Right. So, the economy. Honestly, it’s all a bit… much. Everyone keeps saying things are ‘okay-ish,’ which, let’s be real, is never a good sign. GDP’s up, unemployment’s… not terrible. Inflation’s come down a bit, but still hovering like a slightly judgmental aunt at a party. It’s all very… precarious. Like balancing a stack of cookbooks while wearing roller skates.

I’ve been trying to be optimistic, you know? I even downloaded a mindfulness app. But then I started looking at the numbers, and… well, let’s just say my inner calm has taken a vacation. Job openings are down, government debt is up (shocking, I know), and everyone seems to be maxed out on credit cards. It’s like we’re all living on borrowed time… and borrowed money.

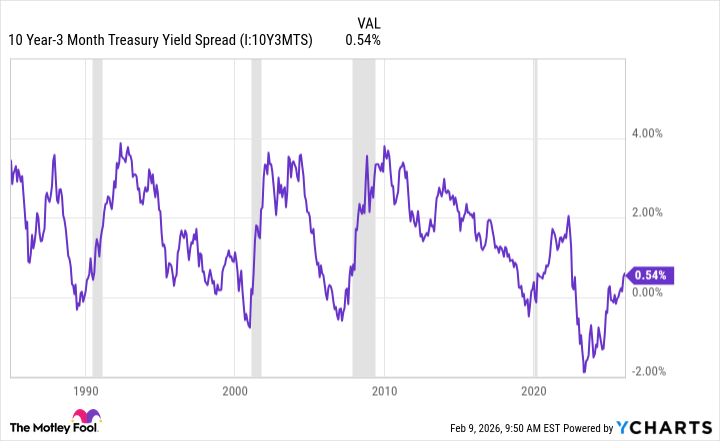

And then there’s this thing. This… yield curve. Apparently, it’s a bit of a leading indicator. Which is a fancy way of saying it can tell us if we’re about to plummet into a recession. Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24.

The Yield Curve & My Increasing Anxiety

Apparently, it’s all about the difference between long-term and short-term Treasury yields. The long-term ones reflect what the market thinks about the future (which, let’s be honest, isn’t usually great). The short-term ones are tied to the Federal Reserve’s interest rates. When the short-term rates are higher than the long-term ones (an ‘inverted’ curve), it usually means trouble. Like a bad omen. Or a really awkward date.

Historically, this inversion has been a pretty reliable predictor of recessions. It’s like the economy is saying, “Hey, things look dodgy, I’m bracing for impact.” And now, the curve has flipped back to positive. Which, according to the experts, means the recession clock is ticking. It’s all very dramatic. I’m starting to think I need a stronger cup of tea.

It’s happened before, apparently. For the last four recessions, this yield curve thing has flashed a warning sign just before things went south. So, it’s not exactly a surprise. It’s just… unsettling. Like knowing your washing machine is about to break down. You can feel it.

Will become disciplined long-term investor: 0%. Current level of financial panic: 8/10.

Does this mean a recession is imminent? Not necessarily. Sometimes it takes a while. Back in 1991, it took over a year. But the S&P 500 tends to take a tumble first. Which, incidentally, is where my savings are currently residing, looking increasingly vulnerable. It’s like watching a small child walk towards a cliff edge. You want to shout a warning, but you’re not entirely sure what to say.

And the labor market? It’s… stagnant. Consumer spending is about maxed out. If people start cutting back, that’s a pretty clear sign of trouble. And if the government tries to ‘spend its way out’ of a recession… well, that just creates a whole new set of problems. It’s a lose-lose situation, really. A bit like trying to find a parking space in the city center on a Saturday afternoon.

So, yeah. I’m officially on recession watch. This yield curve thing is a bit of a warning sign, and the numbers aren’t exactly encouraging. I’m not saying we’re doomed, but… let’s just say I’m starting to think about investing in canned goods. And maybe a good therapist.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Games That Faced Bans in Countries Over Political Themes

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- Most Famous Richards in the World

2026-02-14 18:32