t see a single ruble (or dollar) move. Despite all this, the US Bitcoin Spot ETFs now boast $40.24 billion in total net inflows: proof that, unlike my fellow prisoners in the logging camp, Bitcoin bulls eat better each week. Total net assets: $113.15 billion. A modest 5.87% of Bitcoin’s market cap—a white-collar’s dream, a bureaucrat’s nightmare.

Ethereum Tries Not to Be Forgotten: $107 Million Marches In

Ethereum, not to be left behind in the snowstorm, welcomed a net $106.75 million last week, mostly courted by BlackRock’s ETHA. Together, ETH ETFs now lug about $2.51 billion in net inflows and $6.40 billion in assets. This is said to be 2.87% of Ethereum’s market cap—one wonders if, behind these numbers, an accountant quietly weeps for a lost Excel spreadsheet.

Currently? Ethereum trades at $1,845, down 0.49%—a dip that might trouble those with weak constitutions, but in the camps we learned: when you have food, you eat. Meanwhile, our beloved Bitcoin stands at $95,514, their believers staring at the screen, wondering if this is salvation, or just another circle of the financial inferno. 🚀🐻

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-05-04 17:47