Now here’s a tale for ya: BlackRock’s Bitcoin ETF just emptied its pockets faster than a Mississippi steamboat gambler on payday. Prices dipped lower than a frog’s belly, but the big city money crowd? They’re still hanging around the crypto riverboat, hoping for one last lucky hand. 🎲

BlackRock’s iShares Bitcoin Trust (IBIT)-a name fancier than a preacher’s Sunday hat-just set its own record for losing friends (and dollars) in a single day. Mark my words, if Constable Bob managed the town’s savings like this, he’d be run outta town on a rail.

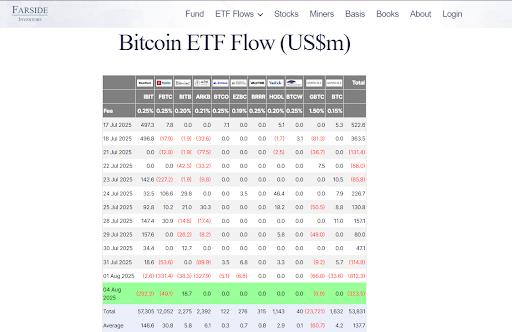

The $IBIT saw $292.5 million get up and skedaddle on Monday, right after Bitcoin stumbled over the weekend like a mule in a hailstorm, then tried to make a feeble comeback come Monday.

This latest outflow? It put the brakes on a hot streak that had BlackRock struttin’ like it owned the river. Maybe the market’s feeling tuckered out after a July that was rowdier than a Fourth of July shindig.

When the Price Goes South, So Does the Money

The timing couldn’t have been worse: as Bitcoin took a nosedive (8.5%!-that’s more than Uncle Hiram’s fall off the barn roof last spring), it dragged investor confidence through the mud. From a high of $112,300-by thunder, that’s a heap of greenbacks-Bitcoin crashed to $115,000 by the start of the week. Or maybe my spectacles are on backwards, ‘cause numbers like that make about as much sense as a screen door on a submarine.

IBIT gave up $292.5 million-the biggest exodus since May. There was a smaller stampede out on Friday, ending a 37-day winning streak. All good things must come to an end, or at least take a siesta.

BlackRock ain’t alone in the soup line: Fidelity’s Wise Origin Bitcoin Fund (FBTC) lost $40 million and Grayscale Bitcoin Trust (GBTC) watched $10 million vanish. Only Bitwise’s Bitcoin ETF (BITB) managed to look clever, picking up $18.7 million-someone found a horseshoe, I reckon.

BlackRock’s July-Richer Than Aunt Polly’s Lemonade Stand

July was still a barnburner for BlackRock. Their iShares Bitcoin Trust hauled in $5.2 billion in new money that month, which means folks brought their nickels and dimes in wheelbarrows-9% of the fund’s total haul, all since last year. I’ve seen less action at the county fair pie-eating contest.

The fund’s holding more than 700,000 BTC-that’s a pile big enough to buy out the whole Territory. Even if the river’s low this week, the big players keep coming back for more. Guess you can’t keep a good gambler down.

Digital Assets Are Faster Than a Greased Pig

Don’t go thinking this is the end for digital assets-no sir! Digital coinage is growin’ so fast it makes the old stocks and bonds look like buggy whips at the Kentucky Derby.

According to this city slicker, Bloomberg’s ETF tinker Eric Balchunas, digital assets and their hedge fund cousins are running laps around private equity and private credit. Those poor suckers are slowing down, probably just catching their breath.

Even JPMorgan’s Nikolaos Panigirtzoglou-try saying that three times with a mouthful of grits-says investors are stampeding toward digital assets. By late July, this segment bagged $60 billion and looks hungry for a rematch with last year’s $85 billion record. Someone ring the dinner bell!

JUST IN: Donald Trump says “we’re embracing the future with crypto and leaving the slow and outdated big banks behind.” 🤠

– Bitcoin Magazine (@BitcoinMagazine)

Bitcoin ETFs: Now With Less Heartburn!

Now here’s a humdinger: since spot Bitcoin ETFs came on the scene, volatility’s dropped faster than a sack of potatoes off a hay wagon. IBIT’s 90-day rolling volatility is below 40 for the first time ever. When this rodeo started, it was tearing through folks at 60-enough to make a fella lose his biscuits.

Less wild swings, less “hold onto your hat” investing. Balchunas calls it “fewer vomit-inducing drawdowns.” (Now there’s a sales pitch for Wall Street: “Buy Bitcoin-Just a Little Less Likely to Make Ya Sick!”) And with a steadier market, the big investors are wading in deeper than a boy at a swimming hole.

If this keeps up, Bitcoin could finally mosey up from “wild-eyed speculation” to “actual money.” Imagine walking into the general store and paying for a barrel of molasses with Bitcoin-well, stranger things have happened on the Mississippi.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-05 20:54