The universe has once again decided to test humanity’s patience with XRP, as if it were a cosmic experiment in financial absurdity. Traders, analysts, and long-term holders (those brave souls who still believe in XRP) are now staring at their screens like bemused archaeologists, wondering if this is a new era of liquidity or just another elaborate April Fools’ joke. Spoiler: it’s probably the latter.

ETF launches, those shiny new toys in the world of finance, are being touted as the next big thing. But let’s be honest-history has shown that ETFs are like a box of chocolates. You never know if you’re getting a gold-plated bonbon or a soggy raisin. Some debut with the vigor of a caffeinated squirrel, while others sputter out like a deflated balloon. So yes, fresh liquidity is coming, but don’t expect it to solve all your problems-or at least, not yet.

Institutional Interest Rises with New XRP ETFs

This week, Franklin Templeton and Bitwise are throwing their hats into the XRP ETF ring like two overly enthusiastic contestants on a game show. Franklin Templeton’s EZRP is set to debut on November 18, following Canary Capital’s impressive $58 million first-day performance (congratulations, that’s a lot of zeros). Bitwise, ever the crypto optimist, is launching its second ETF on November 20, presumably after surviving the existential crisis that was their Solana ETF rollout. Let’s hope they remember to charge their calculators this time.

According to various market strategists and their spreadsheets, these ETFs might attract institutional participation. But let’s not get carried away-just because a whale slaps its tail in the pool doesn’t mean you’ll all suddenly be swimming in gold coins. Inflows depend on macroeconomic conditions, investor risk appetite (a term that sounds suspiciously like “I hope my coffee doesn’t spill”), and liquidity conditions. In short: it’s complicated, and no one really knows what’s happening. Not even the experts. Probably.

Analysts, those self-appointed prophets of the financial world, are quick to point out that ETF launches don’t guarantee sustained price movement. They’re like a firework that only goes “poof” once. Historical patterns suggest that outcomes vary wildly, which is just a fancy way of saying, “Good luck, we’re all guessing.”

Market Sentiment and $2 Support

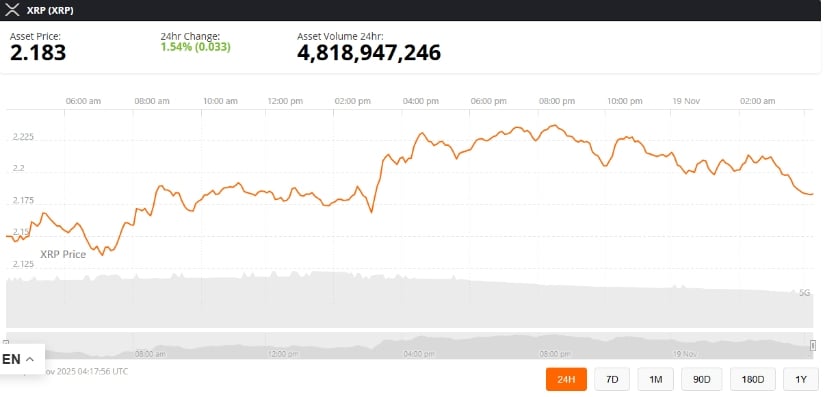

XRP is currently trading at $2.21, a price so tantalizingly close to the mythical $2 support zone that it’s practically winking at you. On-chain metrics, such as Glassnode’s NUPL, reveal that long-term holders are oscillating between “optimism” and “anxiety” like a pendulum stuck in a comedy club. This shift is a useful tool for gauging market sentiment, which is just a polite way of saying, “We’re all panicking, but let’s pretend we’re not.”

Social media is a treasure trove of conflicting opinions. EGRAG Crypto, a technical analyst with a flair for the dramatic, claims XRP might dip before it rallies-because nothing says “confidence” like predicting a brief descent into chaos. Meanwhile, Javon Marks, a trader with a penchant for nostalgia, points to past ETF cycles and whispers of “structured liquidity inflows.” Translation: “Maybe it’ll go up, but maybe it won’t. Buy the rumor, sell the news, and keep your fingers crossed.”

Analysts agree that holding the $2 support level is crucial. A breach would be like a cosmic red flag, signaling the universe to unleash a wave of short-term downside pressure. Or, in simpler terms: don’t let it drop below $2, or we’ll all have to eat humble pie. Again.

Technical Analysis: Breakout Potential vs. Risks

Technical analysts are now scrutinizing XRP’s price chart, which has formed a bullish pattern within a descending channel. If you squint hard enough, it looks like a parabola of hope. Breaking above $2.195 is seen as a green light for a potential rally toward $2.24-$2.30. But let’s not forget: this is all based on the assumption that the market respects lower support bands. Which it rarely does. It’s like asking a toddler to follow the rules of quantum physics.

Chart analysts, those modern-day Nostradamus of the stock market, warn that a close below $2.09 would invalidate bullish setups. Such assessments are derived from “standard technical analysis methods,” which is just a fancy way of saying, “We drew some lines and made educated guesses.” Combine this with broader market context, and you’ve got a recipe for confusion. Or, as Douglas Adams would say, “It’s just another day in the infinite improbability drive of finance.”

Short-Term Volatility and Whale Activity

Recent market data has thrown up some delightful anomalies, like a “flash wick” on Kraken that briefly sent XRP/USD from $2.18 to $2.1979. TradingView contributors are quick to note that such wicks are often the result of isolated liquidity imbalances. In other words, someone accidentally hit “sell” instead of “buy” and then blamed the algorithm. Or maybe it was a rogue AI with a grudge against XRP. Who knows?

Meanwhile, on-chain tracking revealed a $95 million XRP transfer to Binance. This has led analysts to speculate that whales (those elusive, mythical creatures of the crypto world) are repositioning their assets. But let’s not jump to conclusions-just because a whale moves money doesn’t mean it’s a signal. It could just be a midlife crisis. Or a bad investment in NFT penguins.

Bitcoin’s recent decline (from $115,000 to ~$94,000) has added to the general sense of doom and gloom, but XRP has managed to cling to key support levels like a koala to a eucalyptus tree. Whether this is a sign of resilience or sheer luck remains to be seen.

Balancing Opportunity and Caution

Traders, long-term holders, and institutional observers are now keeping a close eye on several factors:

- ETF inflows: Potentially increasing liquidity, but outcomes vary. (Spoiler: they always do.)

- Support levels: $2 is a critical threshold; breaches could trigger short-term downside. (Or a cosmic tantrum.)

- Technical confirmations: Breakouts above $2.195 could suggest upward momentum, but descending-channel dynamics must be respected. (Which they never are.)

- Market sentiment and on-chain metrics: Tools like NUPL offer insight, but signals are probabilistic, not deterministic. (Which means they’re mostly just vibes.)

While ETFs provide a catalyst for renewed institutional interest, analysts are wisely advising balanced expectations. As one senior ETF strategist put it, “The market structure is improving, but risks remain-both from macro volatility and the possibility that ETF-driven demand is partially priced in.” In other words: “Don’t get too excited. The universe is watching with mild disinterest.”

For now, the spotlight is on EZRP’s debut on November 18 and Bitwise’s follow-up launch. Whether XRP can stabilize near $2 and translate institutional liquidity into meaningful price action remains to be seen. But if there’s one thing we’ve learned from history, it’s that the universe loves a good punchline-and the financial markets are its favorite stand-up comedy club. 🌌💸

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-11-20 00:51