As a seasoned analyst with over two decades of experience navigating the ever-evolving financial landscape, I find myself intrigued by the recent developments in the digital asset industry, particularly in relation to Ripple and its CEO, Brad Garlinghouse.

On Wednesday, Brad Garlinghouse, CEO of Ripple, spoke with Maria Bartiromo on Fox Business about how the favorable crypto policy from the Trump administration affects the digital assets sector, Ripple’s approach, and obtaining regulatory certainty.

Garlinghouse outlined Ripple’s mission to enhance cross-border transactions using blockchain technology, with their digital asset, XRP, as a key component. He mentioned that the U.S., due to its perceived unfavorable stance from the Biden administration, has been slower in adopting crypto compared to other countries. This apprehensive regulatory environment has caused confusion and stifled progress, driving 95% of Ripple’s operations overseas.

In my role as a researcher, I’ve noticed an uptick in enthusiasm within the cryptocurrency sector following the latest U.S. presidential election. As Timothy B. Garlinghouse, the CEO of Ripple, has highlighted, the new administration seems to be more receptive towards cryptocurrencies. This could pave the way for significant growth in the world’s largest economy.

Garlinghouse expressed optimism that the Trump administration’s relaxed regulatory stance would bring clarity to the industry. He contended that the existing regulatory structure, which frequently employs antiquated rules such as the 1946 Howey Test, fails to grasp the intricacies of contemporary digital currencies.

He highlighted the importance of clear regulations for fostering innovation and enabling the U.S. to regain its leadership in the crypto space, emphasizing Trump’s potential to “make crypto great again” in the United States.

Garlinghouse also shared details about Ripple’s intention to introduce its own stablecoin, called RL USD (Ripple USD). This digital currency is designed to cater to the institutional requirements in the cross-border payments sector. He pointed out that the stablecoin market, dominated by Tether, has a value of around $170 billion and has potential for further expansion. Ripple aims to tap into this growing market by offering faster, more affordable, and dependable payment services to financial institutions.

Garlinghouse underscored the significance of putting crypto experts in crucial regulatory roles, specifically at the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). He highlighted that past leadership at the SEC under Gary Gensler was found to be politically driven and inconsistent, referring to federal court judgments labeling the SEC’s actions as “unreasonable” and “irrational.

Garlinghouse views Trump’s pledge to appoint a leader knowledgeable about the cryptocurrency industry instead of Gensler positively. He thinks that this action combined with cooperation from Congress could bridge current regulatory loopholes, and help reestablish U.S. leadership in the digital asset market.

As an analyst, I foresee the United States evolving into a vibrant epicenter for cryptocurrency innovation under a more cooperative administration. I am confident that with transparent regulations and a harmonious partnership between governmental bodies and the industry, the U.S. has the potential to claim the title of “the heartbeat of the crypto and blockchain sector” within the coming decade.

According to CNBC’s recent report, Gary Gensler has announced that he will step down as the head of the Securities and Exchange Commission (SEC) on January 20, 2025. This move enables the incoming President Donald Trump to swiftly appoint a new leader, possibly indicating a change in direction for SEC regulations.

The usual term for SEC commissioners is five years, keeping Gensler in office until at least 2026. However, his early resignation, which many had expected, has opened up a chance for the new administration to alter the SEC’s leadership and focus.

Looking back at his tenure with the SEC, Gensler underscored the agency’s unwavering focus on safeguarding investors, promoting investment opportunities, and upholding fairness and efficiency in market operations. In a statement, he acknowledged the hard work and commitment of the SEC team, praising their role in preserving the robustness of the American financial markets.

The team and the Commission are highly committed to their mission, prioritizing investor protection, promoting capital growth, and ensuring fair market operations for both investors and issuers. The team members can truly be considered public servants. It has been a privilege beyond words to work alongside them, advocating for everyday citizens and maintaining our capital markets as the leading ones globally.

Furthermore, it was reported by ETF Stream yesterday that the WisdomTree Physical XRP (XRPW) began trading on significant platforms such as Deutsche Börse, SIX Swiss Exchange, Euronext Paris, and Euronext Amsterdam. This investment product boasts a total expense ratio of 0.50%.

This investment tool, known as an Exchange-Traded Product (ETP), mirrors the Compass Crypto Reference Index XRP. It gives you direct access to Ripple’s market price. Ripple is a decentralized, open-source blockchain platform designed primarily for transactions, offering a quicker and eco-friendly solution compared to Bitcoin.

Alexis Marinof, Europe chief at WisdomTree, shared that the introduction of XRPW enhances their collection of cryptocurrency ETPs backed by physical assets. He pointed out that these investment tools are crafted to effortlessly blend into diverse investment portfolios, providing a regulated and streamlined avenue for investors to tap into the cryptocurrency market. Marinof emphasized that ETPs for cryptocurrencies have grown in popularity as the preferred approach for investing in digital assets.

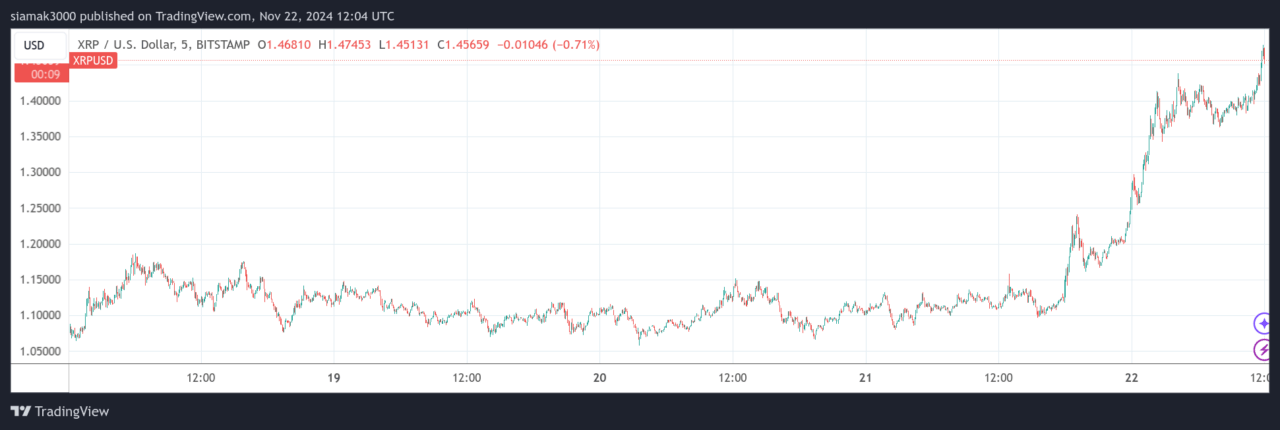

At the time of writing, XRP is trading at around $1.42, up 27% in the past 24-hour period.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-22 15:19