The ‘Magnificent Seven’ refers to the seven most powerful and successful technology companies globally.

Over the last ten years, I’ve witnessed these giants – Google (GOOGL, GOOG), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – consistently outperform the market. A significant reason for their success is that they are at the helm of groundbreaking technology trends that are reshaping history as we know it.

Among the impressive seven corporations, a single stock from The Magnificent Seven catches attention because of its leading market position, its involvement in several key trends, and a favorable price compared to similar companies.

That stock is Alphabet.

An unconventional company

As an observer, I find Alphabet standing out from the rest of the Magnificous Seven. Uniquely, Alphabet is listed under not one but two stock tickers: GOOG and GOOGL.

Why would Alphabet do that? A little history will provide some helpful context.

Back in the year of 1998, my buddies Larry Page and Sergey Brin brought Google (the precursor to Alphabet) to life. When we submitted our Initial Public Offering documents in 2004, I penned a letter to potential shareholders stating, “Google is not your typical corporation; we don’t aspire to be one.” We were, and still are, all about breaking the mold!

In the very same correspondence, Page expressed concerns that transitioning into a publicly traded entity might compromise the autonomy and innovative mindset that played significant roles in Google’s triumph. Moreover, he emphasized that the company would not shy from venturing into ambitious projects with substantial rewards, despite any financial targets set for specific quarters.

Google established a two-tiered share system (dual-class stock structure) to preserve control for Page, Brin, and other key executives, allowing them to dictate the company’s destiny and decision-making processes.

It’s all about insider control

Shares of common stock signify a portion of the ownership in a corporation, granting the holder various decision-making privileges like deciding on matters like executive pay, selection of board members, and whether to approve mergers or acquisitions. In August 2004, when Google first began trading publicly, it adopted a dual class system to centralize approximately 99% of the voting authority in the hands of its creators, executives, and board members by this method:

1. By issuing two types of shares – common stock (with limited voting rights) and Class C shares (holding most of the voting power).

2. Google’s founders, executives, and board members were primarily issued Class C shares, giving them the majority control over the company.

- Each share of Class A common stock (available to regular investors) came with one vote.

- Each share of Class B common stock (held by founders and insiders) came with 10 votes.

In that period, Google, through Page, admitted this was an unusual step for a tech firm, yet it wasn’t rare in other business sectors. Berkshire Hathaway serves as the prime illustration of this. Over the years following Google’s 2004 IPO, several tech companies have implemented dual class structures to preserve control among insiders, with Meta Platforms, Palantir, and Roblox being some notable examples.

This is where it gets a little confusing

In April 2014, Google made its share structure more intricate through a 2-for-1 stock dividend.

On the 2nd of April, 2014, I found a bonus share of Google’s Class C stock in my portfolio for each share of Class A stock I previously held as a shareholder.

Starting on April 3, 2014, two classes of Google stock were available to the public:

- Class A shares (GOOGL): One vote per share

- Class C shares (GOOG): No voting power

It’s essential to understand that Class C shares, unlike others, do not grant voting rights. This was the primary reason behind the 2014 stock split. By distributing nonvoting Class C shares, Google could finance acquisitions and provide stock-based rewards and incentives without reducing the executive team’s voting power.

To recap, this is the share structure that exists today:

- Class A shares (GOOGL): One vote per share

- Class B shares (held by insiders): 10 votes per share

- Class C shares (GOOG): No voting power

Should you buy GOOG or GOOGL?

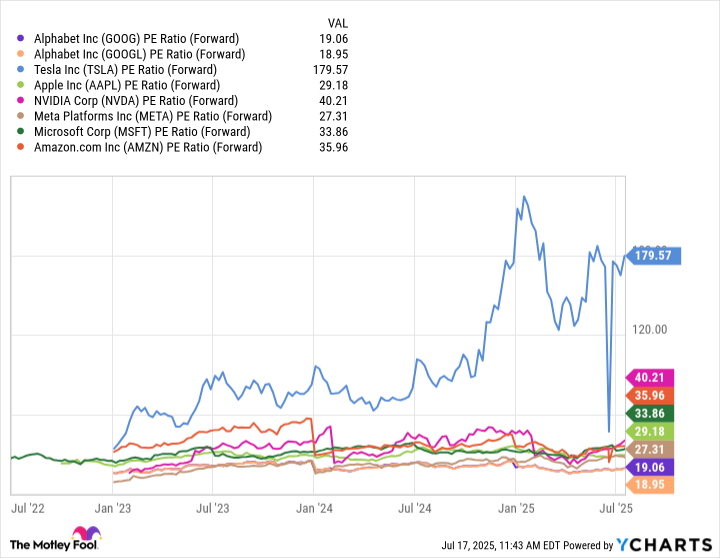

Today, you should know that Google, the search engine we’re familiar with, is simply one aspect of Alphabet Inc., a broader company established in 2015. The allure of investing in Alphabet extends beyond its role as a search-engine provider. By owning Alphabet, you effectively invest in a portfolio similar to an Exchange Traded Fund (ETF), gaining exposure to key tech sectors such as cloud computing, artificial intelligence, autonomous vehicles, cybersecurity, and streaming. Additionally, it’s worth noting that Alphabet trades at a lower price compared to its six major competitors when considering their forward price-to-earnings (P/E) ratios, as I mentioned earlier.

But there’s still one question left to answer: Is GOOG or GOOGL the better investment?

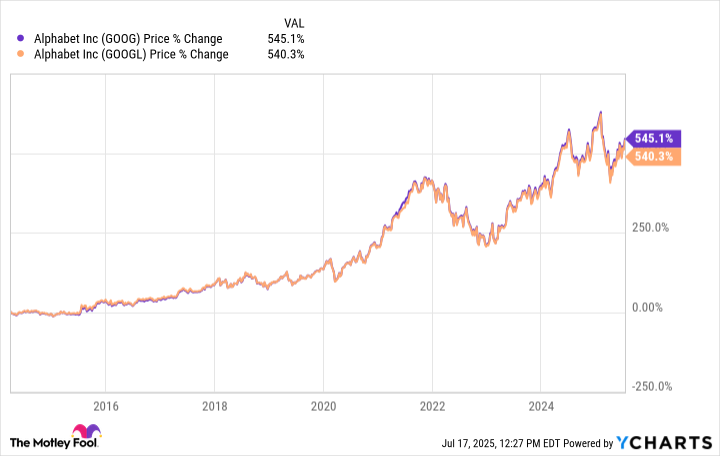

One might expect Google (GOOGL), being the class with voting rights, to trade at a higher price compared to its non-voting counterpart, Google Class C (GOOG). However, surprisingly, GOOG has outperformed GOOGL slightly since April 3, 2014.

As of July 16, the share price of GOOG was $183.77, while that of GOOGL was $182.97. In light of recent market activity, you might consider this interpretation: GOOGL offers the same exposure to Alphabet’s collection of businesses, but at a slightly lower cost, with the additional advantage of voting rights.

In essence, everyday investors typically don’t own enough shares to significantly influence a company’s strategic decisions through their votes due to share distribution. Moreover, since both tickers symbolize the same underlying asset, there’s unlikely to be significant price differences between them. Therefore, if you’re not particularly concerned with voting rights, either ticker is an excellent choice for investing in this exceptional pick from The Magnificent Seven.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 04:25