Experienced investors, those who’ve seen a thing or two, know a trap when they see one. It’s like a particularly alluring puddle – looks inviting, but is almost certainly full of things you’d rather not step in. High dividend yields can be just like that. Too good to be true usually is, and in the world of finance, that’s a rule carved in granite. Which brings us to the YieldMax MSTR Option Income Strategy ETF (MSTY +0.68%). It’s a bit of a mouthful, isn’t it? And, as it turns out, a bit of a puzzle.

This ETF, in essence, is an attempt to wring income out of Strategy (MSTR +0.62%), the company that holds a truly astonishing amount of Bitcoin. Now, Bitcoin and Strategy don’t exactly hand out dividends. They don’t, in fact, hand out anything resembling regular income. So someone, quite understandably, thought, “Let’s create something that does.” The result is this ETF, currently sporting a distribution rate of 75.1% (as of January 21st). It’s become rather popular, holding $1.44 billion in assets – making it the fourth-largest single-stock ETF, which is, frankly, a bit startling.

Now, before we get carried away with the promise of generous payouts, a word of caution. A strong case can be made that this ETF isn’t for everyone – even those of us who quite like a bit of income. It’s not necessarily bad, just… complicated. Like trying to assemble flat-pack furniture with only a teaspoon and a vague sense of optimism. The “plumbing,” as they say in the business, is a little… idiosyncratic.

A Risky Income ETF

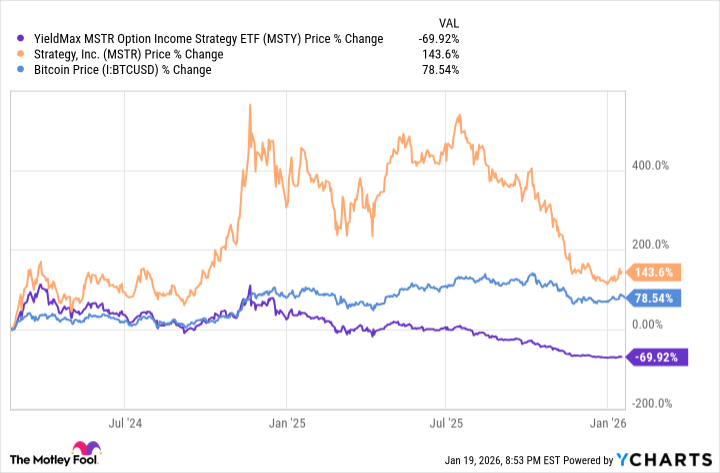

You spend enough time poking around in ETFs, and you start hearing certain phrases repeated. “Under the hood,” “methodology matters,” the usual suspects. They’re overused, certainly, but in this case, they’re actually quite relevant. This ETF isn’t just handing out money; it’s making money in a rather specific way. It’s a covered call product, which means it’s selling options on shares of Strategy. Think of it as a slightly elaborate game of financial Jenga. The trade-off? Your potential upside is capped. The ETF’s issuer is remarkably upfront about this. Limited upside explains why it hasn’t kept pace with Bitcoin and Strategy’s recent appreciation. It’s not that it’s lost money, it just hasn’t… soared.

But that’s not the whole story. Perhaps even more critical is the fact that Strategy doesn’t pay dividends in the traditional sense. It doesn’t send out checks or direct deposits. It delivers… distributions. There’s a difference. Dividends come from company profits – actual earnings. Distributions are a return of capital (ROC), essentially giving you back the money you invested. And a surprisingly large portion of this ETF’s most recent distribution – 94.7%, to be precise – was ROC. For every dollar you put in, you were getting 94.7 cents back. It’s like going to a bakery and ordering a cake, only to discover it’s mostly packaging.

No Free Lunches Here

The biggest issue isn’t the difference between dividends and distributions, but the tax implications. Qualified dividends are taxed at a reasonable rate – up to 20%. But the premiums collected by this ETF can be taxed at as much as 37%. From a tax perspective, many investors are better off sticking with traditional dividend stocks. It’s a bit like choosing between a reasonably priced sandwich and a gilded lobster – both fill you up, but one comes with a hefty surcharge. And if that doesn’t deter you, consider the net asset value (NAV) erosion. Because the ETF is returning so much of your capital, its NAV slowly grinds lower over time. Not only does that cap your upside, but it can also lead to unpleasant scenarios, like reverse splits. Large yield or not, this ETF’s cons may outweigh its pros for many investors. It’s a curious case, isn’t it? A bit like a financial riddle wrapped in a mystery, inside an enigma.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Hulk Hogan Dead at 71: Wrestling Legend and Cultural Icon Passes Away

2026-01-28 07:32