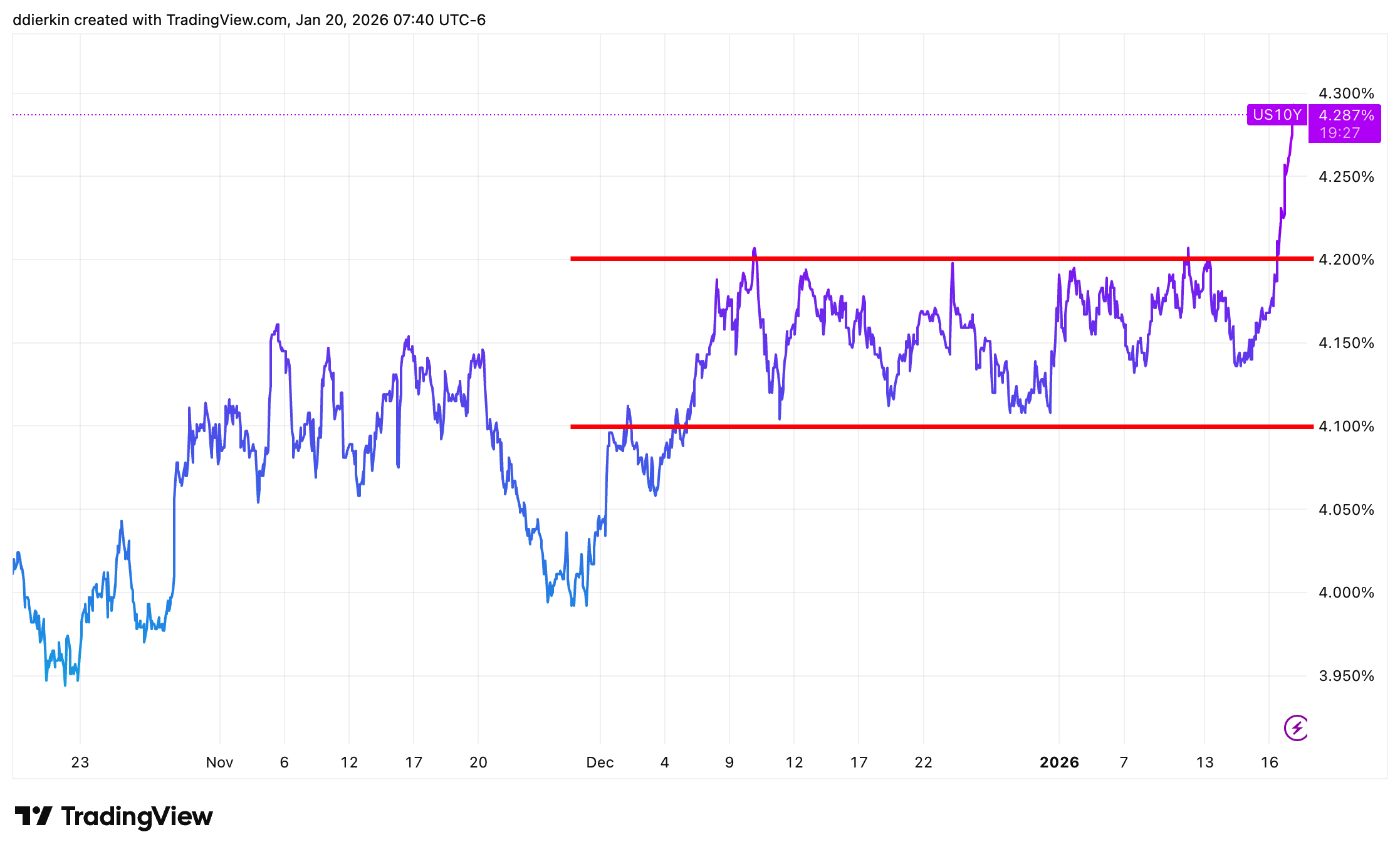

For weeks now, the ten-year U.S. Treasury yield has been doing…well, not a great deal, to be honest. It’s been bobbing about in a rather narrow range, between 4.1% and 4.2%, which is about as exciting as watching paint dry, though slightly less messy. People haven’t been rushing to it as a safe haven – gold‘s been getting all the attention there – and it hasn’t exactly been plummeting as stocks have merrily climbed to record highs. It’s been…present. Which, for a financial instrument, is often the best you can hope for.

But this past week, something happened. It moved. Not dramatically, mind you – we’re not talking about a seismic shift – but it did, undeniably, tick upwards.

Within a couple of trading days, it nudged its way from around 4.15% to a high of 4.31%. That’s the highest it’s been since August 2025 – which, if you’re keeping track, is a surprisingly long time ago, considering how quickly things tend to happen these days. It feels like only yesterday we were all worried about Y2K, and now here we are.

The generally accepted explanation, and it’s a bit of a doozy, involves geopolitics. Specifically, President Trump’s continued musings about acquiring Greenland. It’s a fascinating idea, really, though one that seems to ruffle feathers amongst our transatlantic allies. Every time this comes up, it threatens to upset the delicate balance of international relations. And, in this instance, it’s led to threats of increased tariffs on European nations, who are, understandably, reconsidering their trade relationships and exposure to dollar-denominated assets.

Now, tariffs are a funny thing. They generally lead to higher inflation, which, in turn, can push interest rates upwards. It’s a fairly straightforward equation, really. Though, as anyone who’s ever attempted to balance a checkbook can attest, straightforward equations don’t always work out as planned.

There’s also the possibility, and this is where things get a bit more speculative, that foreign nations might decide to offload some of their U.S. asset holdings, like Treasuries. A sudden flood of supply onto the market could force interest rates higher, just to entice buyers. It’s a bit like trying to sell slightly stale cookies – you have to lower the price to get rid of them.

In either case, higher interest rates are, logically, a response to the political shenanigans we’ve seen recently. The thing is, these threats are often short-lived. They tend to be blustered and then quickly de-escalated. So, yields could drift lower again. Which, in the short term, might make U.S. Treasuries a reasonable buy. Though, honestly, with so many moving parts, the more prudent course of action is probably to brace yourself for a bit more bond market volatility. It’s rarely dull, is it? And, if nothing else, it gives us something to talk about.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 10:02