Some among us build with brick and timber, laying foundations that weather the years, promising a steady hand to those who seek shelter in their rents. Realty Income, they call themselves, and they speak plainly of dependable monthly dividends. A promise, solid as the walls they raise.

AGNC Investment, however, speaks a different tongue. They offer “favorable long-term returns,” a phrase polished smooth, lacking the grit of a direct pledge. It’s a difference, small perhaps, but like the shift in the wind before a storm, it speaks to a different way of building, a different kind of promise kept.

The Land and the Ledger

Realty Income, they are of the land. They acquire properties, real and tangible, and from those holdings, they draw a current, a flow of income born of necessity. It’s a system as old as tenancy, a simple exchange. They operate on a scale that dwarfs most, a sprawling empire of roofs and walls across this country and beyond. They’ve even branded their consistency, calling themselves “The Monthly Dividend Company”—a name earned, not given.

For thirty years, they’ve raised their dividend, a steady climb mirroring the growth of their holdings. For those who seek a reliable current, a stream to sustain them through lean times, it is a beacon worth considering, yielding a respectable 5.3% at present.

AGNC, on the other hand, offers a different lure – a yield of 12.2%, more than double Realty Income’s. A tempting figure, certainly. It glitters, promising quick returns. But a wise man knows that what glitters isn’t always gold, and sometimes, it’s merely a reflection of risk.

For AGNC doesn’t build with brick and timber. They deal in ledgers, in the unseen currents of mortgage-backed securities. They are not landowners, but money lenders, navigating the complex waters of debt.

The Shifting Sands of Return

AGNC manages a portfolio of these securities, bonds built on the promises of others. It’s akin to running a mutual fund, a constant shuffling of assets, a search for the highest yield. They even report a “tangible book value,” a measure of their holdings, a way to gauge their worth.

They are always managing, always shifting, seeking to maximize return. A property owner, too, manages, but their holdings are fixed, rooted in the earth. They are held for generations, while these securities are bought and sold with the turning of the market. There is a difference between tending a garden and chasing the wind.

A property demands daily care, maintenance, a constant tending. These securities, however, simply pass on the payments of others, a passive flow. There’s no need to “operate” anything, only to collect. And perhaps most importantly, AGNC’s focus on total return requires the reinvestment of dividends. A boon for some, a hardship for others. For those who rely on that current to sustain them, it’s a precarious arrangement.

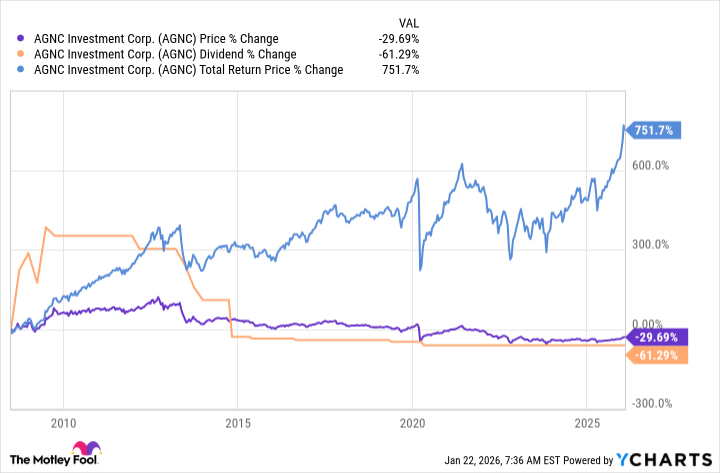

The chart speaks for itself. AGNC has achieved its goal of total return, surpassing even the S&P 500. But look closer. The dividend hasn’t grown steadily. It has fluctuated, dipped, and waned. It’s a restless sea, not a calm river. And with the dividend has gone the stock price, a slow decline mirroring the ebb and flow of the market.

Know What You Sow

AGNC is a well-run operation, rewarding those who have reinvested their dividends, chasing a higher total return. But for those who relied on that current to meet their needs, it has been a lean harvest. They have received less income, less capital, and a growing sense of unease.

If you seek total return, if you are willing to gamble on the shifting sands of the market, AGNC is worth a closer look. But if you seek a reliable current, a steady income to sustain you through the years, look to a property-owning REIT like Realty Income. You may have to forgo some yield, but you will likely sleep sounder at night, knowing your foundations are solid.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

2026-01-25 14:53