The current enthusiasm for real estate as an income generator is, shall we say, predictable. The MSCI US IMI Real Estate 25/50 Index currently yields 3.72%, a figure which, while not precisely dazzling, is at least three times the lamentable return offered by the broader S&P 500. One observes a desperate grasping for yield in these times, a symptom of a market starved of genuine return.

The Invesco KBW Premium Yield Equity REIT ETF (KBWY 1.36%), with its stout 7.72% SEC yield as of January 15th – and the vulgar convenience of monthly payouts – has naturally attracted attention. However, to suggest this is a reason to buy in 2026 is to mistake a palliative for a cure. One must examine the underlying patient with a degree of skepticism.

The yield is, admittedly, appealing. But sentimentality rarely translates into profit. Fortunately, a few fundamental factors offer a glimmer of… not exactly hope, perhaps a delaying of the inevitable.

A Bullish Setup, or a Last Hurrah?

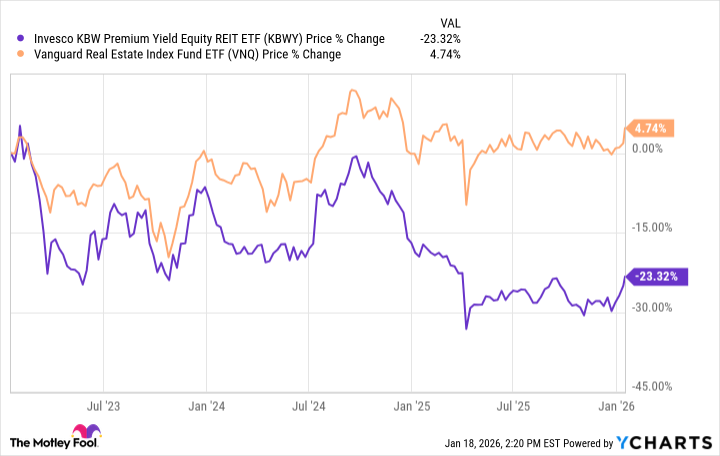

The past three years have been unkind to this particular fund, leaving it trailing in the wake of larger, more robust competitors. But history, as they say, is a foreign country. And one is often presented with opportunities in the ruins of past failures.

The dividends, naturally, are a draw. Seventy-three U.S.-based REITs raised payouts last year, including eleven just last month. Some of these benefactors find their way into the ETF’s holdings of thirty-one companies. A rising tide, one supposes, though it rarely lifts all boats equally.

Strong balance sheets and solid Funds From Operations (FFO) trajectories are cited as support. FFO, for the uninitiated, is the metric by which one judges the operating performance of these landlords. Nearly two-thirds of REITs reported year-over-year FFO growth in 2025. A comforting statistic, though one suspects the numbers are massaged with the usual degree of optimism.

There is also the suggestion that real estate is one of the few sectors currently undervalued. A claim made with tiresome regularity, and rarely borne out by events. The ETF’s holdings, such as Americold Realty Trust and Healthpeak Properties – the latter being the fifth-largest – are presented as examples. One notes the distinct lack of truly compelling value propositions.

Small Stocks, Large Risks

Most real estate ETFs favor large-cap stocks. The Invesco yield fund, tracking the KBW Nasdaq Premium Yield Equity REIT Index, takes a different tack. The average market capitalization of its holdings is a modest $2.46 billion, indicating a preference for smaller companies.

This allows the fund to be paired with broader small-cap funds, which, one notes, rarely offer a comparable yield. The Russell 2000 Index barely yields 1%. A difference, certainly, but one achieved by taking on a significantly higher degree of risk.

Smaller stocks are, apparently, resurgent. And there is a belief that this rally could prove durable, thanks to widening market breadth and declining interest rates. Lower rates, of course, benefit those who have borrowed extensively. A dubious advantage, and one that rarely lasts. If the Federal Reserve continues its easing campaign, this high-yield REIT fund could benefit. The annual expense ratio is a modest 0.35%, or $35 on a $10,000 position. A pittance, really, in the grand scheme of things.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 01:35