The market, a fickle beast, has once again cast its shadow upon General Mills (GIS 0.40%) and Campbell’s (CPB 0.48%). A seven percent drop for GIS following a revised forecast—a mere tremor, some would say. But tremors often precede the collapse of poorly constructed things. They speak of foundations weakened by ambition and a disconnect from the simple needs of those who fill the bowls and spread the soup.

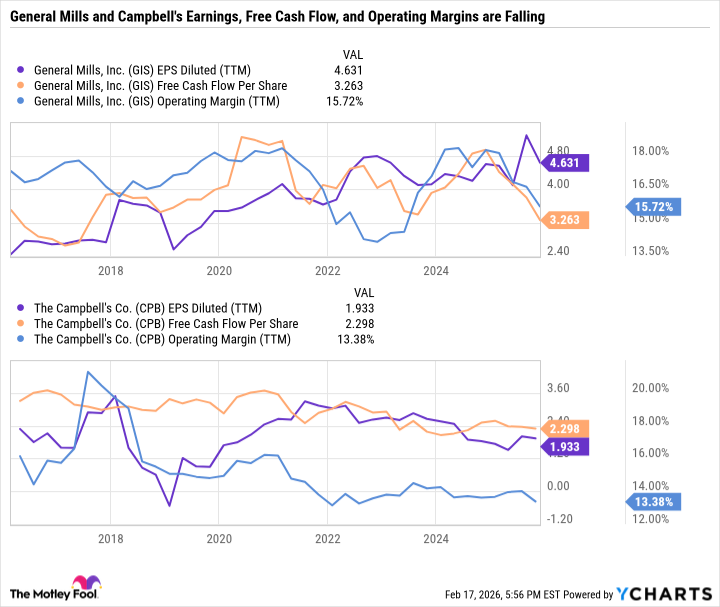

The numbers, as always, tell a story. Organic sales, a slight decline. Earnings, a steeper fall. The suits will wring their hands, speak of headwinds and consumer sentiment. But what they fail to grasp is the weight of empty pockets. When a man has little, he doesn’t seek novelty; he seeks sustenance. And when the price of sustenance rises, he simply eats less.

Both companies, once titans of the pantry, now linger near lows unseen for years. A humbling sight, even for a cynic. To see empires chipped away, not by grand battles, but by the quiet erosion of trust and affordability. They are down more than half from their former glory. A fall from grace, measured not in moral failings, but in the dwindling contents of the shopping basket.

The Slow Grind of the Mill

The entire sector suffered last year, a collective slump. But packaged foods felt it particularly keenly. It is a grim truth: the appetite for convenience wanes when the stomach remains unsatisfied. These companies, once masters of filling that need, are now grappling with a change in taste – a desire not just for filling, but for nourishment.

The pronouncements from GIS speak of “weak consumer sentiment” and “volatility.” Fine words, masking a simpler truth: people are tightening their belts. They are questioning the value of brightly colored boxes and clever marketing when a loaf of bread and a pot of soup offer more substantial comfort. The market is a harsh teacher, and these companies are receiving a particularly brutal lesson.

GIS boasts Cheerios and Cinnamon Toast Crunch, Chex Mix, Betty Crocker, and even the pretense of health with Blue Buffalo. Campbell’s offers Goldfish and Pepperidge Farm, alongside the comforting weight of soup. They are not without their strengths. But strength alone is not enough when the foundations are crumbling.

They are better positioned than some, certainly, than those peddling ultra-processed fare from Kraft Heinz and Conagra Brands. But even a slightly less poisoned offering does not guarantee survival when the well runs dry.

Both are squeezing for efficiency, a predictable response. Cost-cutting is the language of desperation. It’s a game of diminishing returns, a frantic attempt to maintain the illusion of growth while the underlying problems fester. They promise savings, but savings alone cannot conjure demand.

A Dividend as a Bandage

GIS boasts a long history of dividends, 127 years of uninterrupted payouts. A respectable feat, certainly. But a dividend is merely a return of capital, a sharing of the spoils. It does not create wealth; it merely distributes it. And when the well runs dry, even the most generous dividend feels like a cruel mockery.

Campbell’s record is less impressive, a cut in 2001 followed by a slow recovery. A more honest reflection of the times, perhaps. Acknowledging the ebb and flow of fortune, the inevitable cycles of boom and bust.

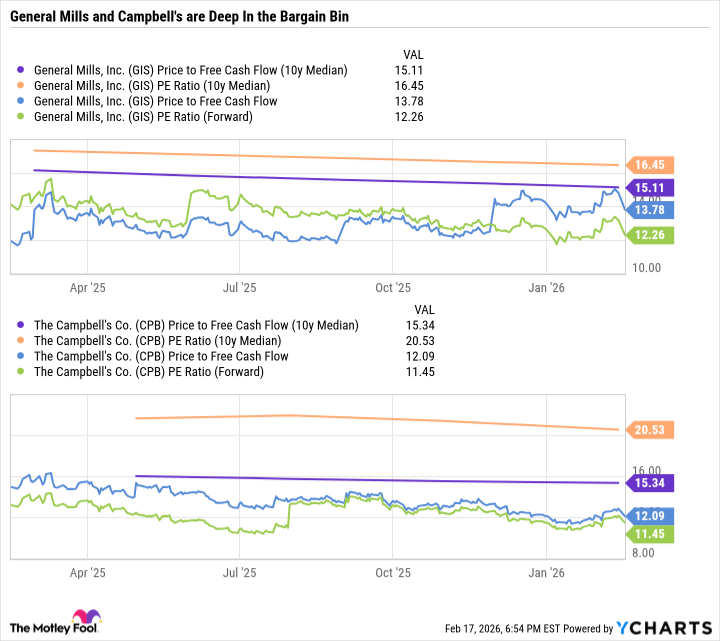

The current yields – 5.4% for GIS, 5.6% for CPB – are attractive, certainly. A lure for those seeking income in a world of low interest rates. But remember this: a high yield is often a sign of distress, a warning that the underlying asset is weakening.

GIS claims it can still cover its dividend with free cash flow. Campbell’s makes similar assurances. But free cash flow is a slippery thing, easily eroded by unforeseen circumstances. And in these uncertain times, unforeseen circumstances are the only certainty.

Both companies are trading at discounts to their historical valuations. A tempting proposition for the value investor. But remember this: a cheap stock is not necessarily a good stock. Sometimes, it is simply a stock that deserves to be cheap.

A Patient Man’s Game

GIS and CPB are not glamorous investments. They are not the companies that will disrupt industries or change the world. They are simply companies that provide basic necessities. And in a world of constant change, there is a certain appeal to that. A quiet resilience, a stubborn refusal to be swept away by the tide.

For the long-term investor, the focus should be on durability, reliability, and affordability. On companies that can weather the storms and emerge stronger on the other side. GIS and CPB check those boxes. They are not perfect, but they are arguably the best options in a rather bleak landscape.

A patient man’s game, this. A waiting game. But sometimes, the greatest rewards come to those who are willing to wait.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-22 12:13