As a seasoned analyst with over two decades of experience in the financial markets under my belt, I must say that the current surge in XRP activity is reminiscent of the dot-com bubble of the late 90s – albeit with a modern twist. The parallels are striking: a highly speculative asset class, skyrocketing prices, and an administration that seems to be embracing the new frontier.

The use of XRP, the native currency for the XRP Ledger, has reached an unprecedented peak following a significant price surge over the last month. This growth has propelled XRP into the third spot among all digital assets in terms of market value.

As an analyst, I’ve observed a significant surge in the price of XRP over the past month. The cryptocurrency has climbed from approximately $0.5 per token to its current value of $2.74, nearing its all-time high of around $3.3 set back in 2018.

The impressive performance of XRP over the past month can be linked to several factors. One significant factor is the speculation that Donald Trump’s re-election as U.S. President in 2024 could lead to a more crypto-friendly government, which has boosted expectations within the crypto community.

There’s a lot of excitement among investors as they await the departure of Gary Gensler from his role as SEC Chair, scheduled for January 20, 2025. This departure might pave the way for a friendlier regulatory climate towards cryptocurrencies.

The cost of XRP rose significantly following multiple applications for a spot XRP exchange-traded fund (ETF) to be listed within the nation, with the most recent entrant being WisdomTree. This newcomer joins a competitive field that already includes Bitwise, 21Shares, and Canary Capital.

To date, the Securities and Exchange Commission (SEC) hasn’t approved a Spot XRP ETF, and there’s been a legal dispute between the SEC and a significant player in the XRP market, Ripple, since 2020. The SEC alleges that Ripple raised $1.3 billion by selling XRP, which they consider an unregistered security.

In simple terms, a notable court win for Ripple was secured in July 2023 as Judge Analisa Torres decided that some automated sales of XRP were not classified as securities trades. Yet, she also concluded that direct sales to large-scale investors were indeed considered as offering securities.

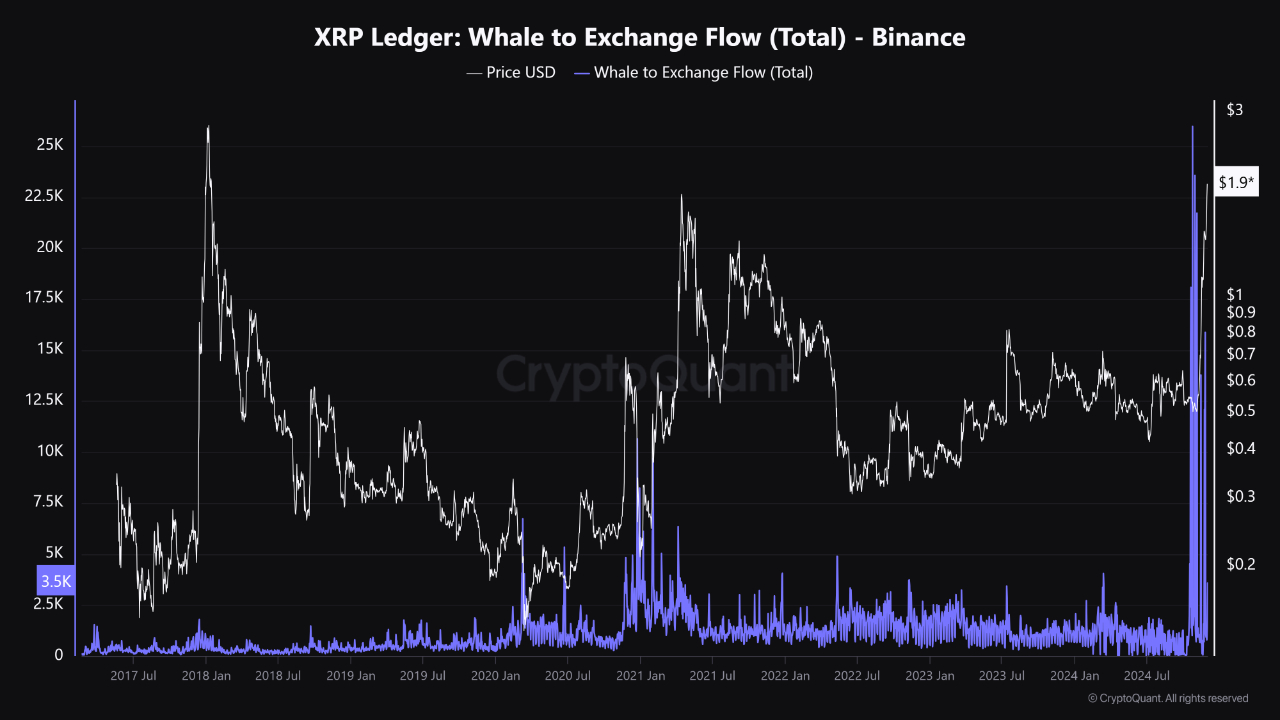

The data provided by CryptoQuant indicates that large XRP holders (whales) seem to be significantly influencing the increase in XRP’s price, as their recent activity has reached an unprecedented peak.

To highlight, CryptoQuant analyst Woominkyu has noted that large increases in transactions between whales and exchanges for XRP have previously coincided with high prices for XRP. A recent surge in these types of transactions suggests a possible peak near $2.3, potentially signaling that whales could be readying themselves for profit-taking or increased market involvement.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-04 02:51