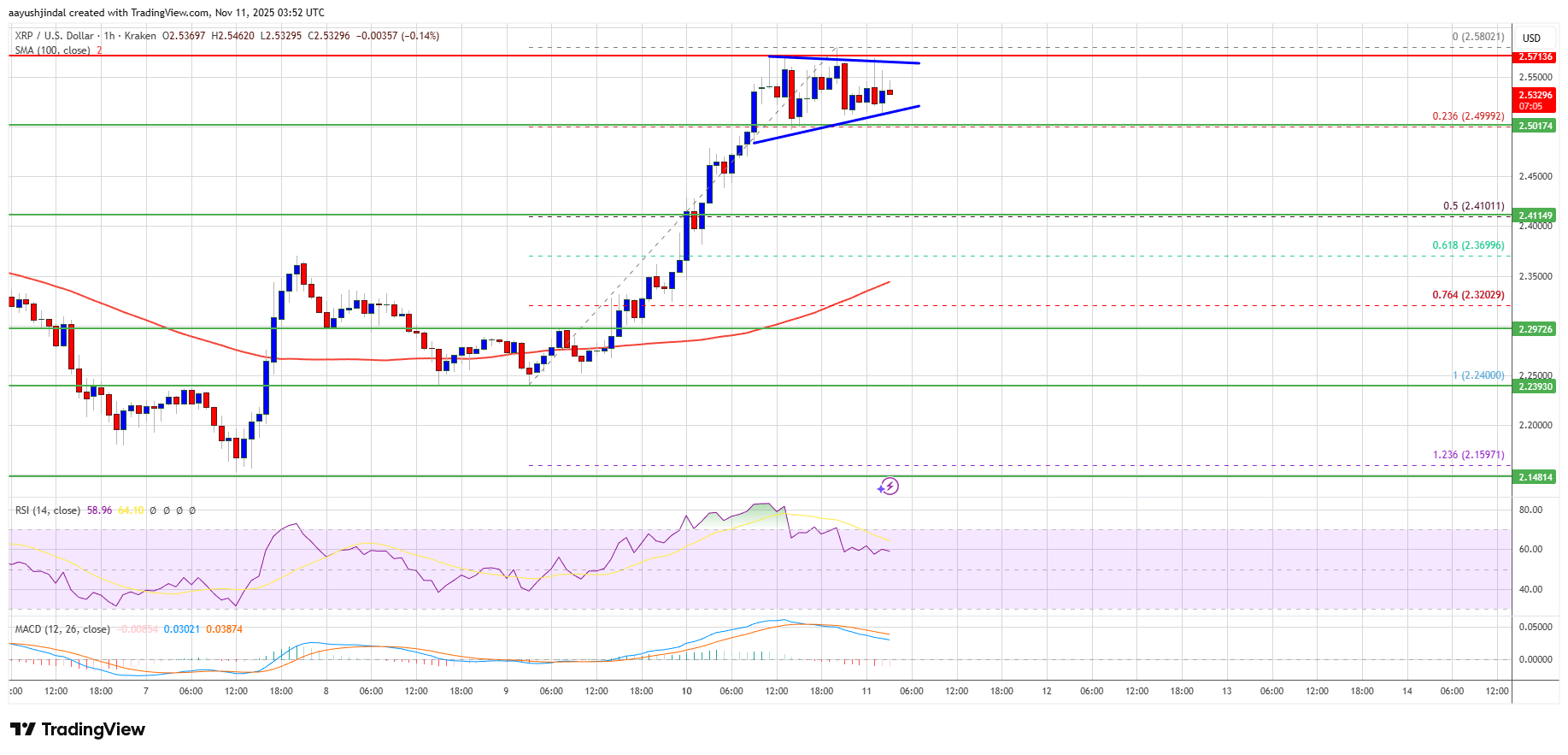

XRP, that capricious sprite of the crypto realm, has fluttered above the $2.420 mark with the grace of a drunken butterfly. Now it lingers, teasing the $2.580 threshold like a coquette at a Victorian ball.

- XRP, ever the drama queen, clung to $2.40 before ascending-slowly, theatrically-like a Shakespearean soliloquy.

- Presently, it lounges above $2.50, smug as a cat on a windowsill, while the 100-hourly Simple Moving Average watches like a jealous ex.

- A “short-term contracting triangle” (read: financial Rorschach test) forms at $2.256, as if the market itself is doodling in boredom.

- Should it vault past $2.580, the next stop is either euphoria or despair-choose your adventure.

XRP’s Ascension: A Tale of Greed and Graphs

Like Bitcoin and Ethereum-its flashier cousins-XRP embarked on a jaunt past $2.320, then $2.350, as if late for a very important date. The $2.420 resistance fell like a poorly constructed metaphor, and soon it was breezing past $2.50 with the confidence of a man who’s just faked his way into a VIP section.

A peak at $2.580! Then-pause-consolidation, because even digital currencies need a cigarette break. The 23.6% Fib retracement level yawned; the “short-term contracting triangle” (still sounds like geometry homework) loomed. The price, now perched above $2.50, eyed the $2.560 resistance like a diner debating dessert.

Clear $2.650? Why, then $2.7320 beckons, and after that-$2.7680! (Because round numbers are for the weak.) The $2.80 hurdle? A mere formality, like wearing pants to a Zoom meeting.

Or, You Know, It Could All Collapse 🤷♂️

Should $2.580 prove too lofty, XRP may slump like a deflated soufflé. Initial support at $2.50-because even cryptos need a safety net. Next: $2.420, the 50% Fib retracement level (which sounds important but probably isn’t). A tumble past that? Say hello to $2.350, then $2.320, and finally $2.250-the financial equivalent of rock bottom.

Technical Indicators (or: How to Sound Smart at Parties)

Hourly MACD – Gaining pace in the “bullish zone,” whatever that means. (Bullish, but not too bullish-this isn’t a rom-com.)

Hourly RSI – Above 50, which is… good? Bad? Schrodinger’s indicator.

Major Support Levels – $2.50 and $2.420 (aka “the excuses you’ll make when it crashes”).

Major Resistance Levels – $2.560 and $2.580 (aka “the numbers you’ll obsess over instead of therapy”).

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-11-11 07:37