Markets

What to know: 🧐

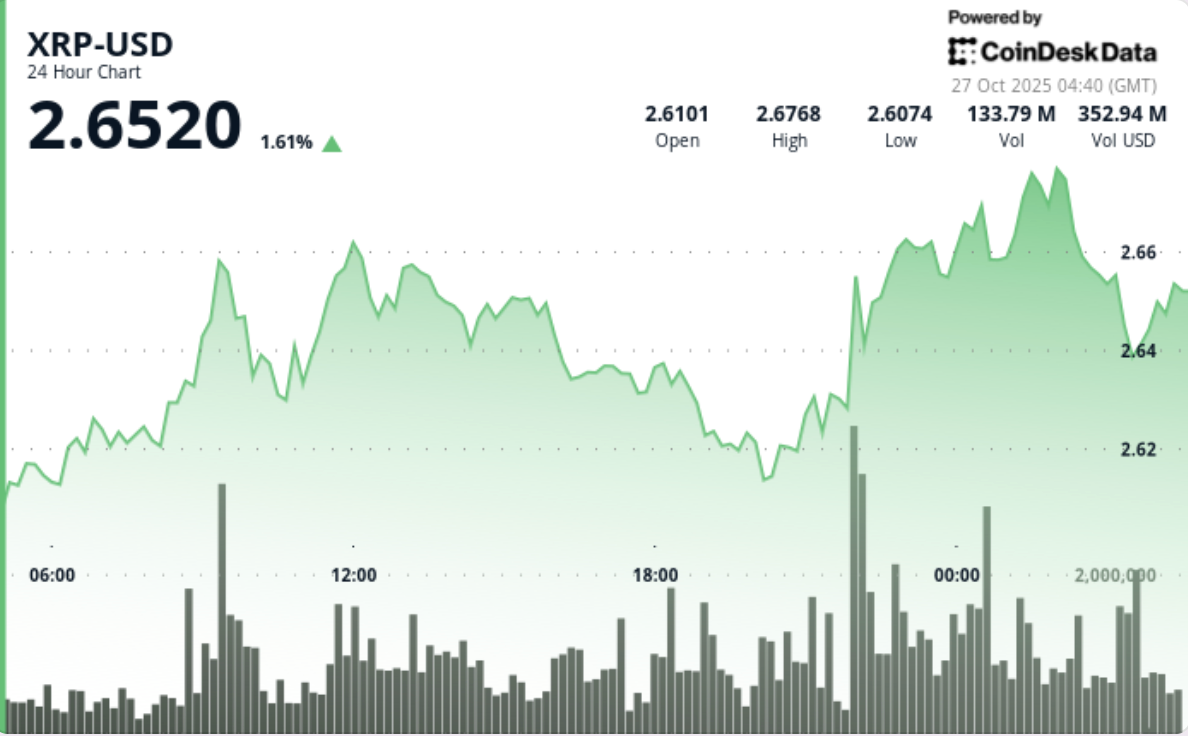

- XRP, that mischievous sprite of the crypto realm, surged 3% to $2.68, breaking above the critical resistance level at $2.63 with a volume so significant it could wake the dead. 💀📈

- Institutional interest, those shadowy figures in tailored suits, and upcoming regulatory developments are driving this frenzied dance of numbers. 🕴️⚖️

- Traders, ever the anxious lot, are monitoring whether XRP can maintain its support at $2.63 and if the volume remains high enough to sustain this financial ballet. 🩰💸

XRP, like a cat leaping from a windowsill, climbed from $2.60 to $2.68, clearing the $2.63 barrier and establishing new support between $2.61-$2.63. 🐱🪟

News Background

- XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a volume spike so dramatic it could rival a Bulgakov novel’s plot twist. 📊✨

- The breakout aligns with growing institutional interest, backed by fund managers whispering of “hundreds of millions” flowing into XRP-exposure vehicles. 🤑🚂

- The move also comes ahead of expected regulatory and ETF developments, which analysts believe could accelerate demand faster than a Moscow tram. 🚋⚡

large spike at breakout, followed by lower volatility during consolidation, pointing toward absorption, much like a sponge soaking up water. 🧽💧 Key momentum indicators (RSI, MACD) remain constructive on daily charts, aligning with broader breakout psychology.

What Traders Should Know

- Traders are now watching two critical behaviors: First, whether XRP can hold the $2.63 support base; a re-test and hold would validate the breakout, like a seal balancing a ball. 🦭🎱

- Second, if volume remains elevated or picks up again, the breakout has a higher-probability extension toward the $2.70-$2.75 zone, a journey as uncertain as a stroll through Moscow’s misty streets. 🌫️🚶♂️

- On-chain flows and institutional product commentary (e.g., remarks from Teucrium Trading executives about large inflows) support the accumulation narrative, though one must always beware of the devil in the details. 👹📜

- On the risk side, a sustained close below $2.61 would undermine the breakout and could trap the price back in its prior consolidation range, like a character trapped in a Bulgakov novel. 📉📖

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2025-10-27 08:11