Ah, the crypto circus! Behold the tragicomic spectacle of XRP, that once-buoyant barker of blockchain, now floundering like a fish out of its digital pond. The broader market, in its infinite whimsy, has decided to don the cloak of uncertainty, leaving poor XRP to wallow in a mire of risk aversion and evaporating bullish spirits. Fear, that most fashionable of sentiments, has taken hold, and liquidity, once as abundant as champagne at a society wedding, is now as scarce as a Waugh novel without a martini. 🥂

From the hallowed halls of Binance, the grand bazaar of digital speculation, comes the damning evidence: XRP’s Open Interest has plummeted to its lowest ebb since November 2024. A clear sign, dear reader, that the speculative rabble has lost its appetite, and leverage, that double-edged sword, is being unwound with all the grace of a fallen aristocrat. 🗡️

Derivatives metrics, those oracles of market mood, paint a picture of despair. Sentiment, once as robust as a country squire’s appetite, is now as frail as a debutante’s resolve. The contraction in Open Interest, from its giddy heights of $1.7 billion to a mere $504 million (with a brief dalliance at $473 million), is a testament to the market’s collective loss of nerve. Longs and shorts alike have fled the scene, leaving XRP in a state of existential limbo, devoid of conviction and direction. 📉

XRP Derivatives: A Liquidity Drain and the Triumph of Bears 🐻

A report from the estimable Arab Chain, via CryptoQuant, reveals the full extent of the debacle. Liquidity, that lifeblood of markets, has fled XRP’s derivatives like a scandalized matron from a disreputable soiree. Funding rates, those barometers of market sentiment, have turned negative with alarming frequency, indicating that short sellers are paying a premium to maintain their positions. A sure sign, if ever there were one, that selling pressure reigns supreme, and buyers are as scarce as a sober guest at a Bright Young Things party. 🍸

The correlation between Open Interest and XRP’s price is as unmistakable as a Waugh protagonist’s disdain for the proletariat. As the price tumbled from its lofty $2.5-$3 range to a humble $2, traders, once so eager to speculate, have retreated to the sidelines, leaving the market at the mercy of short-term whims. Whales and institutions, those supposed saviors of the market, are conspicuously absent, their wallets as tightly closed as a Puritan’s mind. 🦈

XRP Price: A Rebound as Feeble as a Waugh Apology 🙇♂️

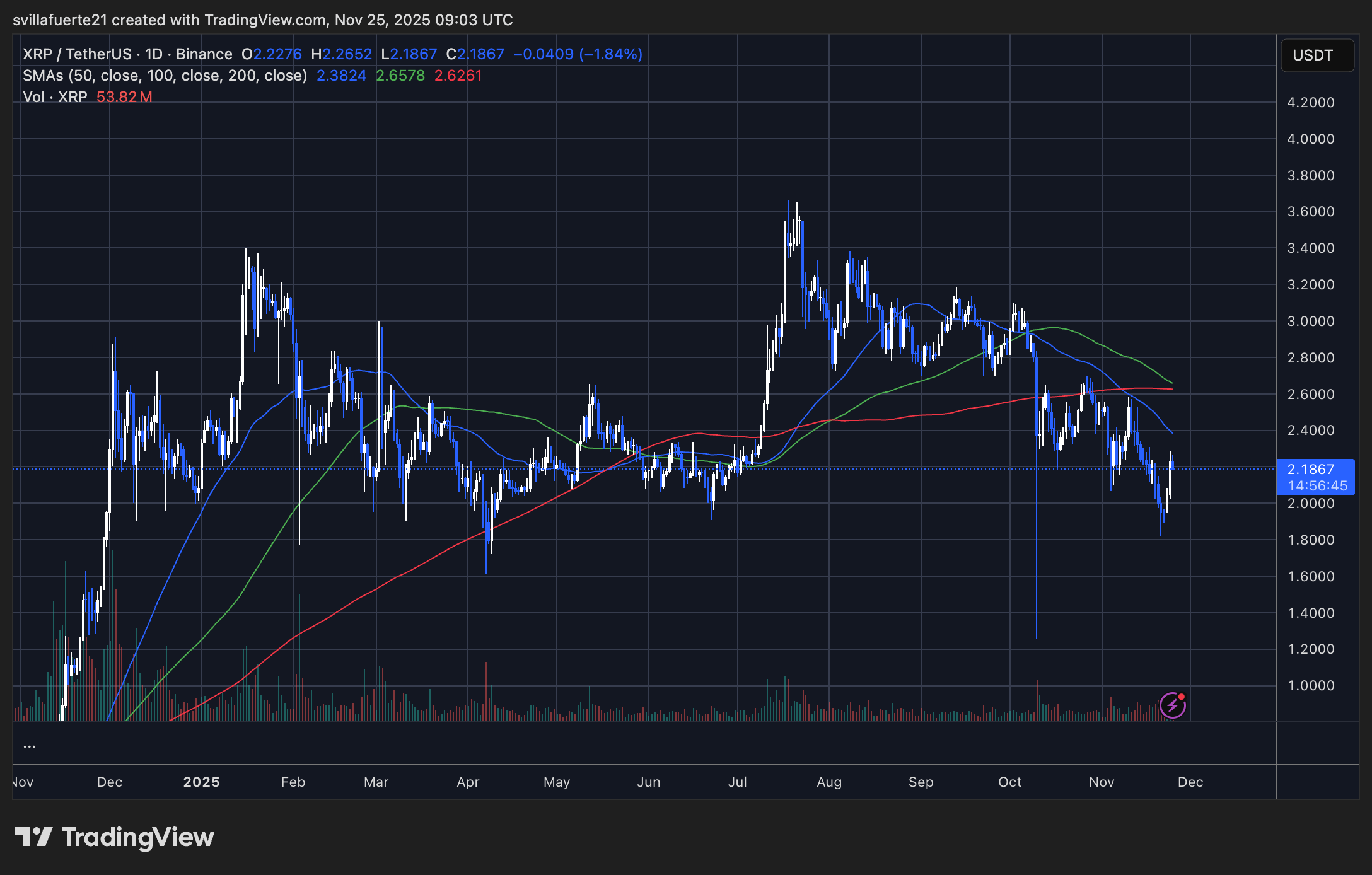

The chart, that unforgiving arbiter of market fortunes, tells a tale of woe. XRP, having failed to maintain its perch above the $2.50-$2.70 range, has broken down with all the drama of a society divorce. A brief flirtation with $1.90 was followed by a rebound as tepid as a Waugh character’s enthusiasm for the working class. The rejection from the 50-day and 100-day moving averages is a stark reminder that sellers remain firmly in the saddle, their momentum as relentless as a Waugh novel’s wit. 📊

Volume, that telltale sign of conviction, spikes during selloffs, suggesting capitulation rather than accumulation. The recent green candles, by contrast, are as anemic as a Waugh hero’s sense of purpose. Lower highs and lower lows form a pattern as predictable as a society scandal, leaving XRP in a precarious position. To regain its footing, XRP must reclaim the $2.40 level and hold it with the tenacity of a Waugh protagonist clinging to his martini. Failing that, a retest of $1.90, or even a descent to $1.70, looms as likely as a rainy day in England. ☔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-11-25 23:22