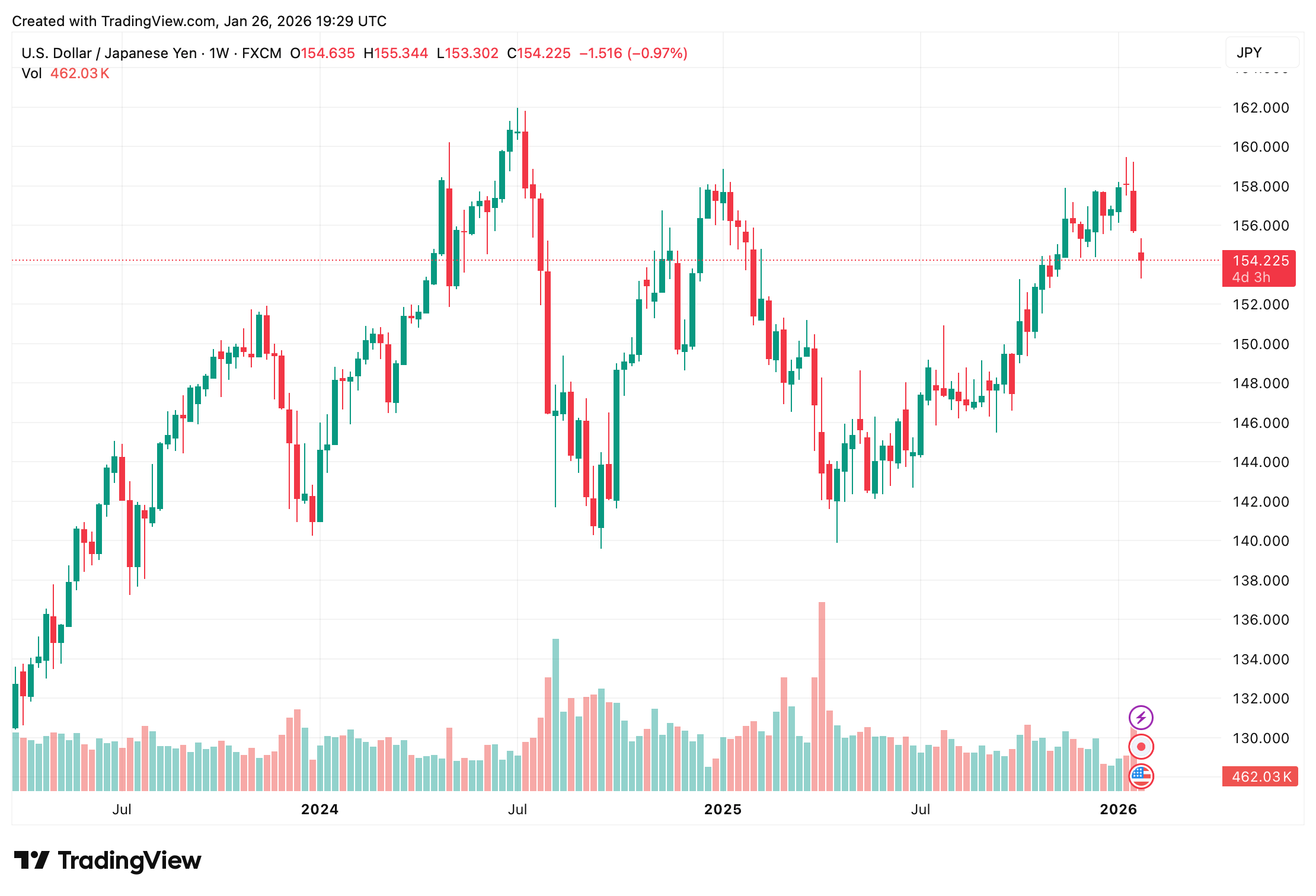

Well, bless my stars and stripes, if it ain’t a Monday on Wall Street-a day so dull you could hear a pin drop, and yet the precious metals were shinier than a politician’s promise. Meanwhile, the Japanese yen decided to do a little jig against the U.S. dollar, as if it had just discovered it was the belle of the currency ball. Seems the market got wind of some highfalutin’ chatter about central bankers playing sheriff in the Wild West of forex.

Currency Shenanigans: Why the Yen’s Got Traders Sweating Like a Sinner in Church

Now, the yen’s sudden spurt wasn’t just a fluke of nature-oh no, it was cooked up by a couple of clever schemes from them bigwigs at the central banks. First off, the New York Federal Reserve-those crafty Yankees-decided to play post office with the banks, checking rates like they were shopping for a Sunday hat. This little maneuver is the financial equivalent of a sheriff tipping his hat before he shoots-a sign that intervention might be a-comin’.

You see, when these fellas start poking around for liquidity, traders get the jitters worse than a cat in a room full of rocking chairs. They figure the big boys are fixin’ to step in and set things straight. And sure enough, the markets took it as a gospel truth that the yen was about to get itself a bodyguard.

Then there’s the Bank of Japan (BOJ), sittin’ pretty with its 0.75% rate, sayin’ it’ll keep the punch bowl out “for the time being.” Well, shucks, that’s about as clear as mud, but it was enough to send the yen soaring like a bald eagle on the Fourth of July.

Now, all this hoopla sent the Japanese government bond (JGB) market into a tizzy, with prices climbing like a squirrel up a tree and yields dropping faster than a politician’s approval rating. The mechanics were simple enough: yields fell across the board, like dominoes after a toddler’s tantrum. This came after a week so choppy, it made a sailor’s sea legs look steady.

Some folks are sayin’ the BOJ’s yield curve control is about as useful as a screen door on a submarine. Metals and Miners YT podcast fella, Gary Bohm, reckons the BOJ’s gotta rethink its whole game plan. “To save the yen and their bond market,” he drawled, “them Japanese institutions gotta bring their money home faster than a hound dog after a rabbit. Sell them foreign treasures and buy up them JGBs like they’re going out of style.”

And what’s the biggest treasure they’ve got stashed abroad? Why, U.S. Treasury bonds, of course-over $1.1 trillion worth. That’s more than a hillbilly’s stash of moonshine.

“Japan’s the biggest foreign holder of U.S. debt, and now they’re fixin’ to cash in their chips,” Bohm added, with a wink.

So, here we are, with the yen climbing like a mountain goat and the bond market doing the jitterbug. The BOJ’s under the gun, global rates are all over the map, and the currency and bond markets are tangled up tighter than a knot in a fisherman’s net. For now, it’s the central bankers holding the reins, and they’re riding this bronco like they own it.

FAQ 🇯🇵

- Why’d the yen get all frisky against the dollar?

Well, seems the market got wind of some intervention whispers and figured the yen was about to get itself a bodyguard. - What’s the New York Fed been up to?

They’ve been playin’ post office with the banks, checkin’ rates like they’re shoppin’ for a Sunday hat-a sure sign they’re fixin’ to step in. - What’s the BOJ’s angle?

They’re keepin’ rates steady and the punch bowl out, sayin’ it’s business as usual-for now. - Why’s everyone yakkin’ about Japanese bonds?

’Cause they’re climbin’ like a squirrel up a tree, and folks figure the money’s comin’ home to roost.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- All weapons in Wuchang Fallen Feathers

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-01-27 00:57